How Brokers Are Scored

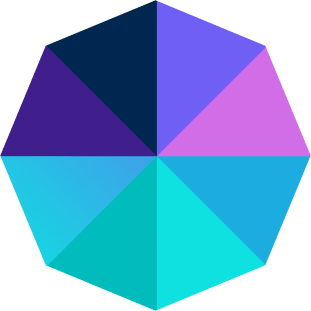

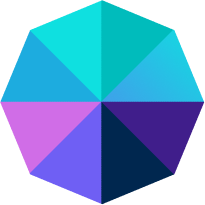

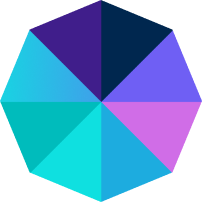

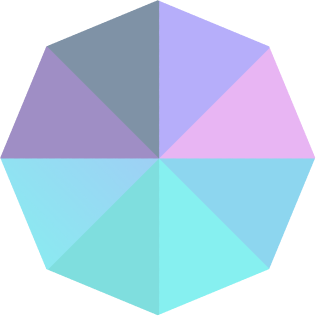

FxScouts’ Broker Score and Trust Rating constantly evolve to reflect the forex market’s dynamics. We ensure transparency by incorporating regulator data and user insights. Our in-depth reviews consider over 200 metrics across seven key categories. The radar chart to the left shows how important each category is when calculating a broker’s final score.

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Learn how we set the standard for broker reviews. Explore our in-depth review process here.