With the right Forex trading app, you can stay up to date with the latest market news, access charts, conduct technical analysis, and carry out trades all from the convenience of your smartphone or tablet.

Regulation and Security: Ensure you choose an app from a well-regulated Forex broker with a good reputation. Well-regulated provide secure trading environments and are transparent about their fees, commissions, and risk management policies.

Fees: This includes any commission charges, spreads, or other costs associated with using the app, such as rollover fees and deposit and withdrawal fees. Always make sure you understand your broker’s fee structure before starting trading.

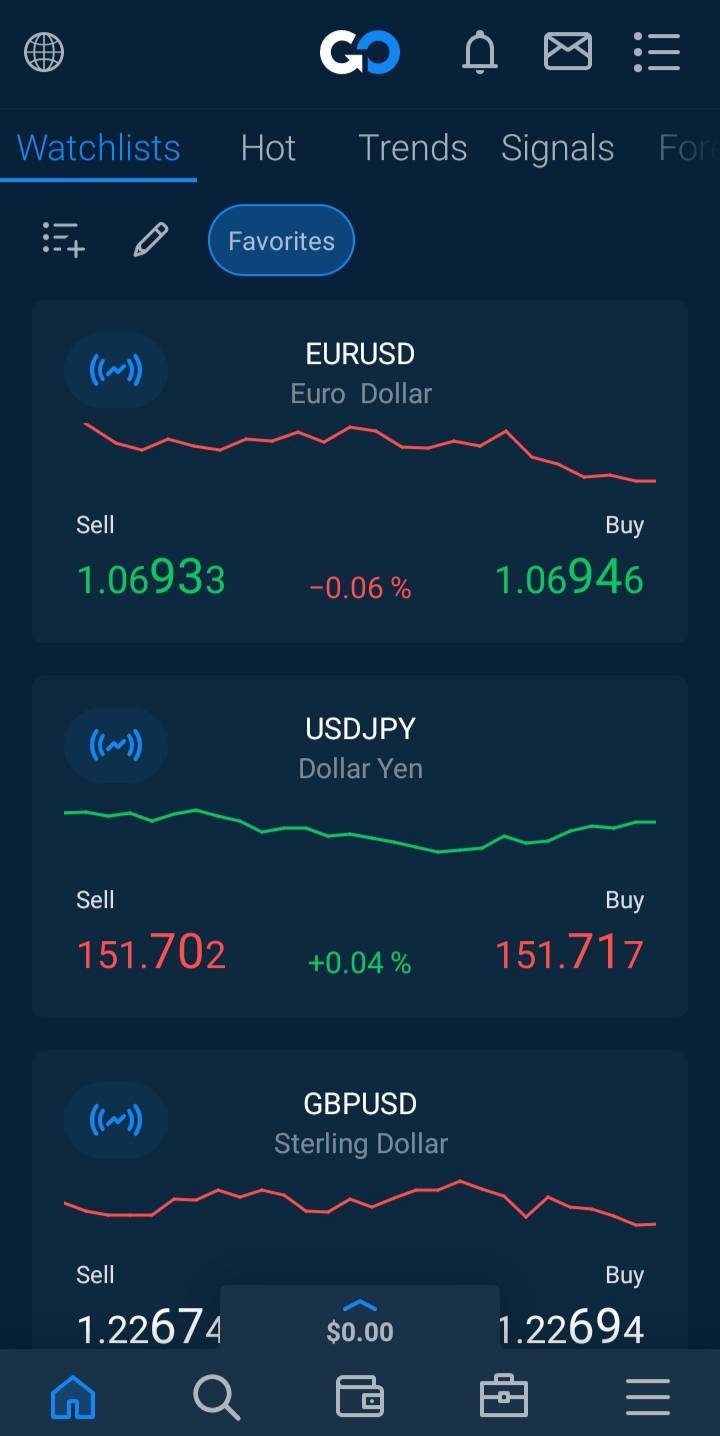

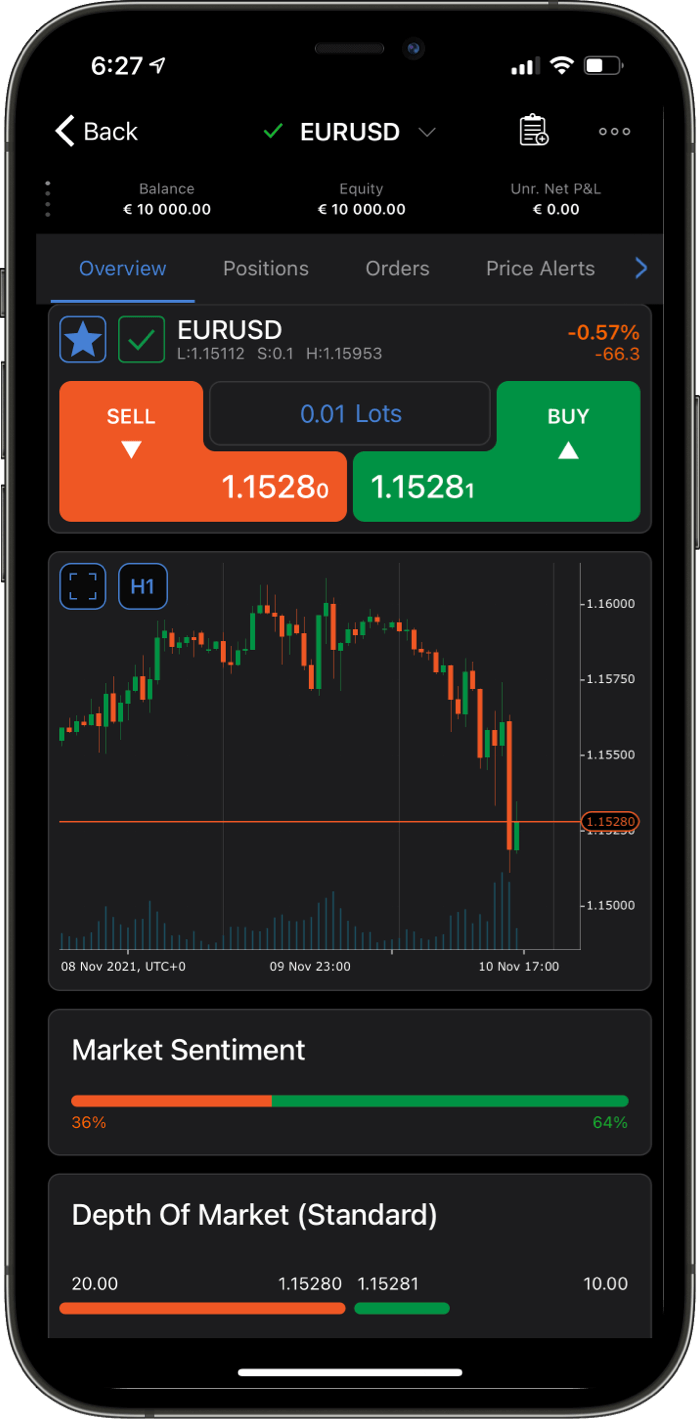

User-Friendly: You don’t want an app that’s too complicated and difficult to use. Look for an app that is user-friendly with an intuitive design that provides a streamlined trading experience. Many good brokers provide tutorial walk-throughs of their apps to help you get on your feet.

Trading Execution: Your app should be fast and reliable, meaning orders can be placed, closed and managed almost instantly. Apps with poor trade execution can greatly increase risk and may lead to higher losses.

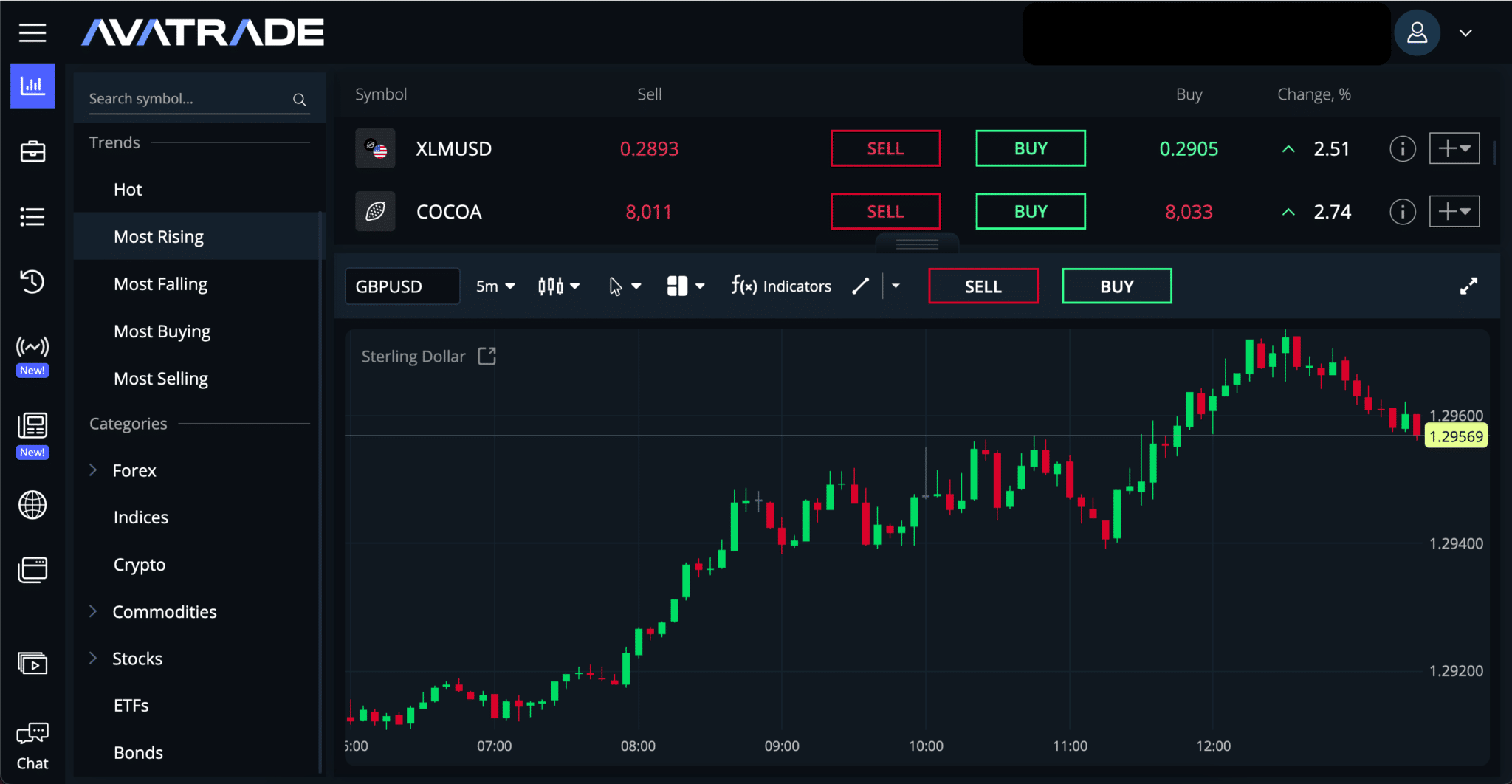

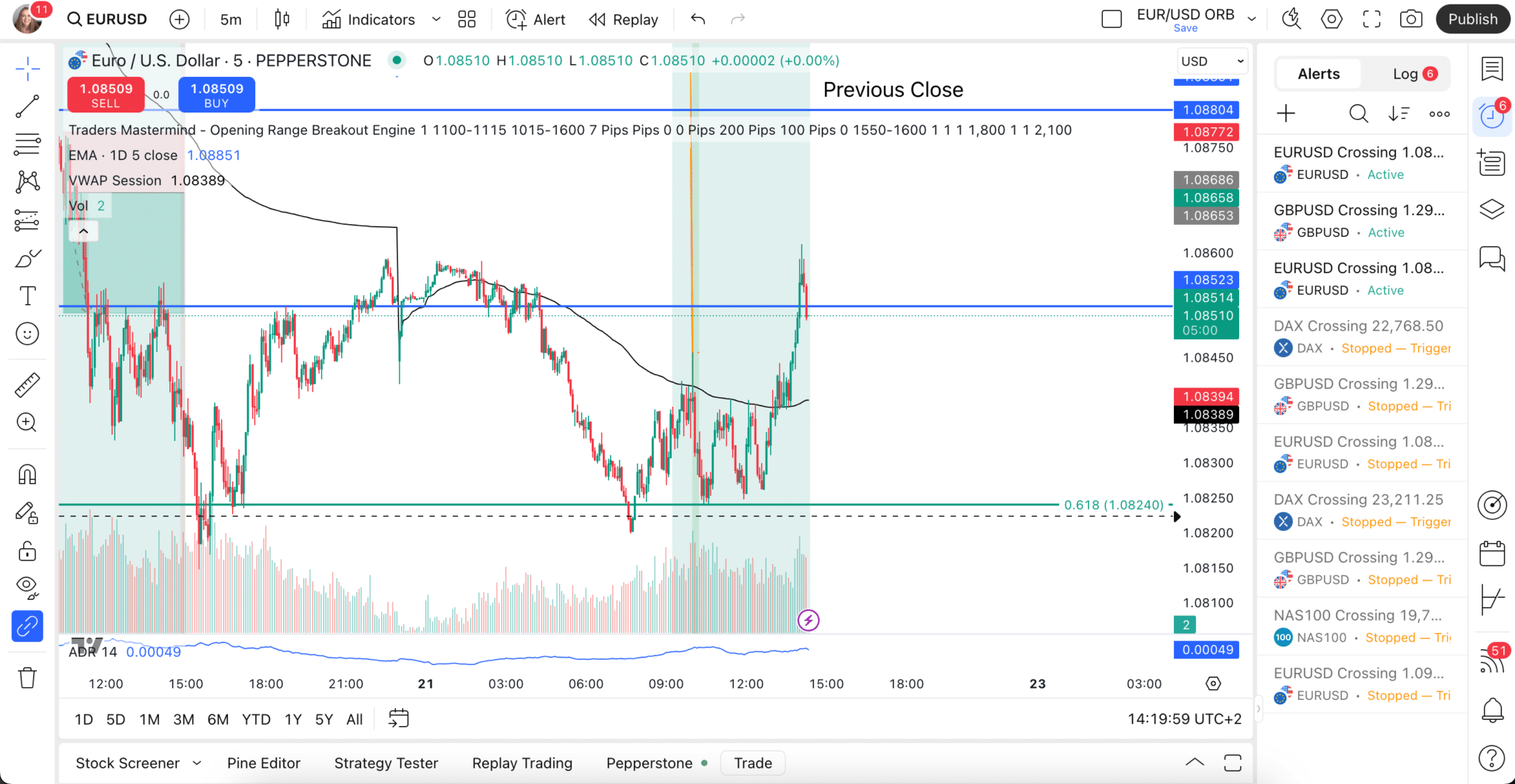

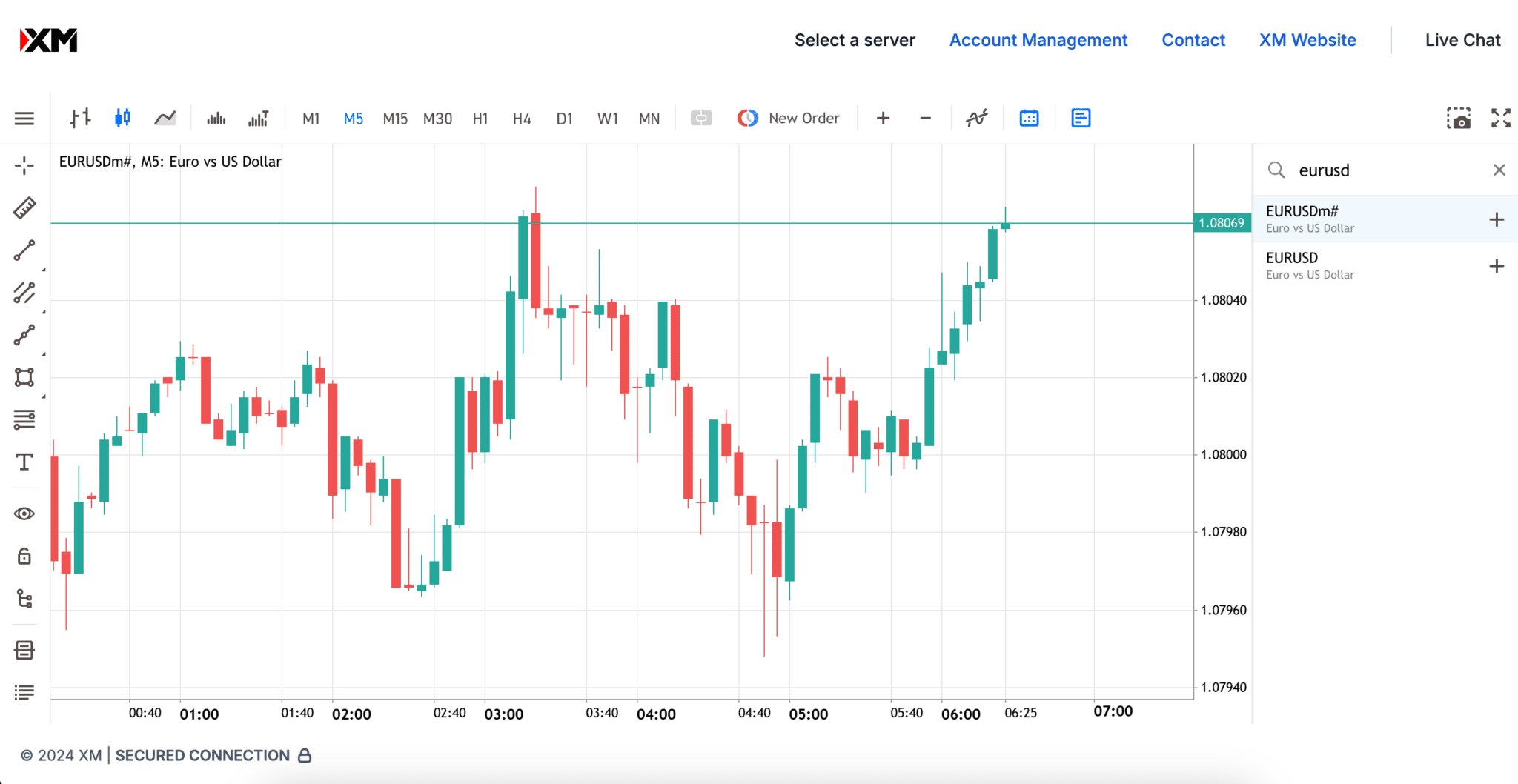

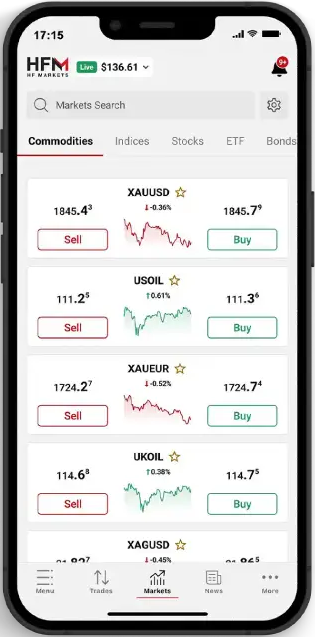

Tools and Features: Ensure the app has the tools to maximise your trading opportunities. Does it offer real-time market data? Does it have advanced charting capabilities? Does it offer automated trading? Can you conduct technical analysis? Can you set automated price alerts? Knowing the features you want will help you narrow down your choice of app.

Demo Accounts: Choose an app with a free demo account that allows you to test out its features and see whether it meets your trading needs. You can also test out your trading strategies in real market conditions before using real money.

Financial Instruments: Many brokers only allow traders to trade on a portion of the instruments available on the desktop and browser versions of the platform. Consider whether the instruments you prefer trading are available on the app.