Desktop Trading Platforms

Like the mobile trading apps, Exness offers MT4, MT5, and its own in-house trading platform available on both Mac and PC.

While MetaTrader 4 and MetaTrader 5 are both excellent trading platforms, Exness’ in-house platform is easier to use for beginner traders. Still, the benefit of Exness offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker.

For the purposes of this review, we tested all three platforms – Exness’ web trader platform, MT4, and MT5.

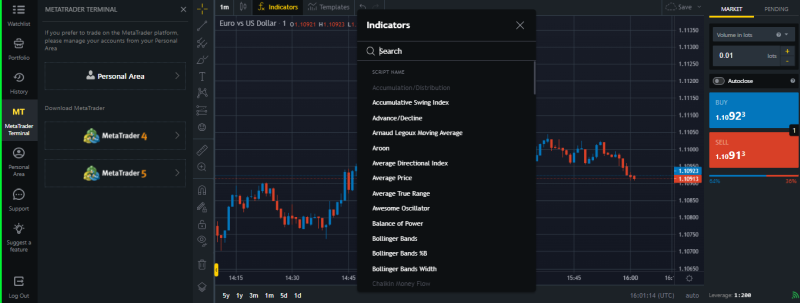

Exness Terminal

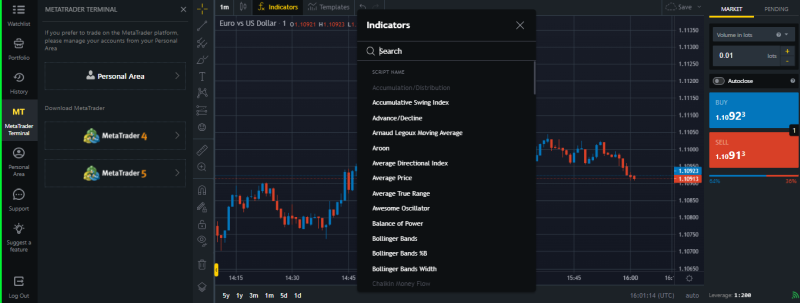

The web trader platform requires no downloads or installation and is available for all devices. When you log in to your account you are immediately redirected to the platform. We found that the web trader has a clean user interface, and it is easy to navigate and search for various instruments.

Additionally, traders can set their stop levels by percentage, account currency, or even price – which makes things much simpler for beginners. The platform also comes with TradingView charts, indicators and drawing tools, providing traders with a comprehensive view of the markets. See below:

One drawback is that the platform does not allow traders to set price alerts and notifications, but these are available on the mobile version. We were pleased to note that TradingView, one of the most popular third-party trading tools on the market, is fully integrated into the platform and provides technical insight and instant pattern recognition.

More advanced traders may prefer MT4 or MT5, both available at Exness, which allows traders to customise their indicators, has many more chart types, and has algorithmic (or automated) trading.

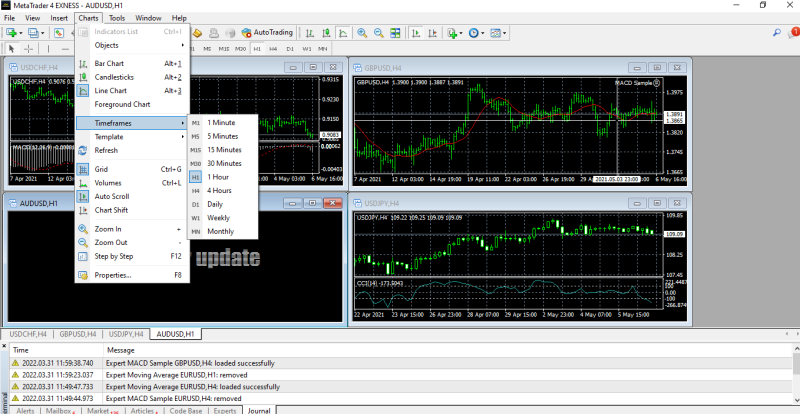

MetaTrader 4 (MT4)

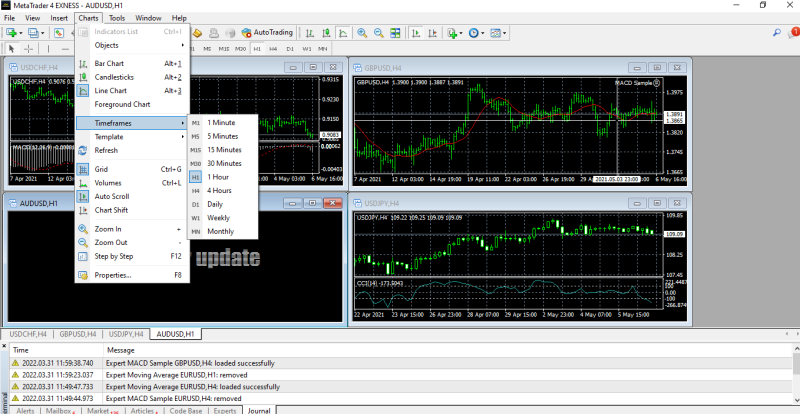

We found that, like most brokers, the Exness MT4 platform is the standard version with 23 graphical objects and 30 built-in indicators. Unlike Exness’ proprietary web trader, algorithmic trading is available, and MT4 is fully customisable.

We found that the platform’s interface is dated, but it is fully customisable. There are three chart types, including Line, Bar, and Candlestick charts, and you can access a wide selection of indicators in multiple timeframes:

MetaTrader 5 (MT5)

Developed in 2010, MT5 is the newer version of its predecessor, MT4, and is available at Exness. We recommend using MT5 if you are looking for a more powerful and faster trading platform when it comes to back-testing functionality for automated trading algorithms. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators (38 as opposed to 30 on MT4), and 22 analytical tools.