cTrader Features

A little-known fact: 35% more cTrader users are profitable compared to the industry average. This surprising statistic comes from Spotware’s internal calculations and highlights why cTrader has become MetaTrader’s main competitor. But what is it about cTrader that makes traders more profitable?

No price manipulation

Unlike MetaTrader and most other broker-owned platforms, cTrader does not allow any broker manipulation of the price feed. This means that it will only connect traders directly to the global Forex market and won’t allow for any dealing desk intervention.

No broker intervention

Spotware manages all the infrastructure behind cTrader, and the interface you download from your broker is just that — an interface. The broker can alter commission and spreads, but the price feed and market data cannot be modified.

Single Login

Because Spotware manages cTrader’s infrastructure, the cTrader ID you receive when you first log in to the application will never change. This is especially useful as you won’t have to remember new passwords or account numbers, even if you switch brokers.

Spotware is invested in your success

cTrader is also offered to brokers on a platform-as-a-service basis, and brokers pay Spotware based on volume traded, meaning that the more traders succeed with cTrader, the more Spotware profits. The result is that Spotware has a real incentive to provide traders with the best chance to trade profitably.

These differences are all enshrined in Spotware’s founding motto: Trader’s First. This guiding mindset has led Spotware not only to ensure that cTrader is an intervention-free platform but also forced them to make transparency and community focus an integral part of cTrader’s business model.

It’s important to note that because most cTrader brokers provide raw spreads, users may have to pay a commission on their trades.

cTrader Platforms

cTrader offers three versions of its trading platform, and while the same indicators, objects, layouts and themes are present across all three versions, there are minor changes to functionality:

cTrader Download

The desktop version is the most feature-complete version of cTrader, download the application for any Windows PC or laptop. Unfortunately, for Mac users, there is no native application, and you will have to rely on cTrader Web or create a system partition to run Windows applications. It’s important to note that cTrader Copy will only run in the Web version,

cTrader Web

The cTrader Web version is almost as feature-complete as the desktop version except for a few changes. Charts are locked, so they cannot move up and down, and cTrader Automate is unavailable.

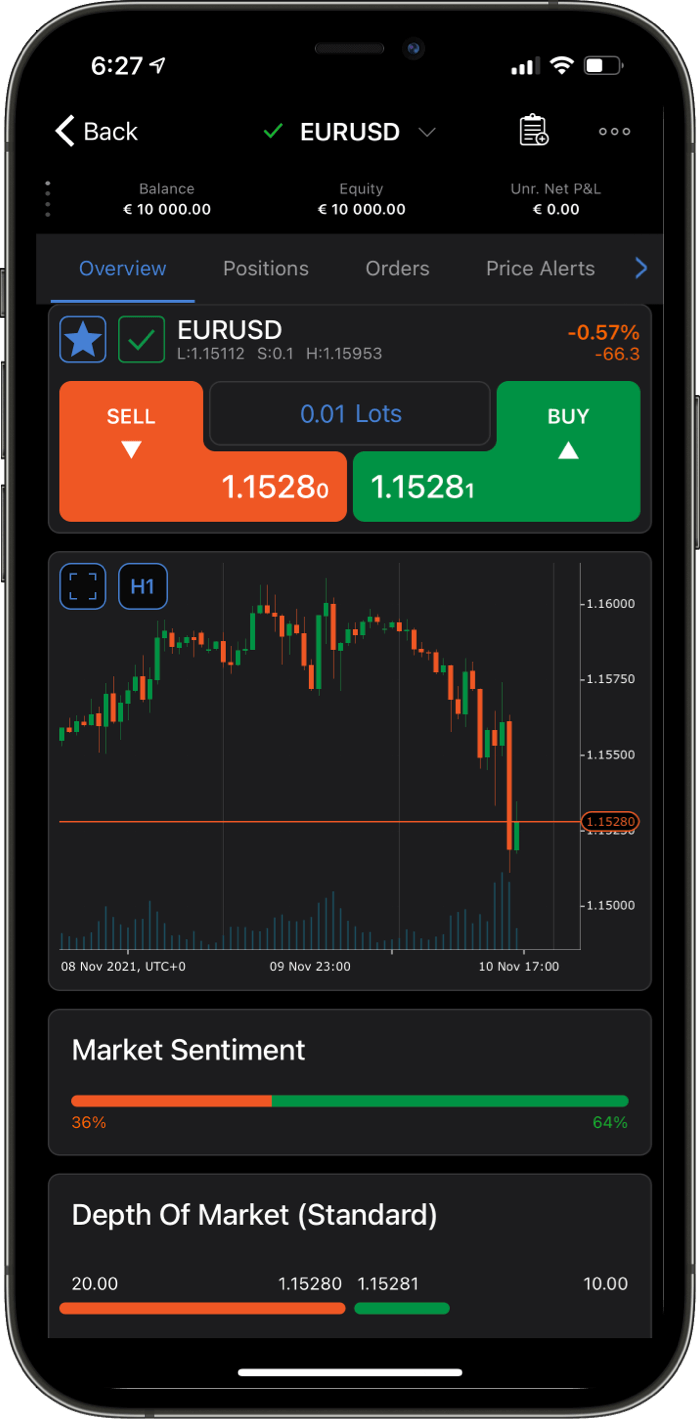

cTrader Mobile

Available on iOS and Android, the cTrader mobile app is perfect for traders on the go and has 26 timeframes and over 50 indicators available. Charts have been redesigned for mobile with features such as pinch-to-zoom, fling to scroll forward or backwards, and double-tap to re-centre.

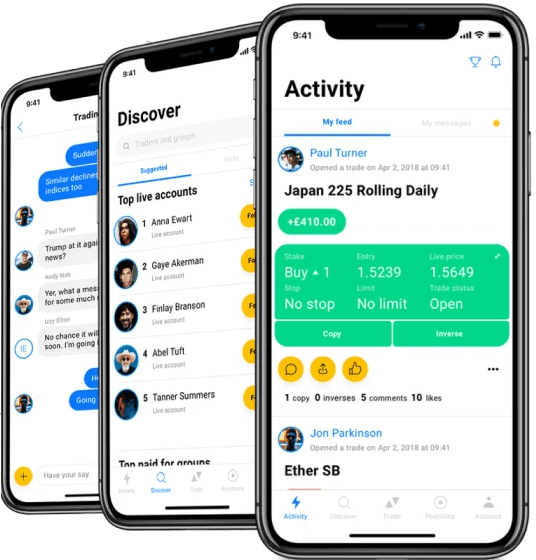

cTrader Forum

The cTrader forum is a place for all cTrader users to post suggestions to the developers for new features for the platform, get support from the community and stay on top of any product announcements and other news. Spotware continuously improves cTrader with enhancements stemming mostly from community feedback; this regular interaction with traders results in several platform updates and upgrades a year.

cTrader ID Site

The cTrader ID Site is a personalised toolbox for anyone holding a cTrader ID. It provides traders with several tools to control their accounts and connect to other traders, apps, and resources.

Standout features include:

- Credential management: traders can view a list of demo and live trading accounts they own with each broker under the same cTrader ID.

- Push Notifications: Traders can alter email and mobile push notifications regarding changes and events on their trading accounts.

- Security: Allows traders to view and revoke active sessions and control which devices are authorised to use cTrader.