-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

ECN Brokers

Trade with Direct Market Access

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

Top MT4 brokers in Philippines

-

MetaTrader 5 Brokers

Top MT5 brokers in Philippines

-

cTrader Brokers

Top cTrader brokers in Philippines

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

The head and shoulders pattern is a multi-candlestick formation, much like the bull flag, another multi-candlestick pattern. It generally signals the potential for a breakout and is a more accurate indicator when viewed across longer timeframes.

Transcript

This video focuses on technical analysis. If you seek more information on various indicators and charting tools, we encourage you to explore our channel and consider subscribing.

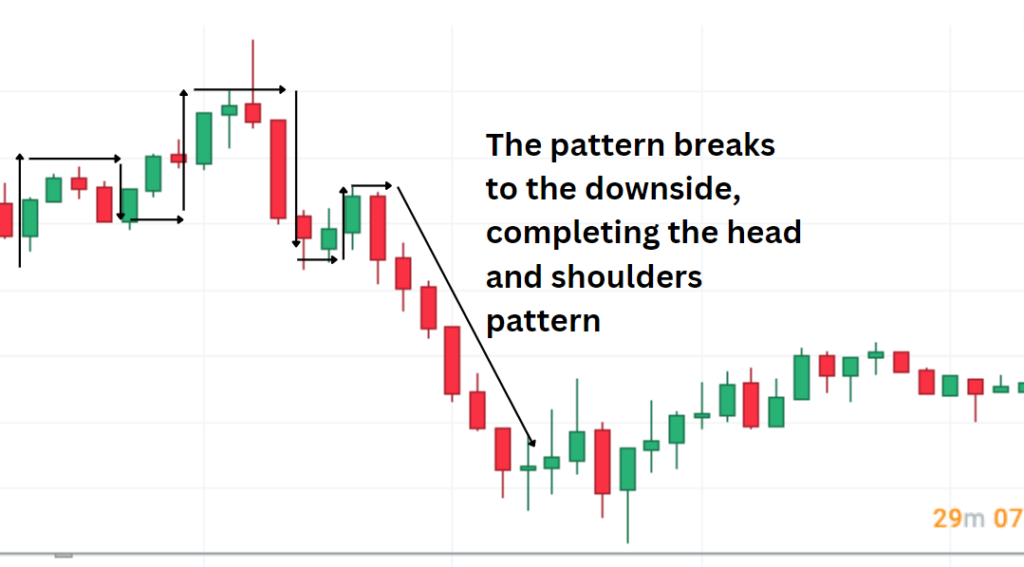

As displayed above, the head and shoulders pattern may not be perfectly aligned, but approximations often suffice with such patterns. We can identify the left shoulder, the head, and the right shoulder.

Essentially, the security moves upward, consolidates, rises again with a subsequent consolidation, and eventually declines. While many traders anticipate a retest of the previous high and set up buy orders, more often than not, the price decreases, completing the head and shoulders pattern.

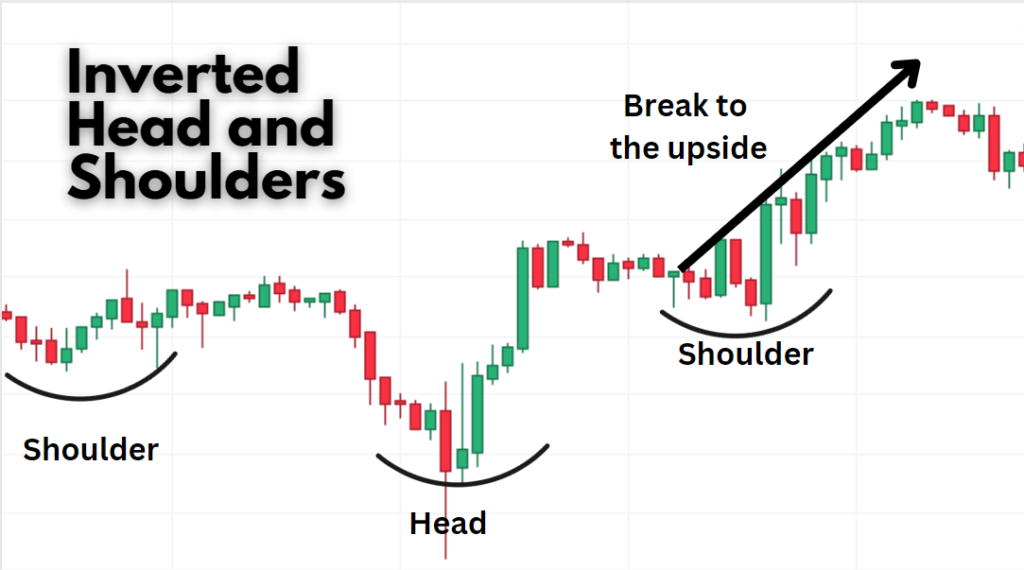

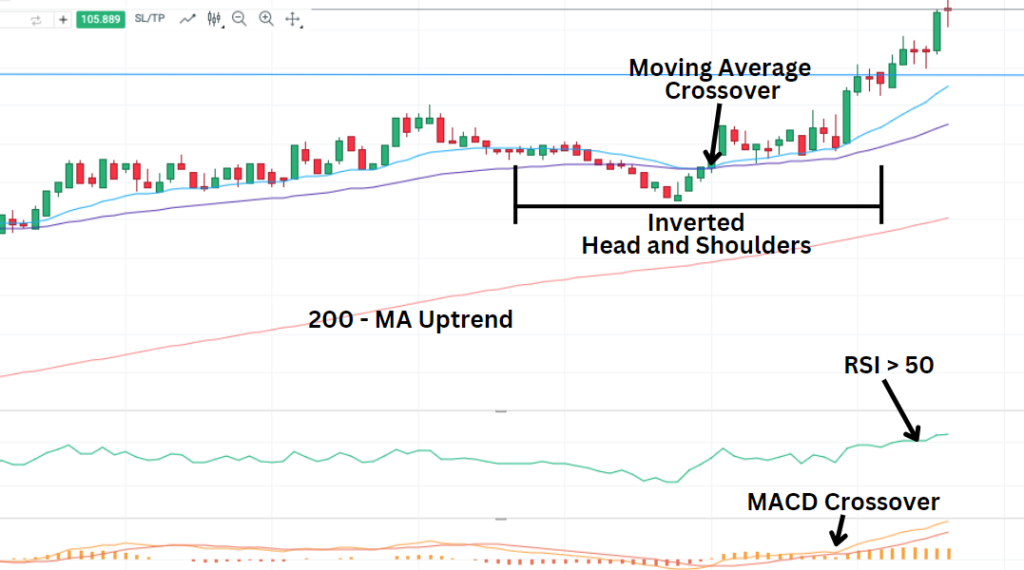

The Inverted Head and Shoulders pattern

Conversely, if we invert the pattern, as demonstrated above, we have an inverted head and shoulders, indicating an opportune time to consider buying.

Returning to our charts, we may observe what appears to be an ascending support level, tempting traders to buy during the dip. However, the subsequent price action, marked by resistance, signals a bearish sentiment.

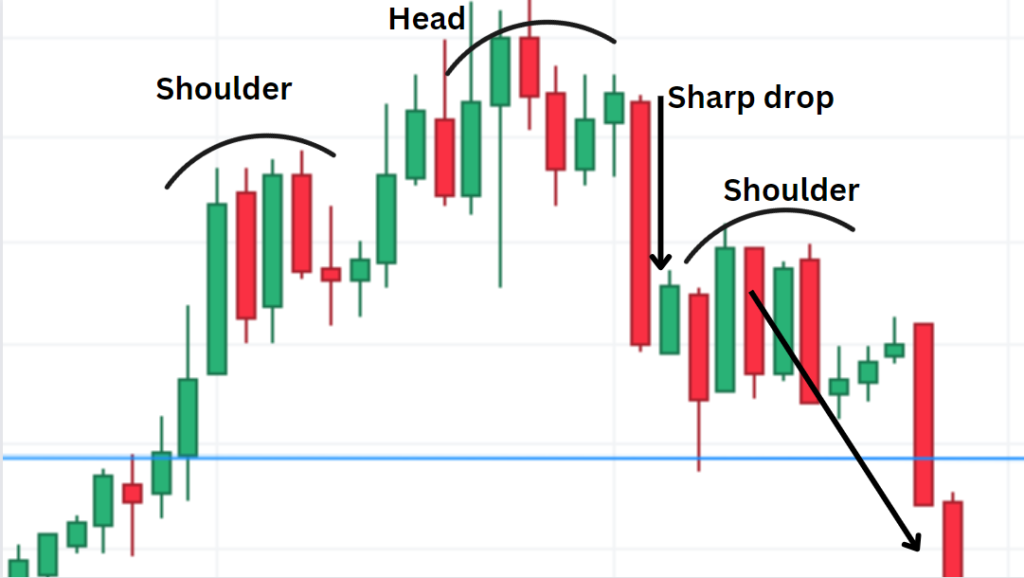

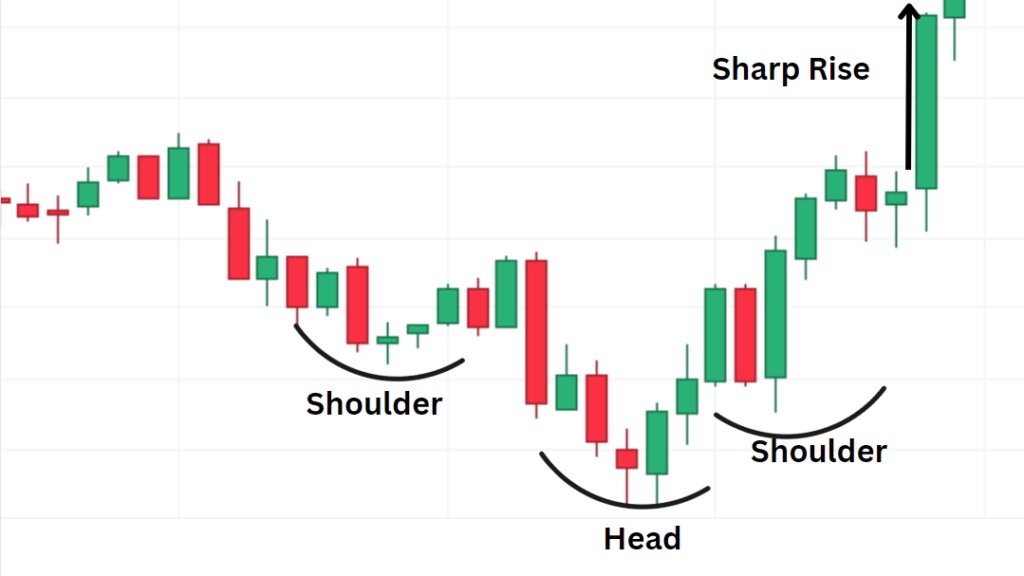

Here are a few more examples:

In this case, the formation of the shoulder is followed by a slight pullback and a subsequent ascent, followed by a sharp decline below the previous support. The key takeaway is to watch for that significant drop.

An inverted head and shoulders, although sometimes harder to spot, can also be powerful. In this scenario, we notice a shoulder rallying briefly before dipping into the formation of the head. A sharp rise above the previous resistance level, followed by consolidation and continued upward movement, completes the pattern.

When to Trade the Head and Shoulders Pattern

Head and shoulders formations serve as potent buy and sell signals. However, trading them when market volume is high is advisable, indicating multiple participants looking for the same signals.

Additionally, ensure that fundamental factors align with your trading decisions, such as interest rate announcements or inflation rate reports. Trading in the direction of the long-term trend also enhances safety. These patterns tend to yield better results on actively traded instruments with catalysts driving their movement.

Confirmation with Indicators

Don’t forget to look for supplementary indicators to validate your analysis.

For instance, in the case of the Dollar Index illustrated above, we observe an inverted head and shoulders pattern, supported by a bullish move after the head formation. Other indicators, such as moving average crossovers, MACD crossovers, and RSI levels above 50, further confirm the upward trend. Consistency across multiple timeframes is another positive sign. Spotting a bullish signal on a shorter timeframe, followed by a matching pattern on a longer timeframe, it strengthens your trade’s potential success.

Conclusion

In conclusion, head and shoulders patterns are valuable tools for traders, but they should be used judiciously, with attention to market conditions, fundamentals, and additional indicators. For any questions or inquiries, please feel free to reach out to us.