What is the minimum investment required for copy/social trading?

The minimum investment varies across platforms. For instance, on some platforms, you can start copy trading with 200 USD, while others may allow you to start with as little as 1 USD.

Is copy trading legal in the Philippines?

Yes, copy trading is legal in the Philippines. Copy trading and social trading are considered self-directed, as traders who use this function always select the trading system to copy. Prior to the explosion in social trading, copy trading was only available via a managed account. Managed accounts require a power of attorney and a large account balance and so are unpopular amongst typical retail traders.

What occurs if the trader I’m copying discontinues trading?

If the trader you’re copying decides to stop trading, your account will not open any new trades. You will then need to select a new trader to follow.

Can I terminate copy trading at any point?

Yes, you can stop copying a trader at any time, and you should continuously monitor your trades’ performance and make adjustments as needed.

How much control do I have over my trades when I’m copy trading?

Although the trades are automatically replicated from the trader you’re copying, you still retain control over your own account. You can manually close trades, pause copy trading, or stop copying a trader at any time.

Can I copy multiple traders at the same time?

Yes, most platforms allow you to copy multiple traders simultaneously. This can be beneficial as it allows you to diversify your portfolio across different trading strategies.

Can I start copy trading with a demo account?

Many trading platforms offer a demo or practice account where you can use virtual money to copy trades. This can be a good way to understand how copy trading works and test out different traders’ strategies before investing real money.

What are the costs associated with copy trading?

Costs can vary between platforms. Some platforms charge a fixed fee, some charge a percentage of profits, and others may apply spreads on trades. Always check the cost structure of your chosen platform.

How are the copied trades sized in my account?

Trades are usually copied in proportion to the amount of money you have allocated to copy a particular trader. For example, if the copied trader opens a trade using 10% of their balance, then a trade for 10% of the amount you allocated for copying them will be opened in your account.

What should I do if the trader I’m copying is consistently losing money?

If the trader you’re copying is not performing as expected, it’s essential to reassess your decision. You might choose to stop copying them and select another trader, or you might decide to pause copying and monitor their performance for a while. Remember, it’s crucial to regularly review the performance of the traders you’re copying.

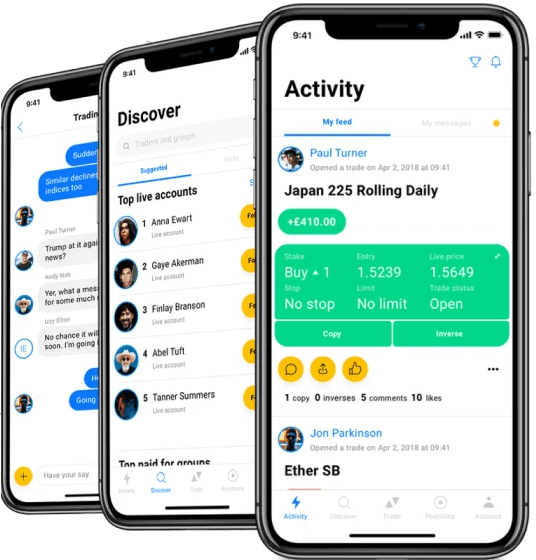

Can I interact with the traders I’m copying?

On some platforms, you can communicate with other traders, ask questions, and share strategies. This feature is more commonly available on social trading platforms, and beginners may find it beneficial as it allows you to learn more about trading strategies and market conditions.

Although copy and social trading might seem overwhelming initially, with the right knowledge and approach, you can leverage the experience and strategies of successful traders. While this opportunity offers an expedited learning curve for beginners and a chance to diversify strategies for seasoned traders, it’s crucial to remember that all trading involves risk. Just because a trader has been successful previously does not mean they will continue to make a profit, so never trade with money that you cannot afford to lose.

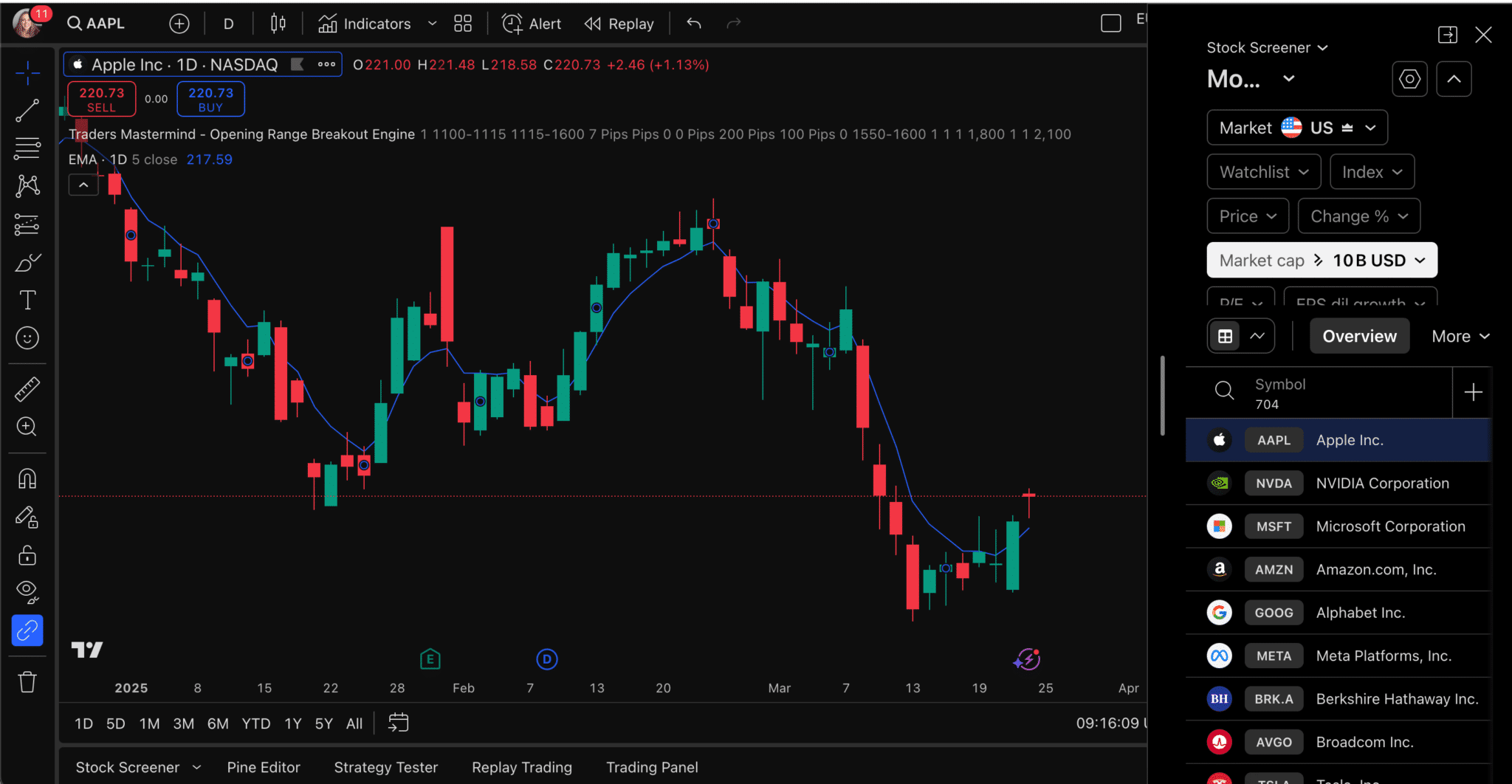

How do I compare copy trading brokers?

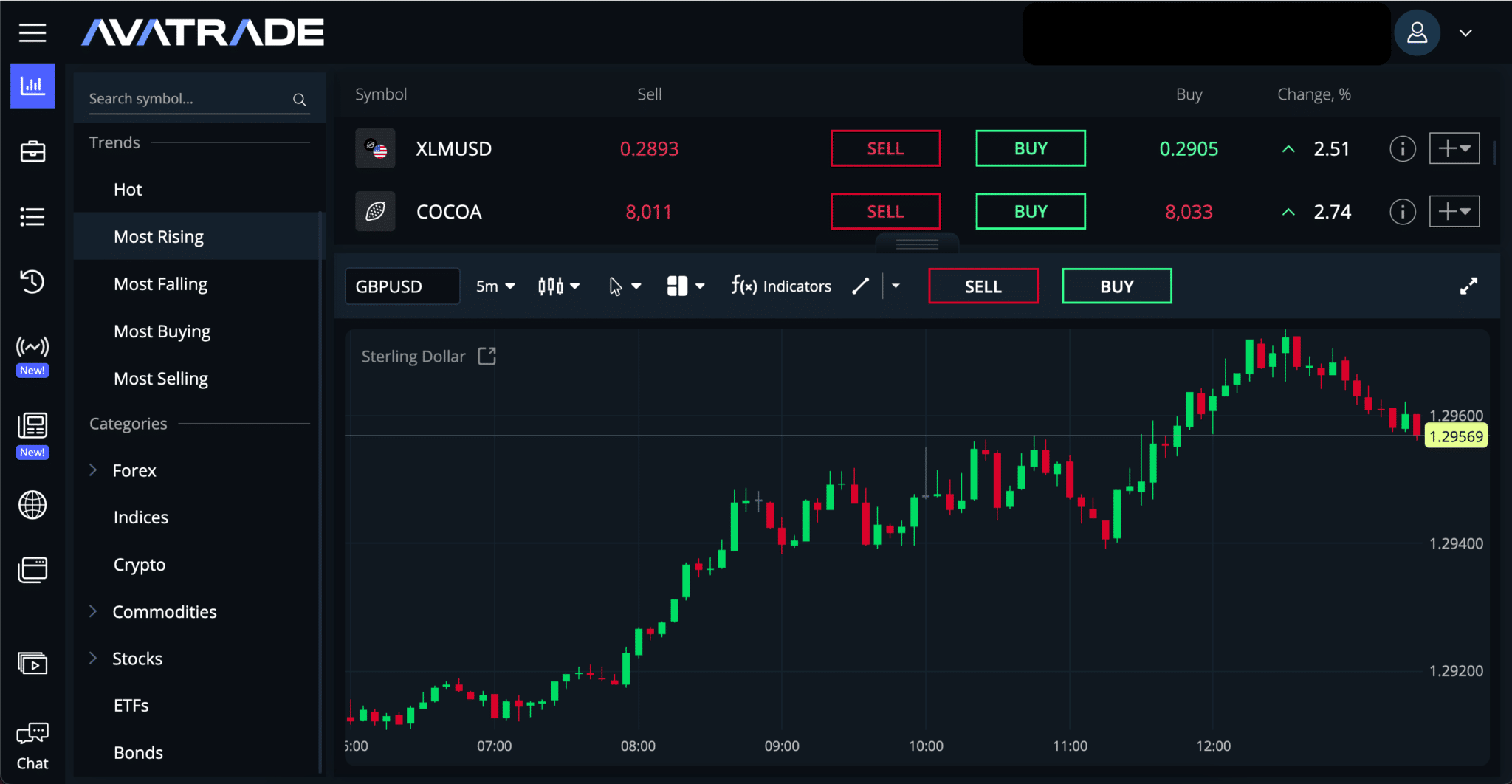

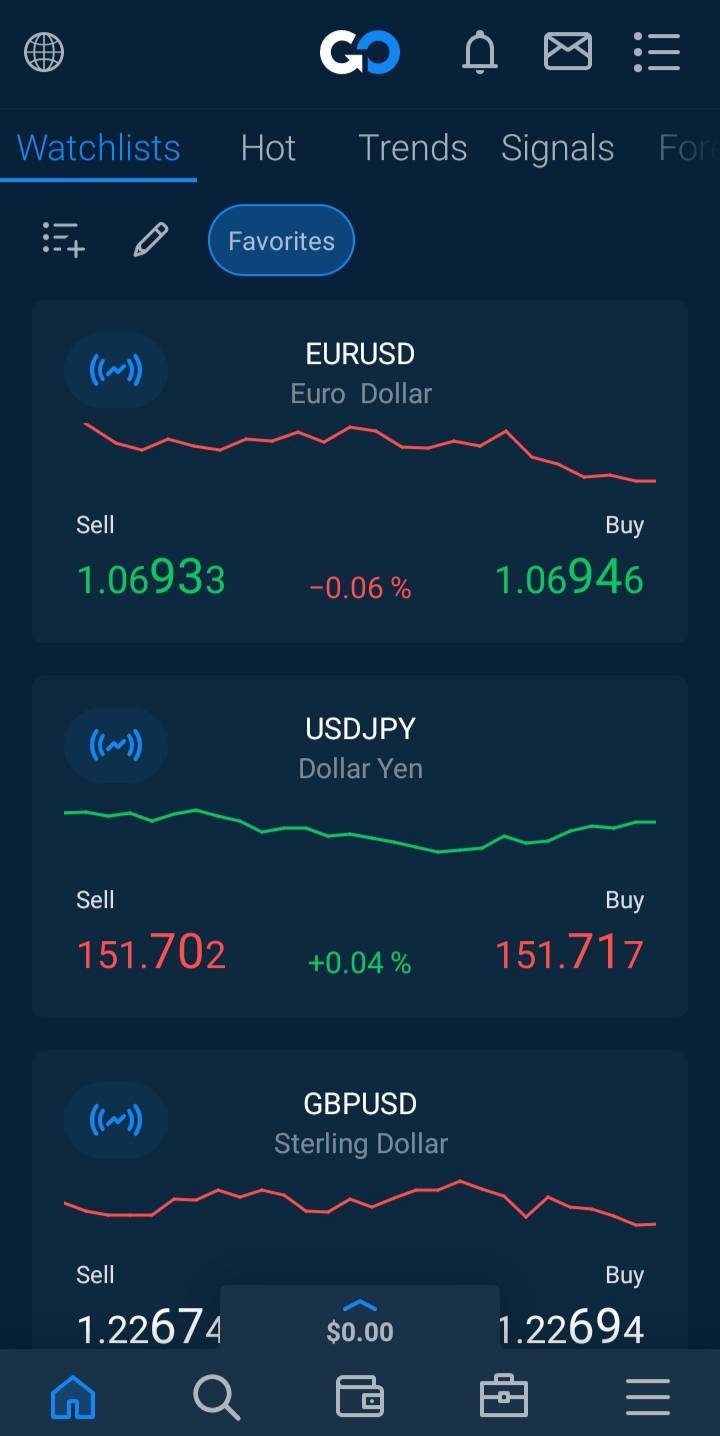

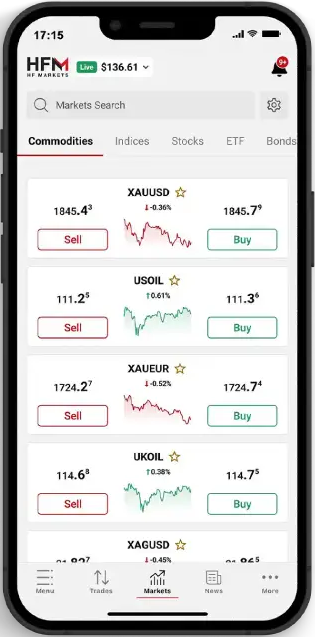

When selecting a copy trading broker, prioritising regulation is crucial as it safeguards your funds. Evaluate the associated costs if the broker’s copy-trading service uses platforms such as Zulutrade, Duplitrade, or Myfxbook. Opt for a system that provides comprehensive metrics of traders you could emulate, including risk indicators and profitability. Ensure your broker offers a broad range of traders to follow, ensuring diverse choices. It’s also essential to have a system that enables trade filtering based on your risk and return preferences, offering flexibility. Avoid brokers that lock you into copy trading for a set period. You should be able to stop copying trades instantly. Be aware of the fee structure, whether it’s a flat, success-based fee or a broker subscription; all costs should be clear and upfront. Lastly, consider the specific broker accounts that offer copy trading, their required minimum deposit, and their trading costs before committing.