-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

ECN Brokers

Trade with Direct Market Access

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

Top MT4 brokers in Philippines

-

MetaTrader 5 Brokers

Top MT5 brokers in Philippines

-

cTrader Brokers

Top cTrader brokers in Philippines

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

With the annual central bankers’ symposium starting today at Jackson Hole, traders are nervously awaiting Jay Powell’s keynote speech on Friday, August 23rd. Recent developments have forced the USD lower as a September rate cut looks certain, but will the cut be 25bps or 50? And will Powell’s speech shed any light?

The DXY, which tracks the USD against a basket of currencies, has had a torrid time of late. The slowdown in jobs growth coupled with the continuing fall in inflation has increased bets that the Federal Reserve Open Market Committee (FOMC) will cut rates in September – and raised concerns of a recession.

At the FOMC’s last meeting in July, participants voted to hold rates steady. But yesterday, Wednesday, 21st August, the Fed released the minutes of that meeting, showing that:

“A majority of participants remarked that the risks to the employment goal had increased, and many participants noted that the risks to the inflation goal had decreased”

and that the “vast majority” of Fed officials said “it would likely be appropriate to ease policy at the next meeting” if the economic data came in as expected.

The remarkably dovish messaging had an immediate impact on the markets, driving the DXY further down and sending gold to (yet another) record high. The impact was exacerbated by an adjustment to NFP figures for last year up to March 2024, with 800,000 fewer jobs created than originally calculated.

With jobs data such a key consideration for the Fed in its attempt to avoid a recession, the surprise downward revision sent jitters through the market. Has the Fed’s decision-making been hijacked by poor data? If so, will the lack of urgency in cutting rates usher in a recession?

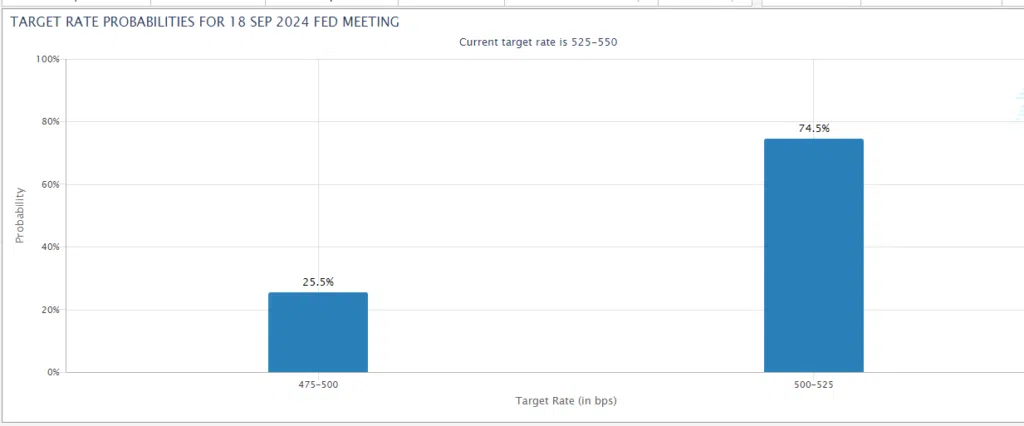

The market’s nervousness is also apparent in the probabilities for the outcomes of the FOMC’s September meeting. The CME Fedwatch tool shows that futures traders believe there is a 30% chance of a 50bps cut, though this figure has fallen from nearly 40% yesterday. The message from traders is clear: A severe economic slowdown in the US is likely enough to be a worry, and the Fed may have to move hard and fast.

Today, the USD recovered somewhat against other major currencies and the DXY has stabilised. Concerns over the Chinese economy and the Middle East conflict lent support to the dollar, though it has struggled to make any real gains.

With manufacturing and services PMIs due out later today, we will get an idea of how the slowdown in jobs growth is impacting the wider US economy. But what will Powell’s messaging be tomorrow?

If the PMIs come in weaker than expected today, and Powell continues the dovish tone set by the FOMC minutes, expect the chances of a 50bps cut to increase further and the DXY to continue to fall.

But the markets are fragile, as we saw a couple of weeks ago, and if the possibility of a recession rears its ugly head again, we could see another bout of increased volatility.

Technical Analysis

The DXY has been in a long-term downtrend since June 26th this year. This is largely due to the poor data out of the States, the Fed’s dovish stance on rate cuts, and, more recently, the NFP figure adjustment. The likely rate cut in September has also played a role.

That said, the Dollar Index remains bearish, with some rallies in the near-term. Having recently entered oversold territory, the RSI confirms a rally, but not necessarily a bullish reversal. Price also sits far below all three moving averages, which means that for price to change direction, it will have a lot of resistance to overcome.

Should price continue upwards, resistance sits at the 101.863 level, which corresponds with the 78.6% Fibonacci retracement level, and beyond that at the 102.226 level. Support in the near-term sits at the 100.840 level, and below that at the 100.615 level, which corresponds with the low of December 2023.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.