-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

ECN Brokers

Trade with Direct Market Access

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

Top MT4 brokers in Philippines

-

MetaTrader 5 Brokers

Top MT5 brokers in Philippines

-

cTrader Brokers

Top cTrader brokers in Philippines

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

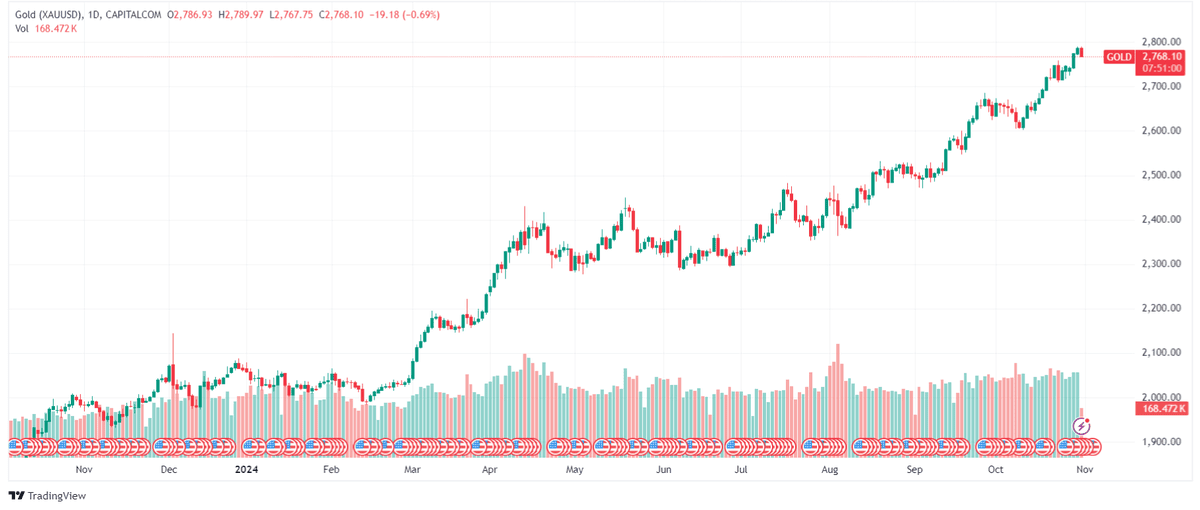

Gold prices remain elevated near Wednesday’s new record high of 2788 USD per troy ounce as uncertainty around the US election continues to drive demand. However, there are warning signs that current prices are unsustainable.

Gold’s unprecedented year-long bull run was initially driven by central bank purchases, as national governments worldwide have started to reduce their reliance on the US dollar as a reserve holding.

However, as gold prices have repeatedly set new highs through the summer, central bank purchases have slowed. Year-on-year purchases fell 49% to 186 tonnes, the lowest quarterly level in two years.

However, record-breaking prices have not slowed retail demand, with the total volume of global gold demand up 5% to 1,313 tonnes over the same period.

Traditionally, falling interest rates have supported gold prices. As gold is a non-yielding asset, lower interest rates reduce the opportunity cost of holding the precious metal. Alongside falling interest rates over the summer, gold has also benefited from a perfect storm of events, with conflict in the Middle East and Ukraine and Asian retail demand propping up prices.

But in recent weeks, the chances of aggressive rate cuts in the US have declined, and gold prices have continued to rise. With central banks pulling out of the market and the data showing that speculators are still net long on gold, some analysts are beginning to worry that the gold market is turning into a bubble.

In a recent article, David Llewellyn-Smith, co-founder of MacroBusiness and Chief Strategist at Nucleus Wealth, pointed out the importance of the US election outcome for gold prices:

“CFTC holdings show speculators are net very long gold contracts at the moment. This is a warning sign that the market is seriously overheated. [But], if Kamala Harris wins, large fiscal deficits will continue, [and] the US dollar is likely to correct savagely because the Fed will have more of a free hand to lower rates. This is good for gold.

If Donald Trump wins, tax cuts and tariffs mean stronger inflation, higher yields, and a much stronger US dollar. These are bad for gold.”

Either way, gold prices are in danger of becoming unmoored from underlying fundamentals that support price. If Trump wins the election, expect a large correction in price. If Harris wins, we may still see a correction as the uncertainty surrounding the “Trump effect” is removed – though prices may remain elevated for some time.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.