Is Trading Crypto Profitable?

Like all trading, if you’re on the right side of the market, you can make a profit. However, if you’re on the wrong side of the market with cryptocurrencies, you can lose a lot of money in a short period.

The cryptocurrency market is very volatile, and it’s not uncommon to see 20%, 30% and even 50% swings every single day. If you are day trading, this can translate to good profits if you can capitalise on the short-term fluctuations.

Is Crypto Trading Safe?

Trading cryptocurrency is a very high-risk market. In part, this is because the market doesn’t have a long history, so we can’t refer to previous market behaviour, but also because it does not have the same oversight and controls as fiat currencies. This lack of control makes the market an unpredictable asset to trade.

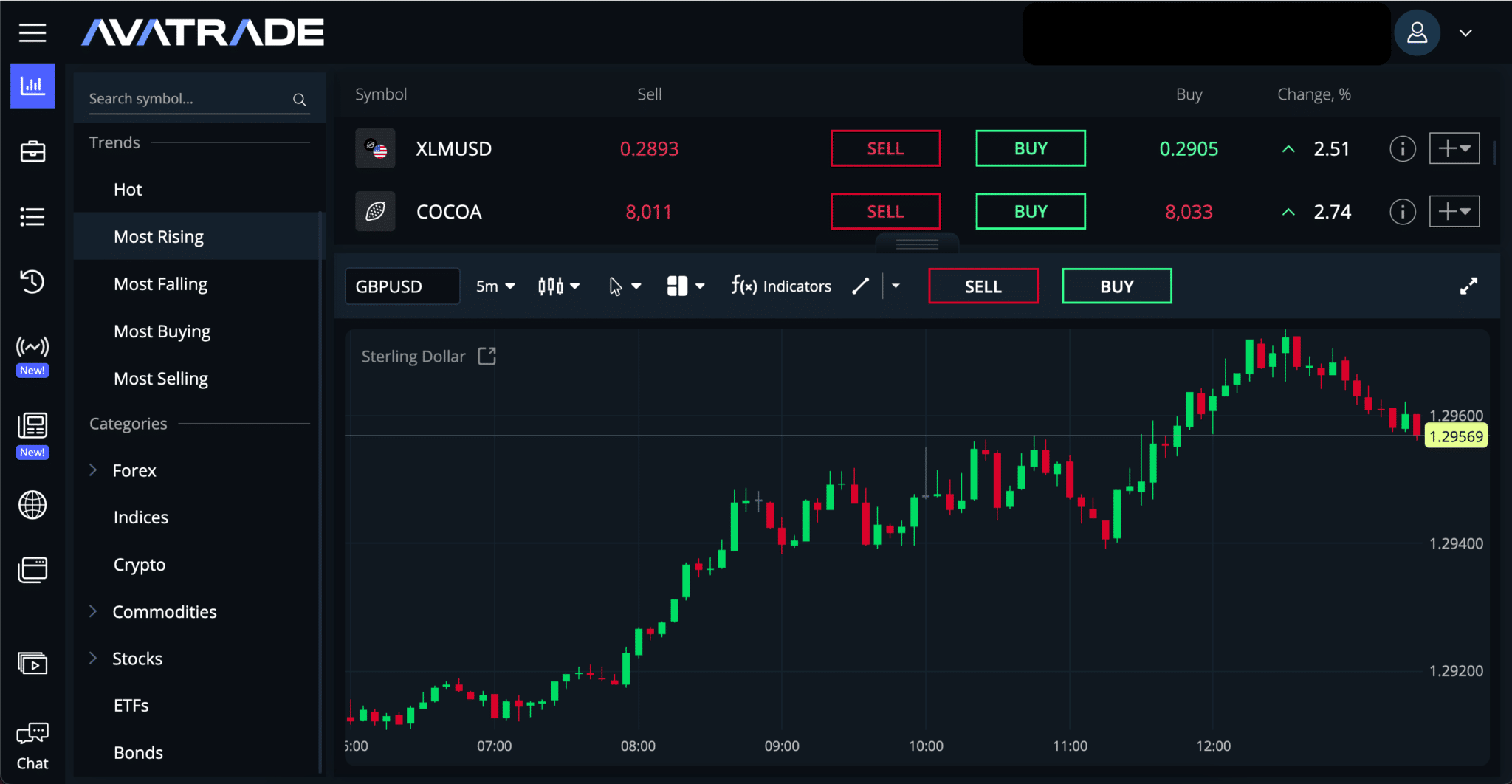

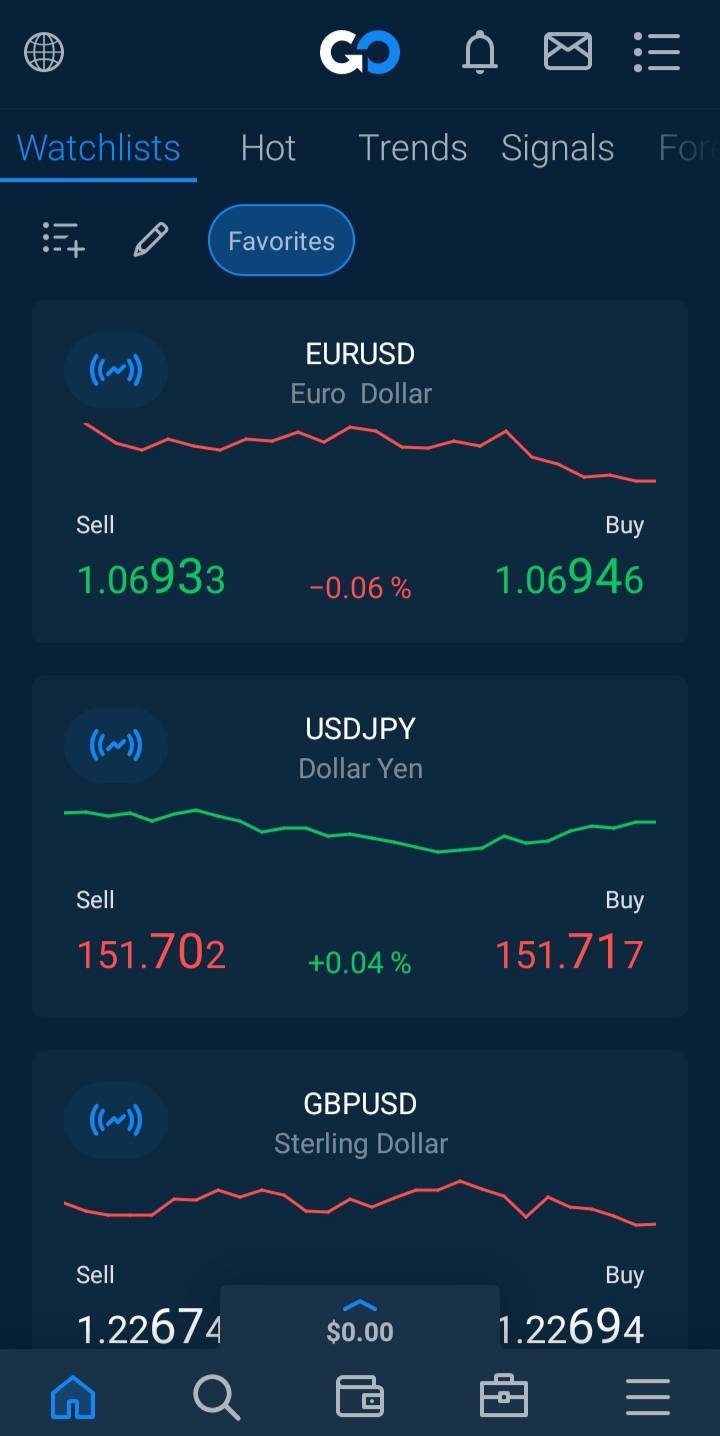

Cryptocurrency CFD trading is also only as safe as your broker. The same rules apply when looking for a broker to trade crypto CFDs, as they do for fiat currencies. Finding a well-regulated broker, with an acceptable account choice, trading conditions and reputation is key to your trading safety.

When Can I Trade Cryptocurrency?

Because there is no actual cryptocurrency exchange, and all trades use a broker as a counterparty, cryptocurrencies can be traded 24/7. Crypto CFDs are the only assets that trade around the clock, seven days a week, 365 days a year, which is very rare in the financial world.

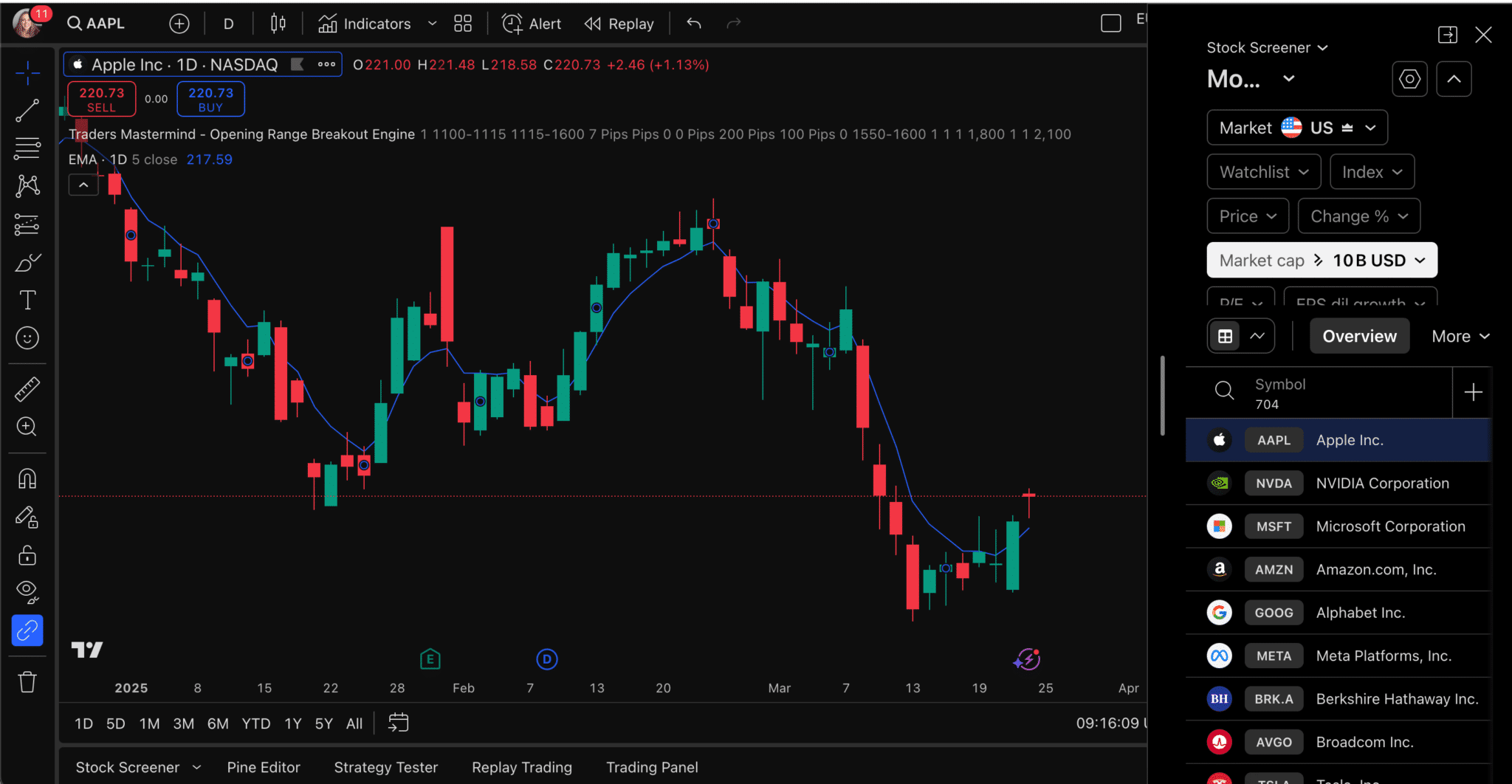

In contrast, the stock markets operate 8 hours a day; 5 days per week while the Forex market pauses trading over the weekend.

The main advantage of a 24/7 market is that you can buy and sell cryptocurrencies any time of the day, making them accessible to all traders.

Are Profits From Crypto Trading Taxable?

Like any other regular income, cryptocurrency trading is taxable. However, the cryptocurrency market remains a relatively new market, and because of that, there is also a lot of ambiguity in the laws.

If you’re transacting any cryptocurrency, you need to be aware of the tax consequences — no matter where you live. If you have significant money invested in cryptocurrencies, you should always seek guidance from a financial adviser when it comes to legal issues and taxes.

Cryptocurrency vocabulary

There is a wide range of terms you should know before you try trading cryptos. The main ones are listed below.

Altcoin

This refers to any crypto that is not Bitcoin. Altcoins share similarities with Bitcoin but can also vary in key respects, such as using a different mechanism to validate transactions.

Bitcoin

Bitcoin was the first cryptocurrency. It was created in January 2009 when an unknown author using the pseudonym Satoshi Nakamoto mined the genesis block. The total value of the crypto market is now estimated at around US$2 trillion. Interest among small traders and investors took off in 2017 after the price of Bitcoin reached US$20,000 per coin.

Bitcoin Cash

Bitcoin Cash is a peer-to-peer crypto created in August 2017 as a “fork” (see below) of Bitcoin. While Bitcoin is believed to be too volatile to be useful as a currency, Bitcoin Cash is designed for transactions.

Block

Blocks are where the data related to the Bitcoin network are permanently recorded. Blocks contain the records of valid transactions that have taken place on the network, so a block is effectively like a page of a ledger or record book.

Blockchain

A blockchain is a digital form of record-keeping and the underlying technology behind cryptocurrencies. It is a system of recording information in a way that makes it difficult or impossible to change, hack or cheat the system. The blockchain is composed of sequential blocks that build upon one another, creating a permanent and unchangeable ledger of transactions.

Coin

A coin is a crypto or digital currency that is independent of any other blockchain or platform. As a single unit of currency, a coin can be traded for an agreed-upon value, depending on current market conditions. Some blockchains, like Bitcoin, have the same name for both the network and the coin.

Coinbase

Coinbase is an exchange that offers a secure online platform for buying, selling, transferring and storing digital currency. In April 2021, it became the first crypto exchange to go public on the NASDAQ.

Cold wallet/hardware wallet/cold storage

A cold wallet, also known as a hardware wallet or cold storage, is a physical device that offers a secure method of storing your crypto offline. Many look like USB drives.

Cryptocurrency

Cryptocurrency is decentralised digital money based on blockchain technology. The most well-known cryptos are Bitcoin and Ethereum, but there are more than 5000 different cryptocurrencies in circulation. Cryptos can be used to buy and sell things, as a long-term store of value, or for speculative purposes.

Decentralisation

In blockchain technology, decentralisation refers to the transfer of control and decision-making from a central authority to a distributed network, so reducing the level of trust that participants must place in one another. It also undermines the ability of one entity to exert authority or control over others. Blockchains require majority approval from all users to operate and make changes.

Decentralised finance (DeFi)

DeFi aims to provide financial services without intermediaries, such as banks or governments, using automated protocols on blockchains and stablecoins (see below) to facilitate fund transfers.

Decentralised applications (Dapps)

A decentralised application is an application built on a decentralised network that combines a smart contract, a programme that runs on blockchain, and a front-end user interface. The vast majority of dapp development is on the Ethereum blockchain. Dapps allow users to carry out transactions with each other without intermediaries.

Digital gold

This term can have two meanings. One is a form of digital money based on units of gold. However, cryptos are often referred to as digital gold because they share some of the characteristics of physical gold, having a limited supply and acting as a haven in times of trouble and a store of value and protection against inflation.

Ethereum

The second-largest cryptocurrency by trade volume, Ethereum is a decentralised, blockchain-based platform that facilitates the use of smart contracts and the creation of decentralised apps or “dapps”. It also has a native cryptocurrency called Ether (or “ETH”).

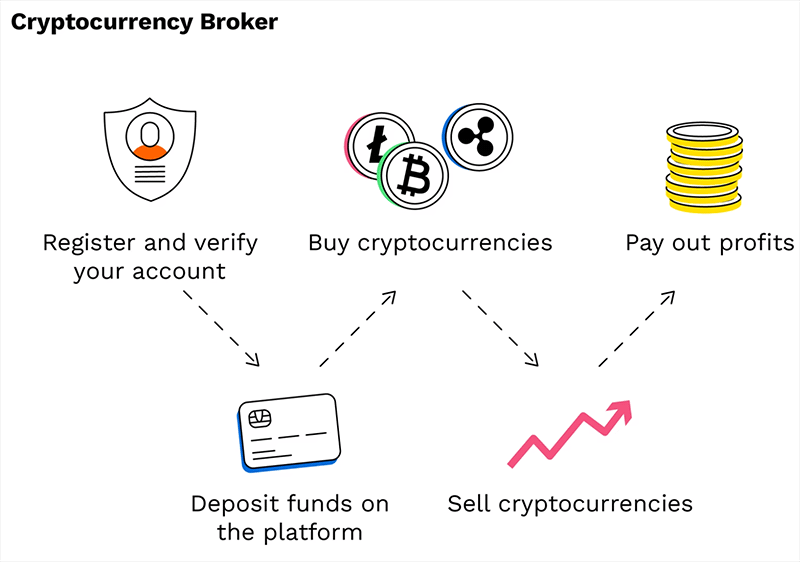

Exchange

An exchange is a digital marketplace where you can buy and sell cryptos.

Fork

A fork occurs when a blockchain’s users make changes to the rules (known as protocols) of the blockchain. This often results in the creation of two paths: one follows the old rules, while the other is a new blockchain that splits off from the previous one.

Gas

The term “gas” refers to the fee that must be paid to successfully conduct a transaction or execute a contract on the Ethereum blockchain platform.

Genesis block

The genesis block is the first block of a cryptocurrency ever produced.

HODL

This term means “Hold On for Dear Life”. It originated from a user typo (intended to be “HOLD”) in an online Bitcoin forum in 2013 and refers to a buy-and-hold investment strategy executed in the belief that the cryptocurrency will increase in value over the long term.

Halving

Halving is a method of controlling the supply of Bitcoin (in contrast with traditional currencies like the US dollar, which are essentially unlimited in supply and lose value when governments print too much of them). Halving involves cutting in half the number of new units entering circulation. Bitcoin last halved on April 2024, and the next halving is expected in 2028.

Hash

A hash is a function that generates a fixed-length character string from data records of any length. A data record can be a word, a sentence, a longer text or an entire file. A hash is used for security purposes and constitutes the backbone of crypto security.

Hot wallet

A hot wallet is a form of cryptocurrency storage that is connected to the internet and can be accessed through your computer or phone. Because they are online, hot wallets are more susceptible to hacking and cybersecurity attacks than offline wallets (also known as cold wallets – see above).

Initial coin offering (ICO)

An initial coin offering is a method of raising funds for a new cryptocurrency project. ICOs are similar to initial public offerings (IPOs) of stocks.

Market capitalisation

The market capitalisation of a cryptocurrency is the total value of all the coins that have been mined. It is calculated by multiplying the current number of coins by the current value of each coin.

Mining

Mining is the process whereby new cryptocurrency coins are created and the log of transactions between users is maintained.

Node

A node is a computer that connects to a blockchain network.

Non-fungible tokens (NFTs)

“Non-fungible” refers to something that is unique and cannot be replaced by something else. NFTs have unique identification codes and metadata that distinguish them from each other, and, unlike cryptos, they cannot be traded or exchanged at equivalency.

NFTs are most often held on the Ethereum blockchain. They can be used to represent real-world items such as artwork and real estate. NFTs are created through a process known as minting and, once minted, they cannot be deleted or edited. The value of NFTs is subjective and this is why they are usually issued through auctions on digital marketplaces.

Peer-to-peer

The term “peer-to-peer” refers to two users interacting directly without a third party or intermediary. A peer-to-peer platform is a decentralised platform that allows individuals to interact directly with each other.

Public key

A public key is a unique cryptographic code used to facilitate transactions between parties, allowing users to receive cryptocurrencies in their accounts. It is effectively a wallet address, and similar to a bank account number. It can be disclosed to other users so that they can send you money.

Private key

A private key is an extremely large encrypted code that allows direct access to your cryptocurrency. Like a bank account password, it should never be shared.

Smart contract

A smart contract is a program stored on a blockchain that runs when predetermined conditions are met. Smart contracts are typically used to automate the execution of an agreement, so that all participants can be immediately certain of the outcome without the involvement of any intermediary or loss of time. They can also automate a workflow, triggering the next action when the defined conditions have been met.

Stablecoin/digital fiat

A stablecoin is a digital currency that is pegged to a “stable” reserve asset like the US dollar or gold. Stablecoins are designed to reduce volatility relative to unpegged cryptocurrencies such as Bitcoin. They are also known as digital fiat.

Token

The word “token” has several meanings. It can be used as another word for a crypto, or to describe all cryptos other than Bitcoin and Ethereum, or as a name for certain digital assets that run on top of a crypto blockchain. Tokens have a huge range of potential functions, from helping make decentralised exchanges possible to selling rare items in video games. But they can all be traded or held like any other cryptocurrency.

Vitalik Buterin

Vitalik Buterin is the programmer who created Ethereum in 2015.

Wallet

A wallet is a place to store your cryptocurrency holdings. Many exchanges offer digital wallets, which can be hot (online, software-based) or cold (offline, usually on a device).