Tips for Using a Forex Demo Account

You should approach using a demo account like you would if you were using real money. That way, you will get the most out of the experience. Real trading can spark a strong emotional response, and you have to know how this can influence your decision-making. The fear of making losses can cause a trader to execute their trade too early or hold on to a position for too long in hopes of the market reversing. Greed, meanwhile, can drive a trader to make reckless decisions.

Monitor your emotions and make the trading experience more realistic by giving yourself a reward for trading well or withholding something if your trading is poor. Do anything that will make the experience more realistic. That will allow you to learn to control your emotions and stop them from influencing your trading decisions in the live market.

It is also a good idea to practise with the same amount of capital you would deploy if you were trading for real. That will better prepare you for live trading and give you a better understanding of how much money you could realistically make… and how much you could lose.

Learn How to Open/Close a Trade

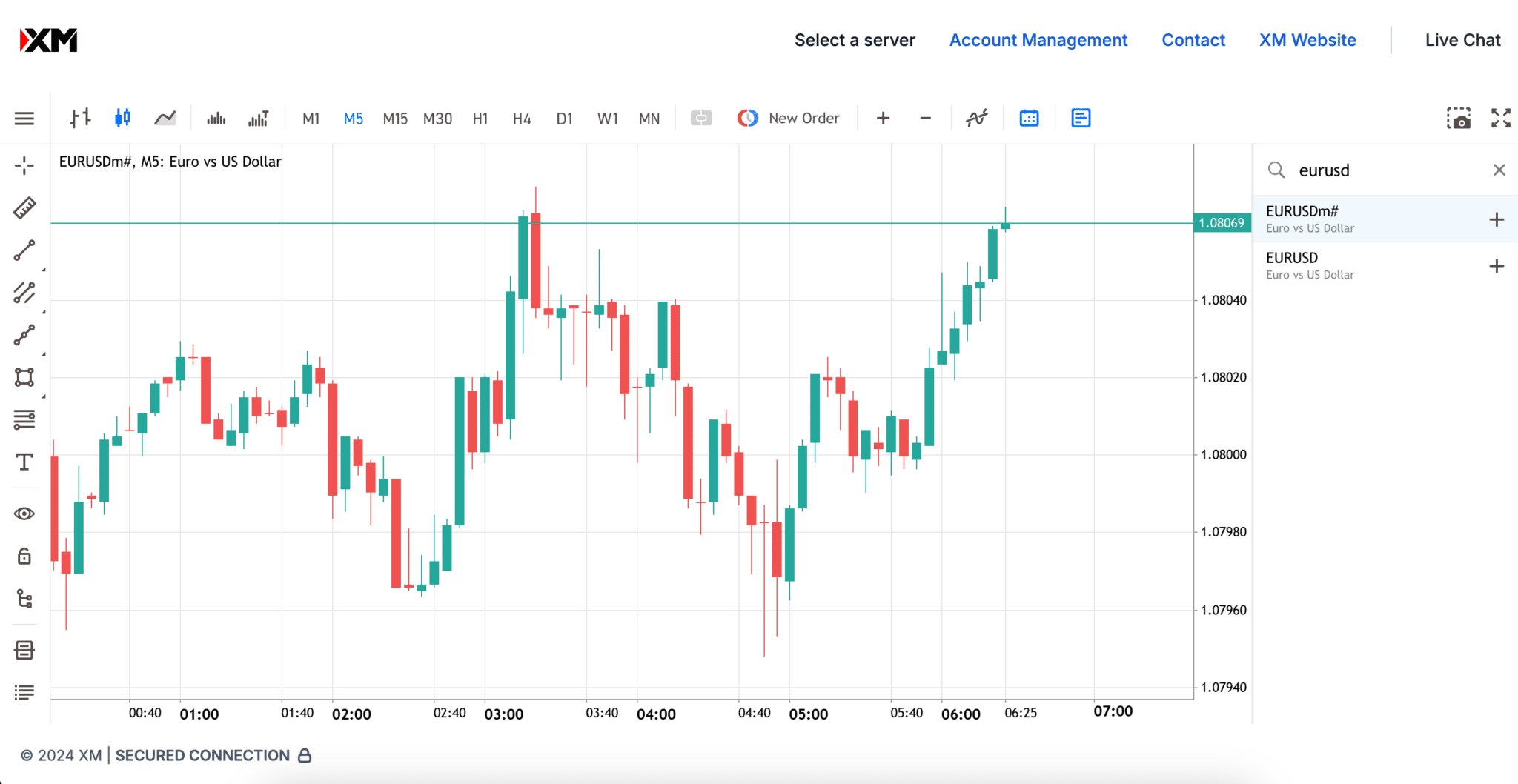

A Forex trade involves a simultaneous purchase of one currency and the sale of another, the combination of which is commonly referred to as a cross pair. You can open virtual trading positions – using a demo account – for just about any currency pair you wish, use various trading tools and features, and see how the trade would have fared had it been conducted on the live market.

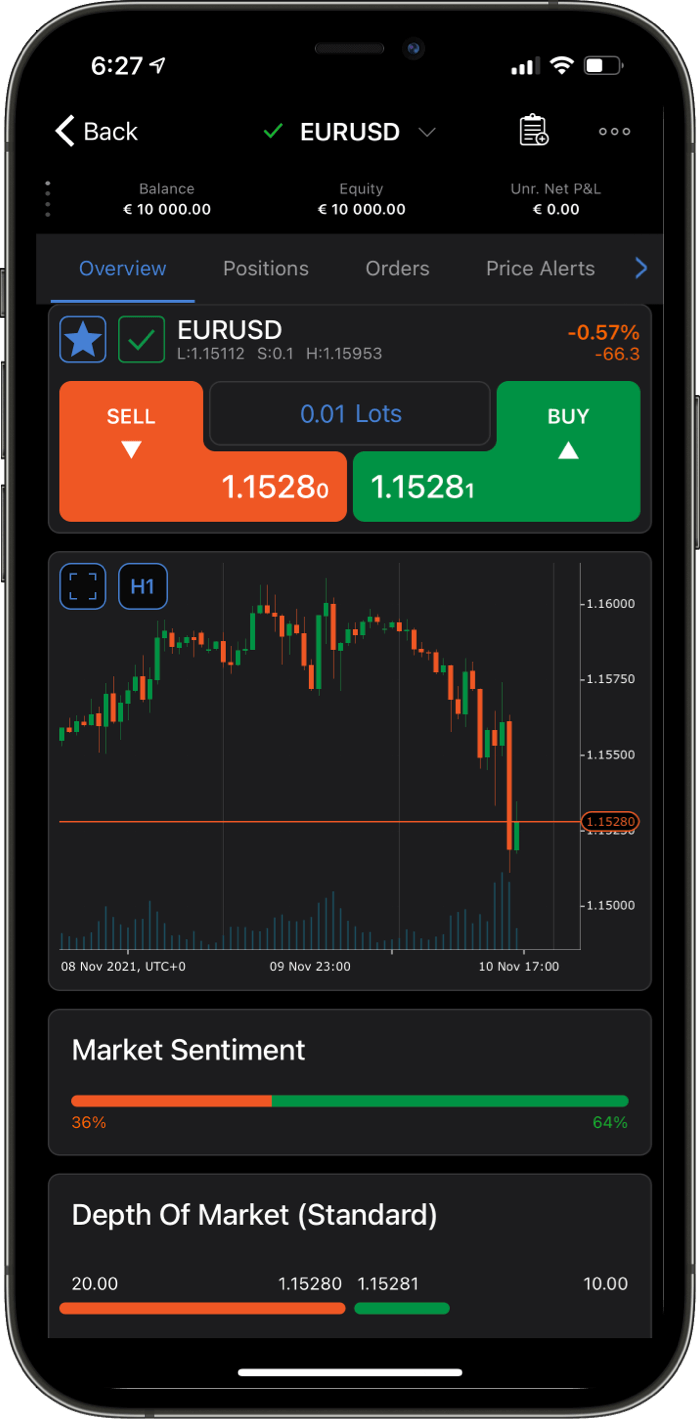

Imagine you have a demo account, and you have decided to focus on trading the euro against the US dollar. The currency that is used as reference is called the base currency (in this case, the euro), while the currency that is quoted in relation is called the quote currency, the US dollar in this example. Trading platforms generally show one ticker symbol per each currency pair, and the EUR/USD currency pair’s ticker symbol is EUR.USD

Imagine you expect the euro’s value to rise against the dollar; you would then “buy the pair”. If you expected the euro to fall in value against the greenback, you would “sell the pair”. In this case, based on your analysis, you believe it is a good time to buy euros as you anticipate the currency will rise further.

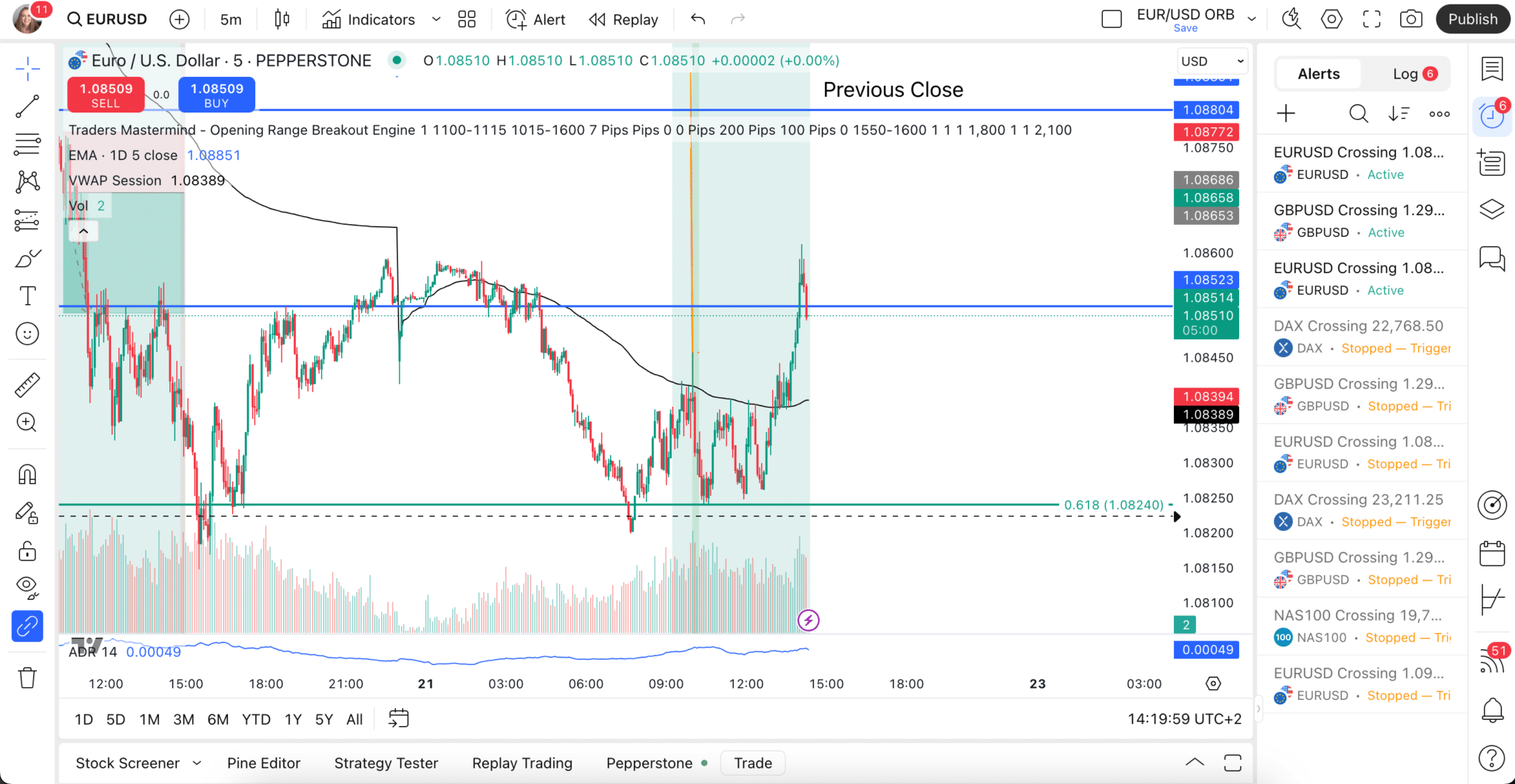

Having clicked in the ticker symbol (using the MetaTrader4 platform) to get the EUR.USD, you will see a chart showing how the pairs are performing. You press the buy button in the top left-hand corner of the screen to execute a buy order, and a green horizontal line will immediately appear, showing at what price you bought into the market. You also are shown how the trade is performing in terms of profit or loss. Any profit or loss is notional until you close the position, again achieved with the click of a mouse.

The decision whether to buy or sell or even whether to trade at all will be based on the analysis you have already conducted. The two main types of research are fundamental and technical. Fundamental analysis is based on a thorough understanding of the impact of political, economic and social factors on the relative value of a currency and using that knowledge to develop informed trading decisions. Technical analysis involves using historical price movements and patterns to try and predict future price movements.

Exploring the Platform

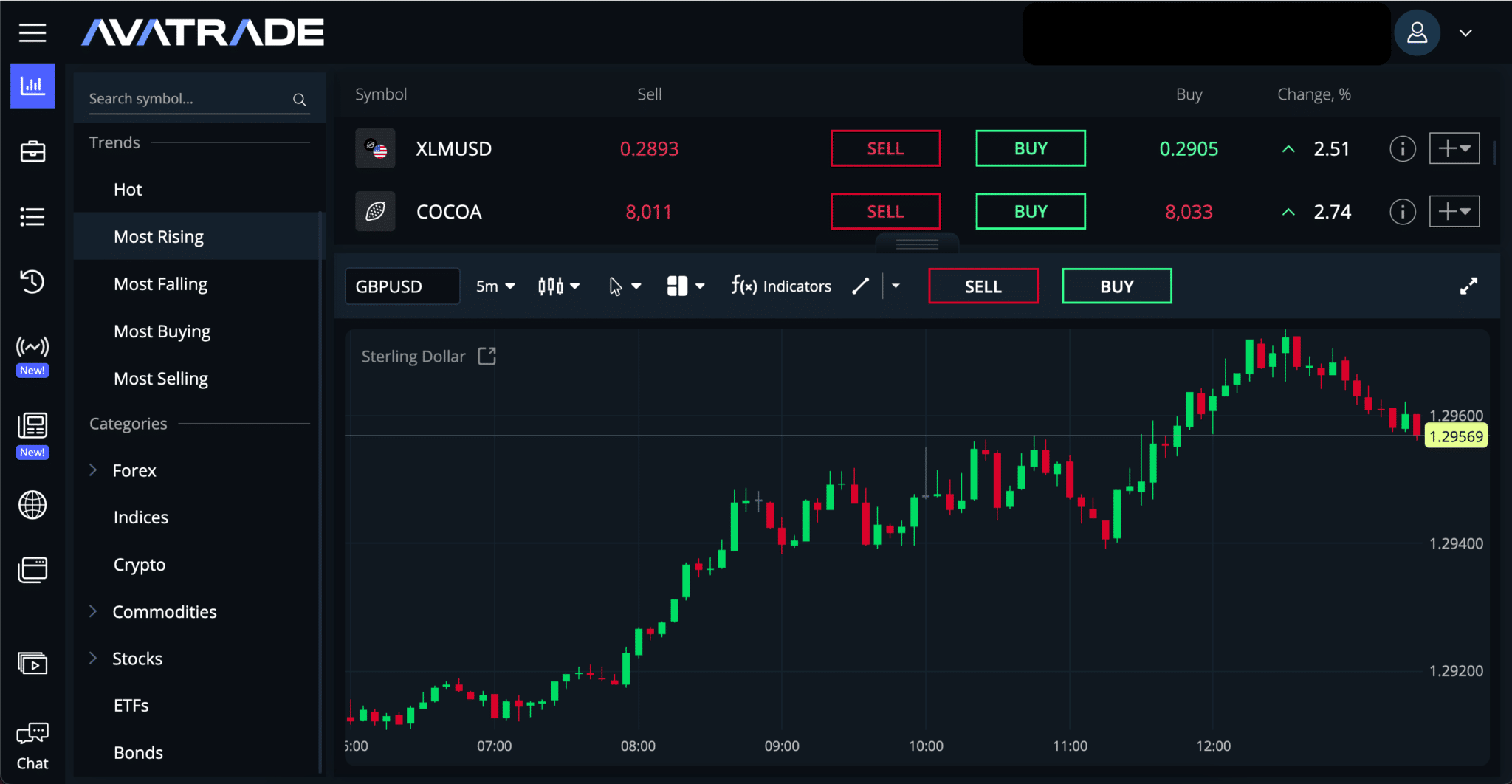

Demo accounts are the perfect way to learn how a trading platform works, allowing you to explore the platform without risking any real money. When using a demo account, these are some factors you want to consider when deciding if the platform is right for you:

- Is the platform easy to navigate? Can you adjust it to best suit your specific needs?

- Does the platform work well on the device you favour and using your internet connection?

- Does it contain all the instruments you will ever need to trade?

- Do you understand how to conduct research into trades?

- Can you use the tools for technical analysis, charting, etc., and do they suit your particular needs?

- Do you understand how to open and close positions, apply stops and limits, and do other trading-related tasks?

- Do you know how to use the platform to implement a particular trading strategy?

- Can you easily access information about your previous trades, and is it easy to analyse them to learn how to improve as a trader?

- Does the news feed work well, and does it contain useful information?

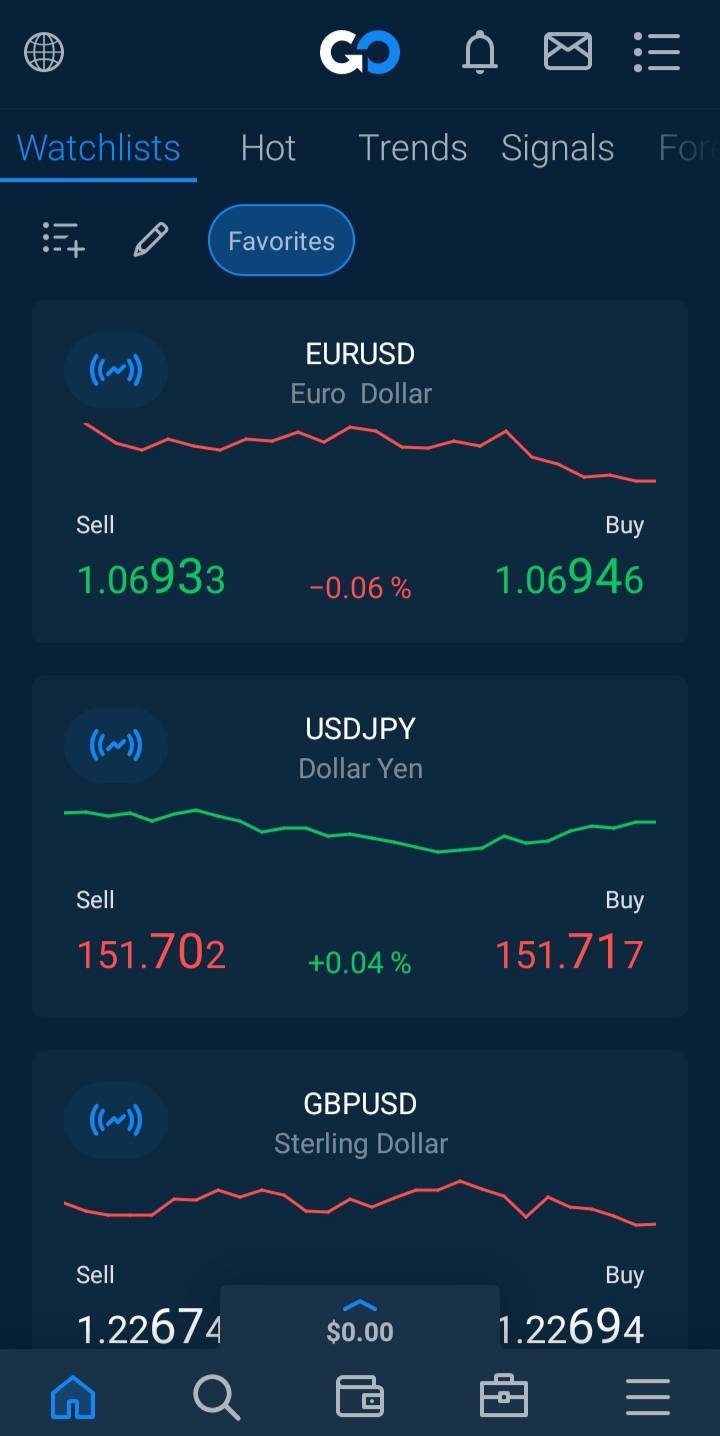

- Is there a watch list feature? This is a list of financial securities that are monitored for potential future trading opportunities.

Understanding the Basics of Forex Strategies

Forex trading strategies help traders decide when or where to buy or sell a currency pair. They are simply a set of rules that help a trader determine when to enter a trade, how to manage it and when to close it. There are many, many strategies available. Fortunately, a vast amount of information is also available on forex strategies, from books to YouTube videos to the educational information offered on broker platforms.

No single strategy is best, and the type of strategy you decide to employ depends upon many factors, not least your skill and experience. As a beginner, it is best to focus on the most basic and effective strategies. Other variables include how much time you want to devote to trading, which pairs you want to focus on, the size of your positions, whether you are going long or short etc, etc. Moreover, some may work better in certain situations than others. A demo account allows you to practise these strategies repeatedly until you find the ones you are most comfortable with and are ready to use in live trading.

A trading strategy can be very simple or very complex.

Charting and Trading Tools

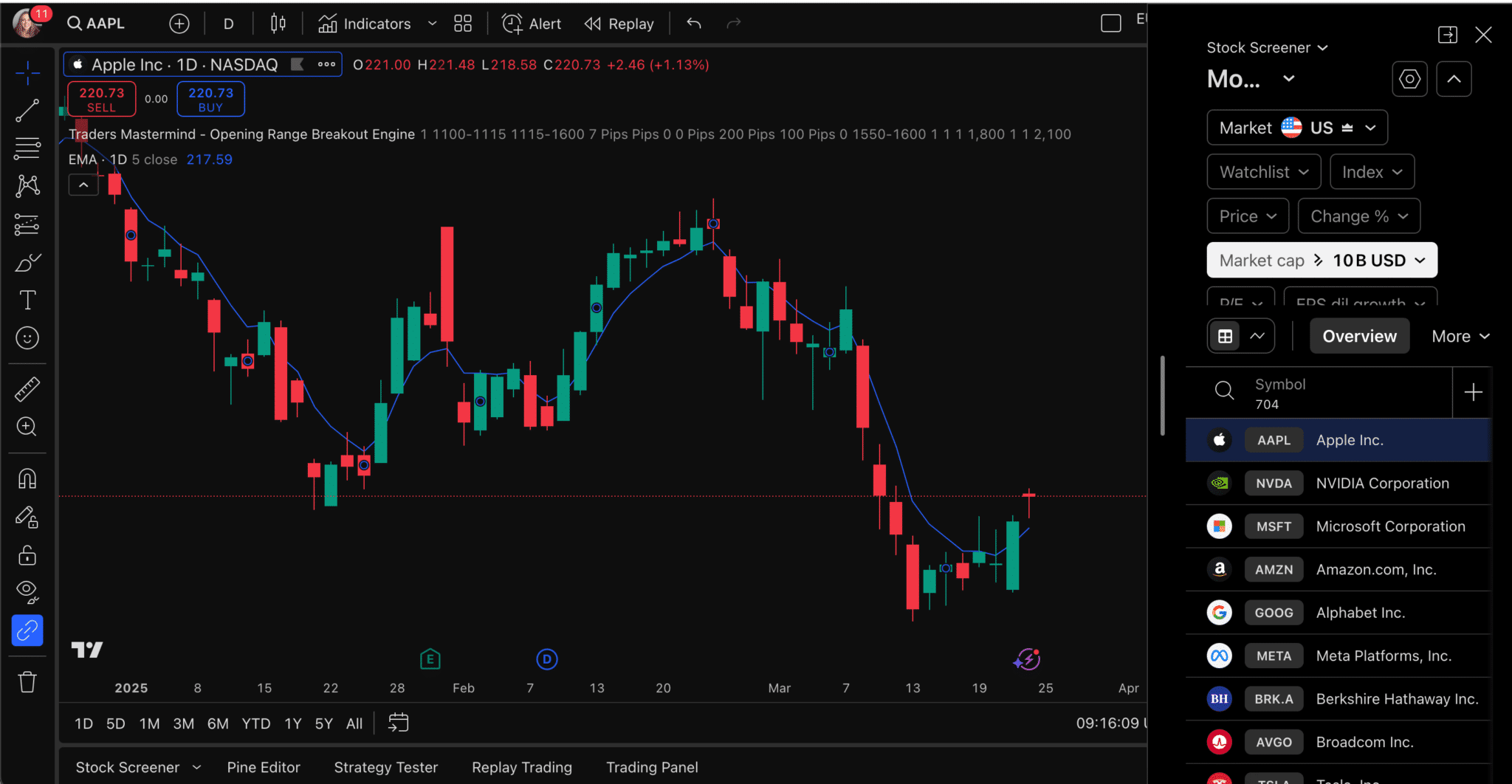

Learn how to interpret and utilise charts, from testing technical indicators to identifying patterns on a demo account. You can also learn how to interpret and utilise information from news feeds and market data.

Find Out What the Customer Service Is Like

Demo accounts are used mainly by beginners, who often need customer support. Almost all brokers offer 24-hour customer support during the working week, but some still offer only office-hours support. If you are still learning how to trade and expect to be trading overnight, ensure that your broker can help you with technical or administrative support during the night.