MetaTrader 4, MetaTrader 5, cTrader and TradingView are the most popular trading platforms. Many brokers also have their own proprietary trading platforms. Almost all trading platforms are also available as mobile trading apps.

The table below is an easy guide to the main differences between the four main platforms.

| Features |

MetaTrader 4 |

MetaTrader 5 |

cTrader |

TradingView |

| Timeframes |

9 |

21 |

26 |

Unlimited – customised timeframes |

| Chart Types |

Line, Bar, candlesticks |

Line, Bar, candlesticks |

Bar, Candlesticks, Line +4 more |

Bar, Candlesticks, Line +9 more |

| EA Trading |

|

|

|

|

| Indicators |

31 |

38 |

55 |

100+ |

| Pending Order Types |

4 |

6 |

4 |

6 |

| Depth of Market |

|

|

|

|

| Integrated Economic Calendar |

|

|

|

Available as a widget |

| One Click Trading |

|

|

|

|

| Trailing Stop |

(But from the terminal side) (But from the terminal side) |

(But from the terminal side) (But from the terminal side) |

|

|

| Sentiment Display |

|

|

|

|

| Coding Language |

MQL4 |

MQL5 |

C# |

Pine Script |

MetaTrader4 (MT4)

Available at over 90% of Forex brokers, MT4 can run on any system, regardless of age, has extremely fast execution, and has the largest number of Expert Advisors.

Developed in 2005 by MetaQuotes, MT4 is the world’s most popular Forex trading platform. MT4 gives traders real-time access to the Forex market, enabling them to trade currencies, commodities, indices, and cryptocurrencies. However, it does not natively allow trading on stock CFDs, ETFs, and bonds, which are available on MT5, cTrader, and TradingView.

The platform also has advanced charting tools and customisable trading layouts, but its interface is outdated, and other platforms, such as MT5, cTrader, and TradingView, have a much broader range of platform tools and more advanced functionality.

Because MT4 has such low resource requirements, it can run on both new and old devices and has been developed to initiate trades as quickly as a Forex broker can process them.

One of the main benefits of MT4 is automated trading with trading robots called Expert Advisors (EAs). Traders can build or purchase EAs, which will trade within the parameters of a pre-set algorithm. Before MT4, automated trading was only available to banks and hedge funds. There are also many more EAs available for MT4 than any other platform in the world.

Watch our MT4 tutorial video

Find out more about our favourite MT4 brokers

MetaTrader5 (MT5)

A feature-rich and modern trading platform compared to MT4, MT5 is more powerful and efficient and offers trading on a broad range of tradable assets, including stocks, ETFs, and bonds.

Released in 2010, MT5 is considered a more advanced and versatile platform than MT4. One of the key differences is that MT5 has a built-in economic calendar and more advanced charting tools. MT5 also supports more order types than MT4 and, unlike MT4, allows native trading of assets like stocks, ETFs and bonds.

Another feature that sets MT5 apart from MT4 is its Depth of Market DOM feature. DOM measures the liquidity of an asset based on its supply and demand. It displays the number of open buy and sell orders for a given asset.

MT5 also has an improved programming language called MetaQuotes Language 5 (MQL5) that allows traders to create more complex EAs than is possible with MQL4, but there are far fewer pre-programmed EAs available for download on MT5.

Although MT5 has slowly gained popularity and is available at many more Forex brokers than cTrader and TradingView, it is not as user-friendly or easy to set up.

Watch our MT5 Tutorial Video

Find out more about our favourite MT5 brokers

cTrader

cTrader is a modern-looking and user-friendly platform with more advanced functionality than MT4 and MT5. cTrader users are also more profitable than their MetaTrader counterparts.

Developed by Spotware and released in 2011, cTrader is a trading platform popular among forex traders for its advanced features and user-friendly interface. cTrader advanced charting capabilities include 70+ technical indicators, 26 time frames, a range of chart types, and Depth of Market functionality. cTrader also has a built-in economic calendar and a wide range of advanced order types.

Like MT4 and MT5, cTrader supports automated trading through cTrader Automate, a feature for developing and backtesting trading robots called cBots. cTrader also has an integrated copy trading function called cTrader Copy, allowing traders to copy the trades of other traders.

Unfortunately, cTrader is not as widely available as MetaTrader software programs, but according to Spotware’s internal calculations, 35% more cTrader users are profitable compared to the industry average. This amazing statistic highlights why cTrader has become MetaTrader’s main competitor.

Watch our cTrader Tutorial Video

Find out more about our favourite cTrader brokers

What is TradingView

TradingView has the most advanced charting functionality of all third-party trading platforms and is the most customisable. However, because it is fairly new, it is the least widely available platform.

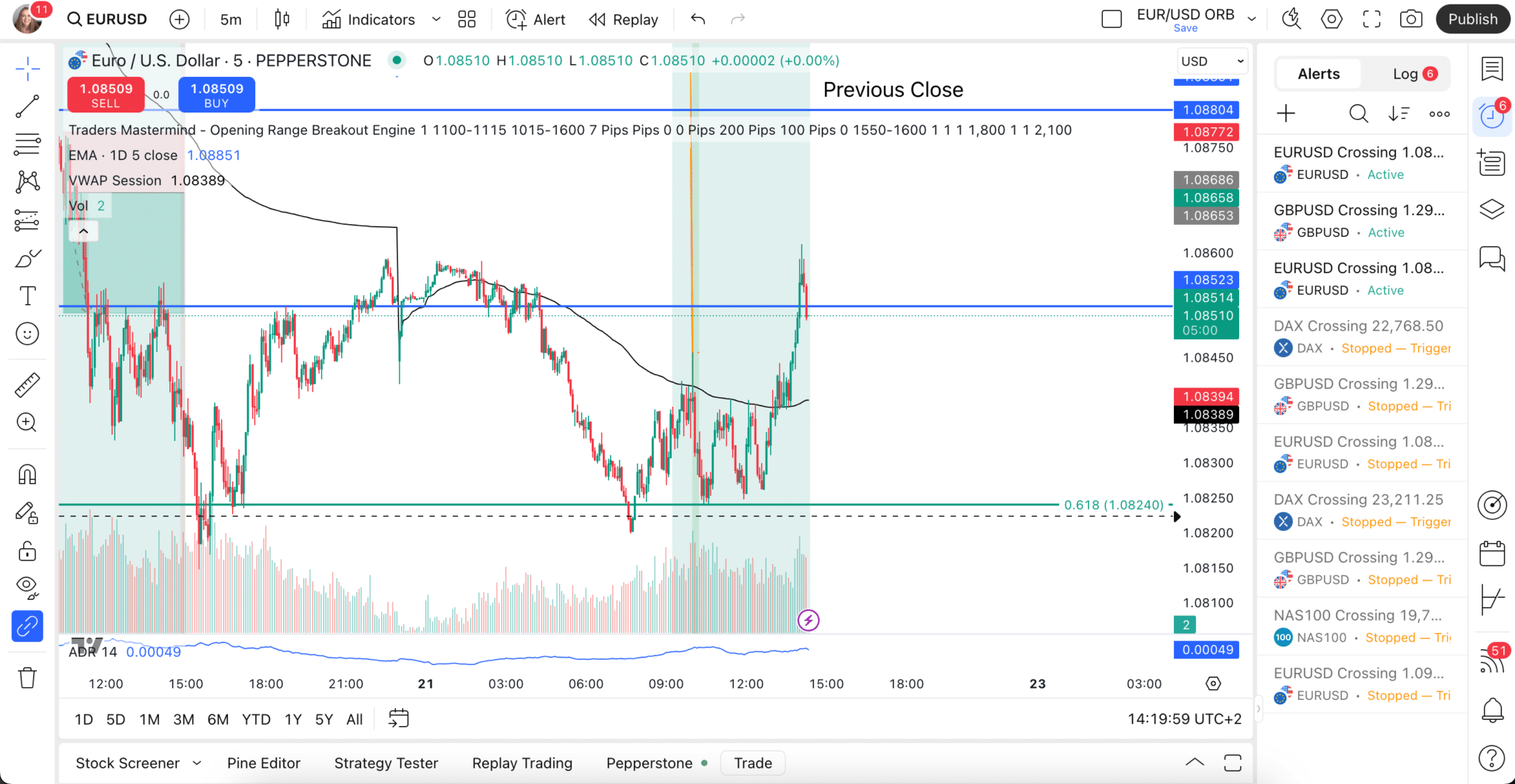

TradingView is a charting platform and social network used by 50 million traders and investors worldwide to spot opportunities across global markets. TradingView also works with select brokers, allowing traders to trade directly from TradingView’s charting platform.

The TradingView platform offers a fully customisable experience, with 12 chart types, custom time intervals, 100,000+ community-built indicators, integrated financial analysis, and its own programming language, called PineScript, which allows traders to share their automated trading strategies.

Overall, TradingView is the most advanced, customisable, and feature-rich third-party platform available, but traders will have few brokers to choose from that offer its services.

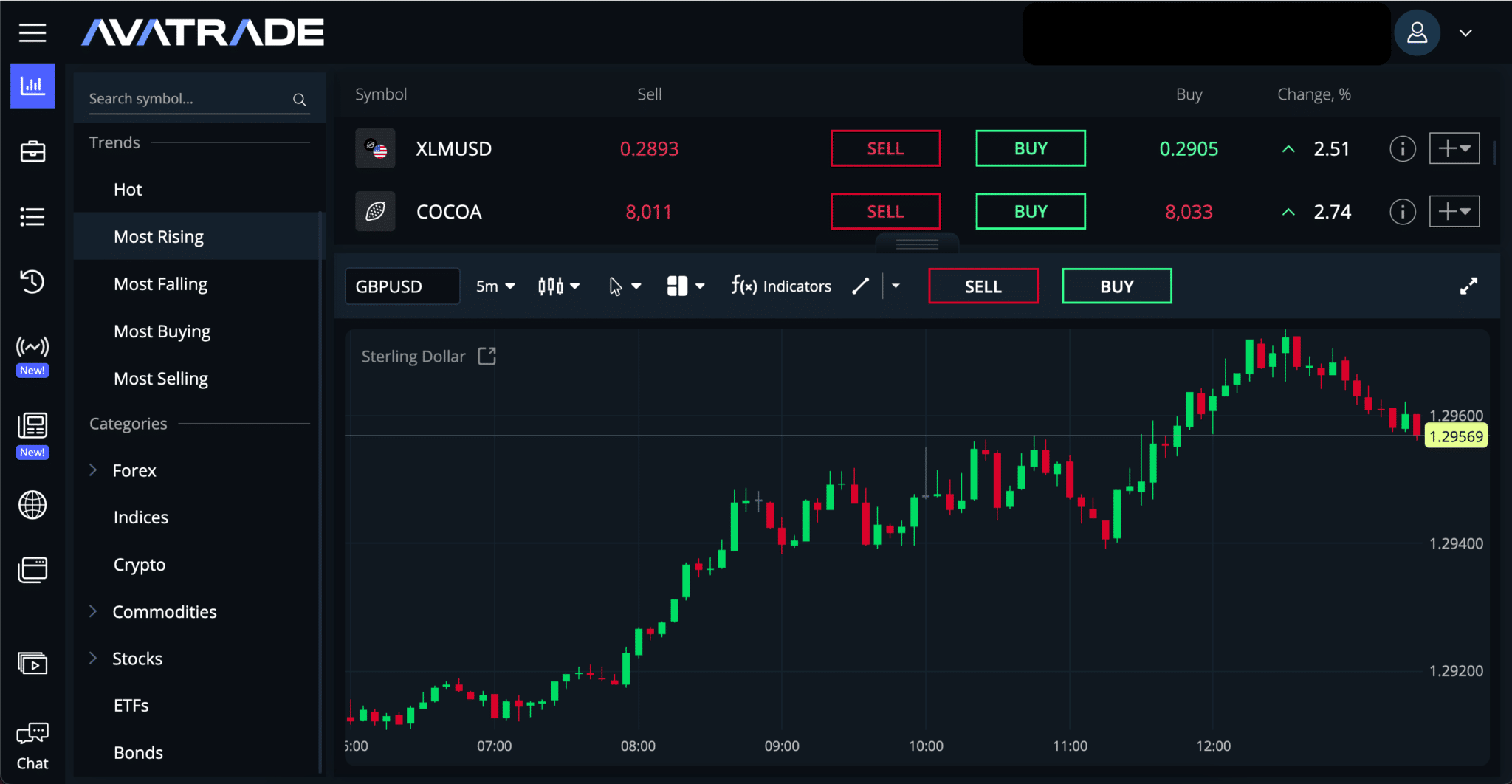

Proprietary Trading Platforms

Proprietary trading platforms are trading platforms that belong to a single broker. Most of the larger brokers have proprietary platforms. They generally work in a web browser and are designed to be intuitive and easy for beginners to learn. However, they tend to be less advanced; many do not have automated trading, for example.

Be aware that by choosing a broker’s proprietary platform rather than MT4, MT5, cTrader or TradingView, you will not be able to take the platform with you if you decide to switch brokers. So, you will lose all your specific platform knowledge and will have to start all over again with your new broker.

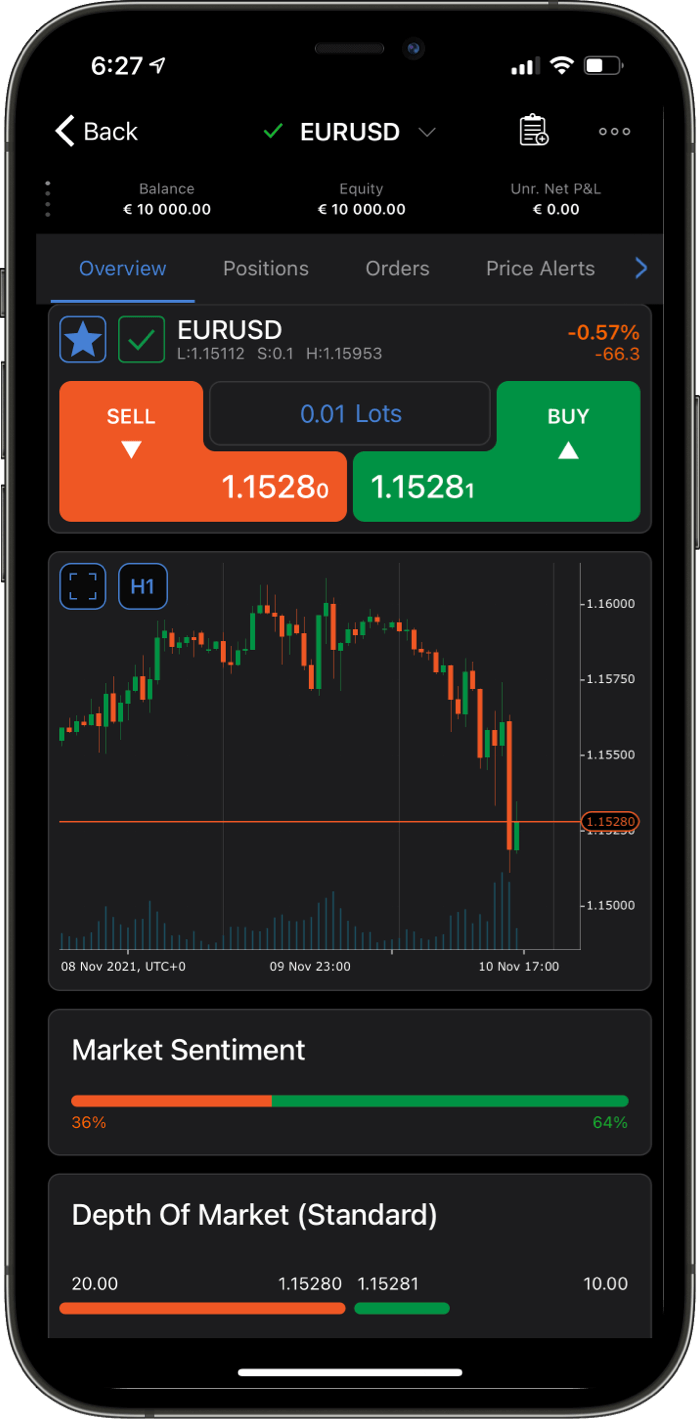

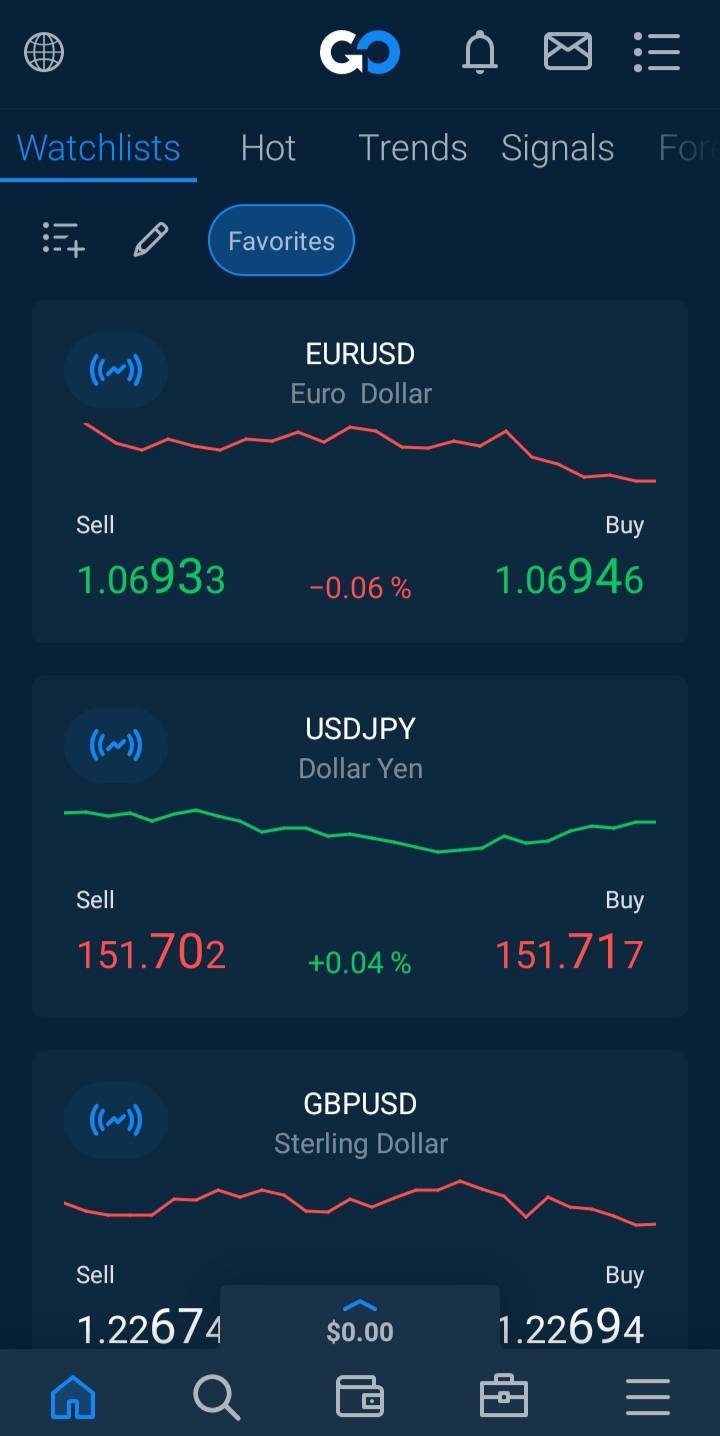

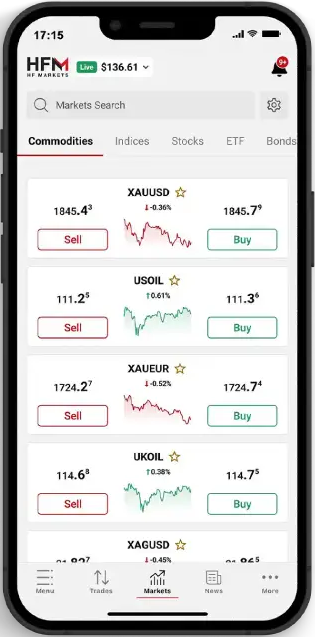

Mobile Trading Apps

Mobile trading apps are trading platforms that work on mobile devices, like mobile phones and tablets. Most trading platforms are available on Android and iOS devices, though they lose some functionality in the switch to the smaller screen size and emphasis on touch-screen controls.

Learn more about which mobile trading apps are best and how they differ from desktop trading platforms.

Key Factors to Consider When Choosing a Forex Trading Platform

Regulation

Because traders generally have to use a broker to trade on a platform, choosing a broker regulated by a reputable financial authority is essential to protect your funds and ensure that you are treated fairly. Brokers regulated by authorities such as the Financial Sector Conduct Authority (FSCA) of South Africa, the Financial Conduct Authority (FCA) of the UK, or the Australian Securities and Investments Commission (ASIC) tend to be reliable and trustworthy brokers.

User interface and functionality

The platform should have an easy-to-use interface with straightforward navigation, advanced charting tools, customisable indicators, and other features that suit your trading style and preferences. For example, TradingView and cTrader are more user-friendly and feature-rich than their MetaTrader counterparts, but these two platforms are only available at select brokers.

Reliability and speed

The platform should have fast order execution, low latency, and minimal downtime to ensure you can place trades quickly and efficiently. For example, a trading platform that can execute trades in under 100ms is considered a low-latency platform, but this will also depend on the broker’s ability to process trades.

Trading tools

The platform should offer a range of trading tools, including risk management tools, economic calendars, market analysis, and educational resources. More advanced trading platforms, such as cTrader, have integrated economic calendars and a trailing stop order function that operates from the server side rather than on the terminal side like MT4 and MT5. This functionality means the trailing stop will stay in place even if the terminal goes offline. Find out more about the various order types between the trading platforms here.

Security

The platform should have robust security features, including two-factor authentication, encryption, and firewalls, to protect your personal and financial information. Most trading platforms have robust security features, but this will largely depend on your broker.

Costs and fees

Consider the trading fees, spreads, and commissions associated with your broker to ensure they are reasonable and competitive. Brokers with a minimum deposit of 200 USD or less, an average commission-free spread of around 0.9 pips (EUR/USD), or a commission of 7 – 10 USD with a spread of 0.1 – 0.3 pips (EUR/USD) are considered brokers with low trading costs.

Trading Goals

When choosing a trading platform, ensure it has compatible functionality with your trading goals and style. For example, if you use Expert Advisors or automated trading, you may consider using a platform like MT4, MT5, cTrader or TradingView. However, traders who trade on stock CFDs would not choose MT4 because it does not natively offer stock CFD trading. In contrast, beginner traders may consider a user-friendly platform or one that offers copy trading functionality.