-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

ECN Brokers

Trade with Direct Market Access

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

Top MT4 brokers in Philippines

-

MetaTrader 5 Brokers

Top MT5 brokers in Philippines

-

cTrader Brokers

Top cTrader brokers in Philippines

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

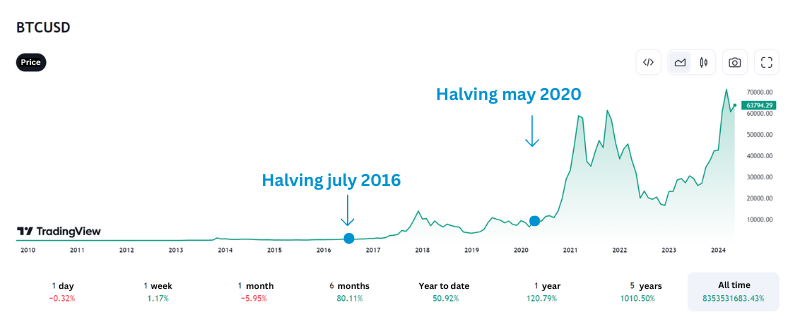

The fourth Bitcoin halving since its launch in 2009 occurred a few weeks ago, on the 19th of April.

What is the Bitcoin halving, and why is it happening?

The halving, which occurs every 210,000 blocks* (about every four years), reduces the reward for mining a block by half, leading to a decrease in the frequency of new BTC on the market. The purpose of gradually reducing supply is to make it harder and more expensive to mine new coins over time.

The first halving happened in 2012 when the reward was lowered to 25 coins per block. After another 210,000 blocks, the reward dropped to 12.5 BTC in 2016, to 6.25 BTC in 2020, and to 3.125 BTC per block after the latest one. The next halving is expected to take place sometime in 2028.

* A block in a blockchain is a small group of data that is linked to other blocks to create a secure and transparent digital log.

Historical development

Historically, declining supply, along with rising demand, have played a significant role in price movements. Previous halvings have generally led to price increases; for example, the last two halvings saw a 51% and 83% increase in BTC, respectively, over the next six months (source: Coinledger).

After the halving

However, research has shown that the effect of each halving has gradually decreased over time, which may indicate a greater maturity in the market compared to before. In addition, other factors have also influenced the recent halving, not least the launch of Bitcoin ETFs (exchange-traded funds) by major financial institutions such as Blackrock and Fidelity.

What happens now?

While the market adjusts to the new dynamics of reduced supply and a smaller compensation for miners, investors should expect increased volatility in the coming months.

According to 21Shares, the new BTC ETFs have also seen significant trading volume and indicated strong interest from traditional investors. Furthermore, the entry of institutional players has changed investment behaviour, with long-term holders becoming increasingly important. If this trend continues, the supply of Bitcoin could become more limited, potentially leading to reduced supply and, thus, an increase in price (source:https://www.21shares.com/research/bitcoin-halving-report-2024).

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.