Leverage in Forex Trading

Leverage enables traders to open positions much larger than their deposits. For example, a trader with PHP 100,000 using 100:1 leverage could control a PHP 10,000,000 trade. While this multiplies profit potential, even a small adverse market move can quickly wipe out the margin.

SEC and Leverage Regulation in the Philippines

The Securities and Exchange Commission (SEC Philippines) regulates the broader financial markets but does not license or oversee international forex brokers serving retail traders. As a result, there are no official leverage caps, and most Filipino traders rely on offshore brokers.

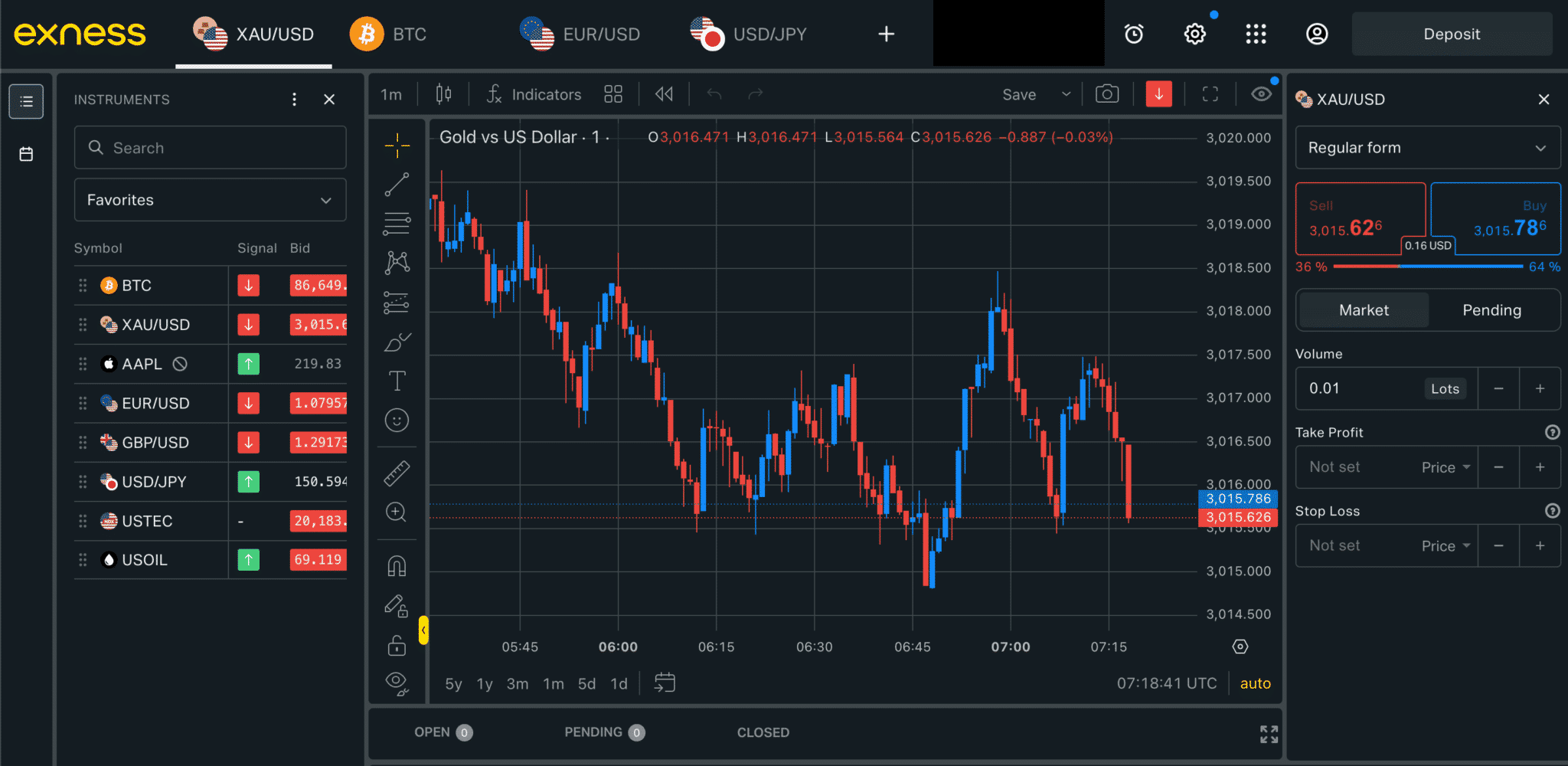

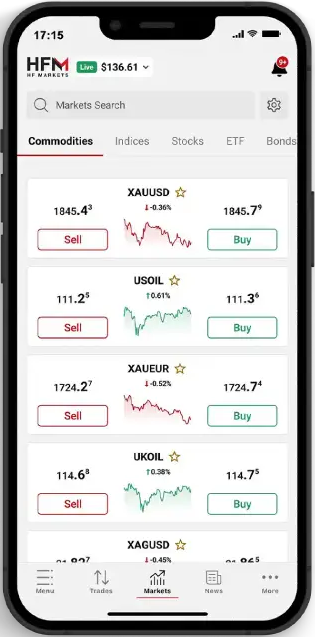

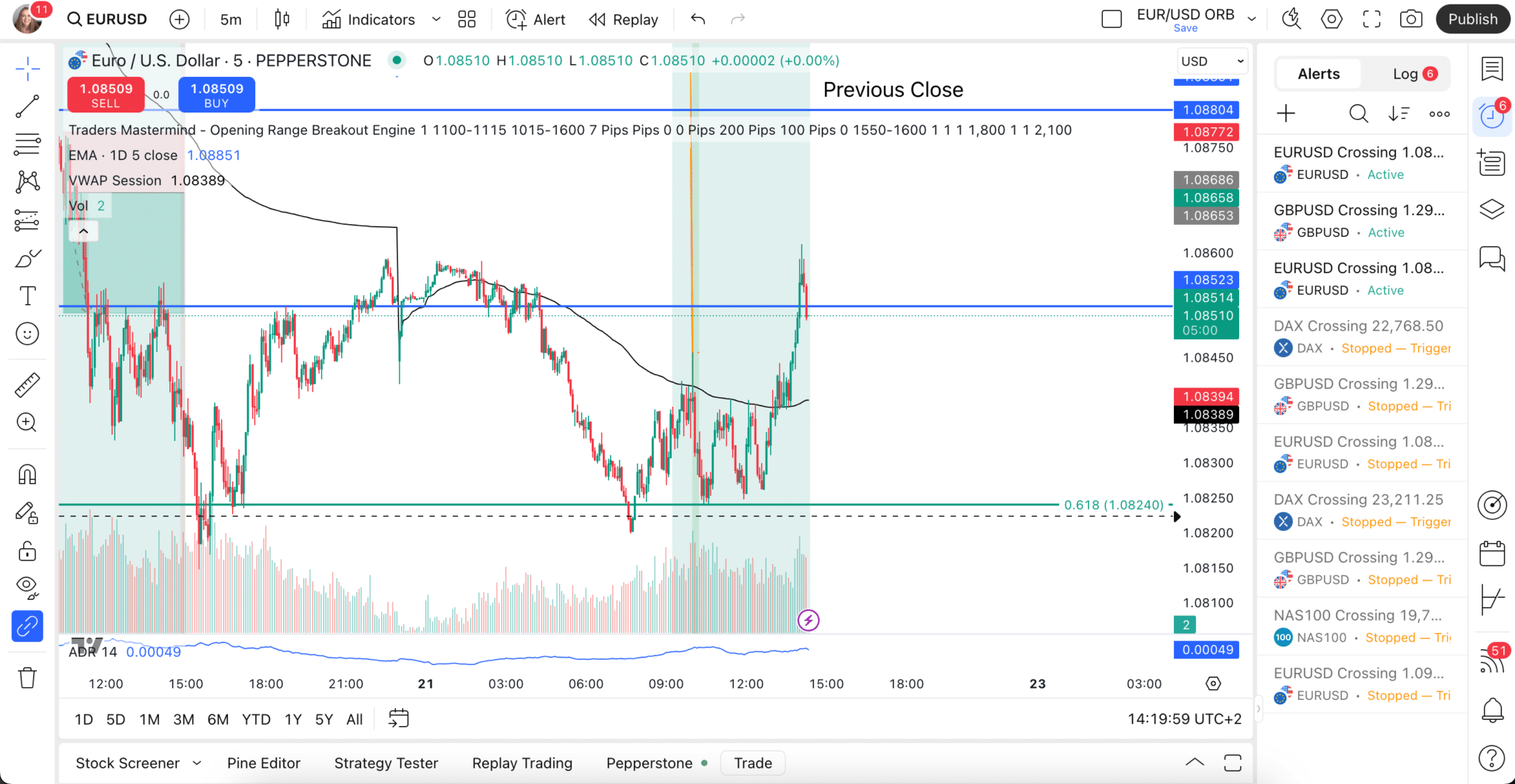

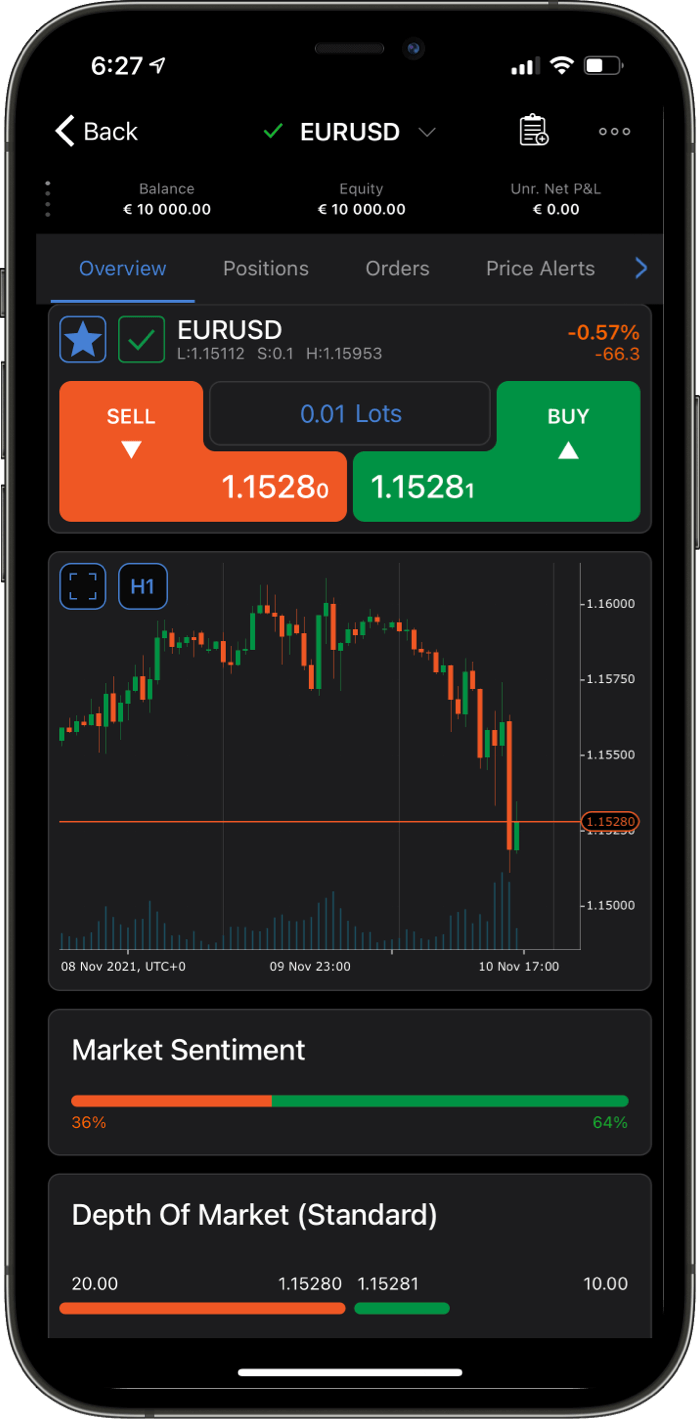

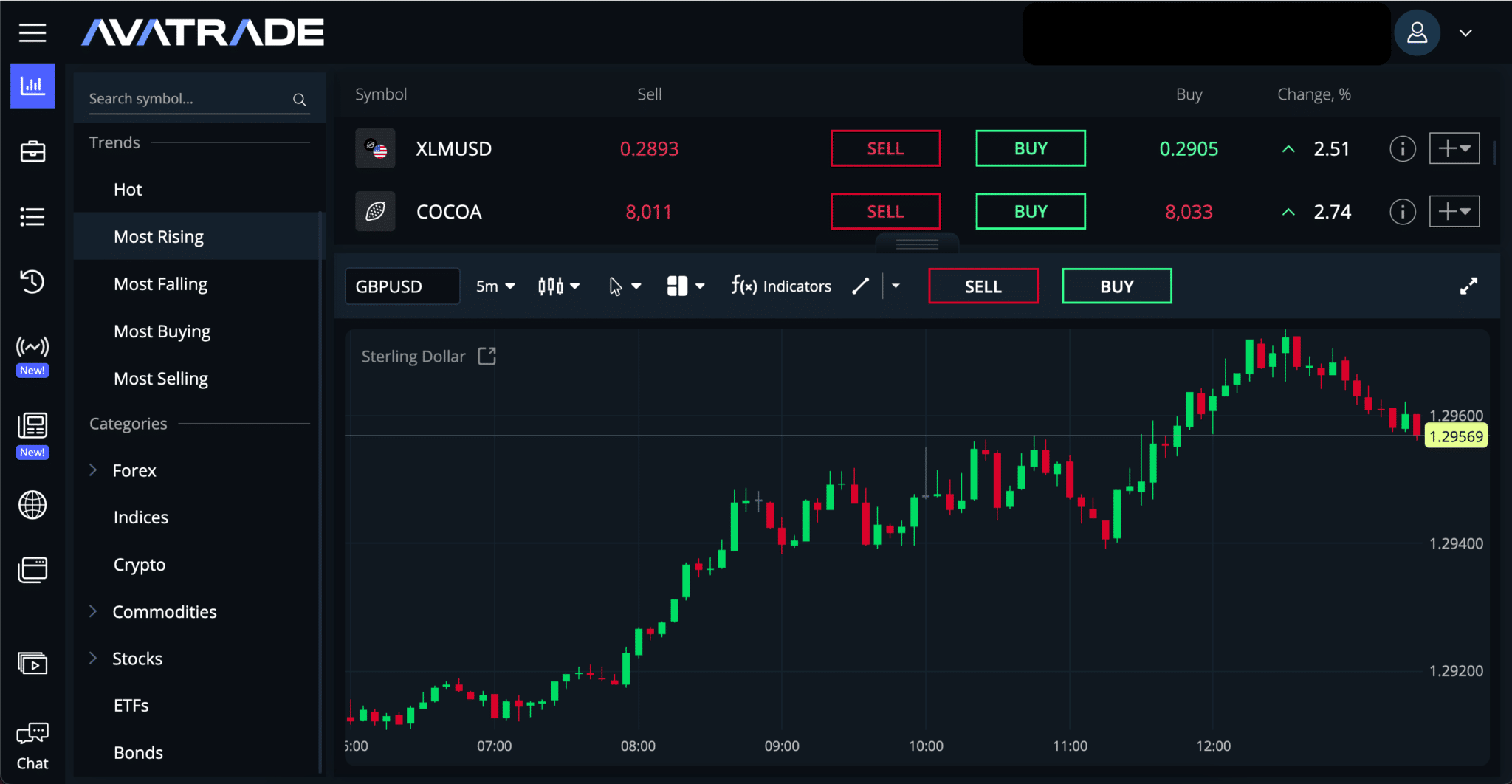

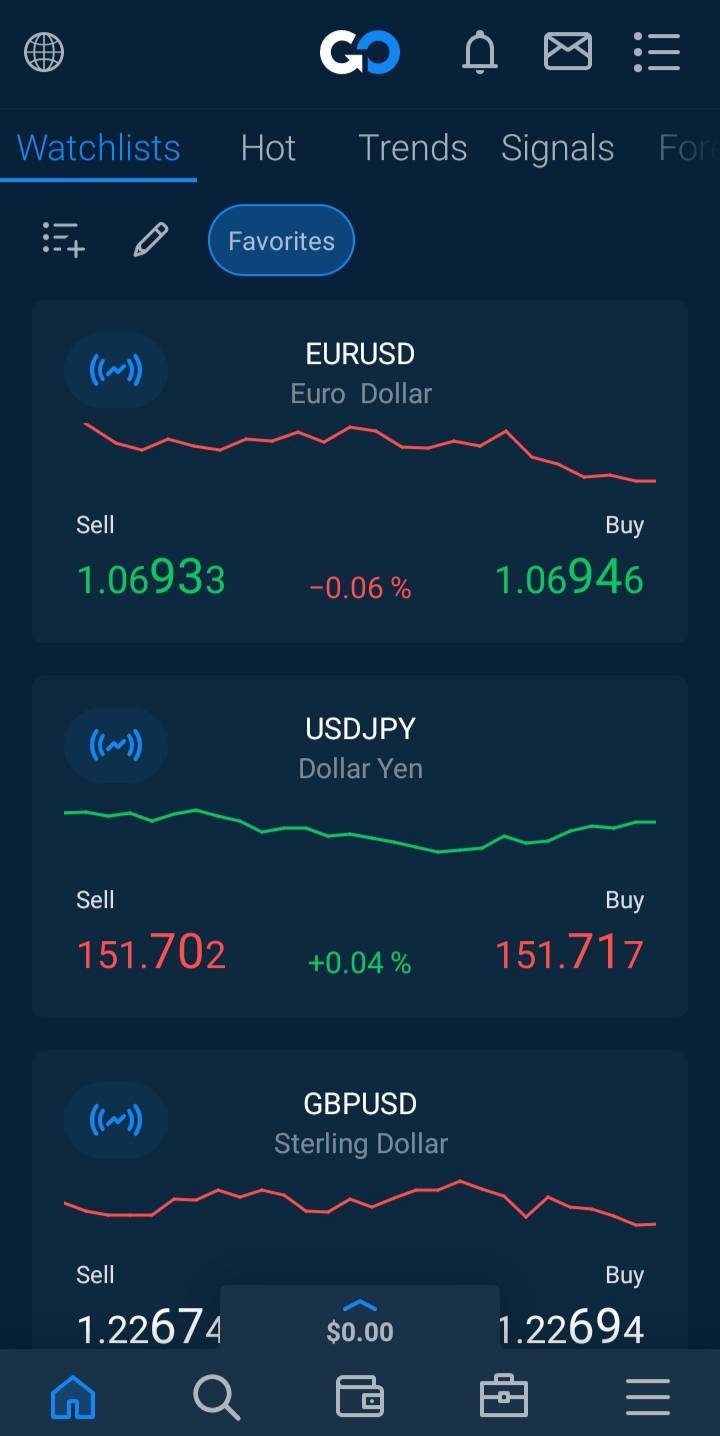

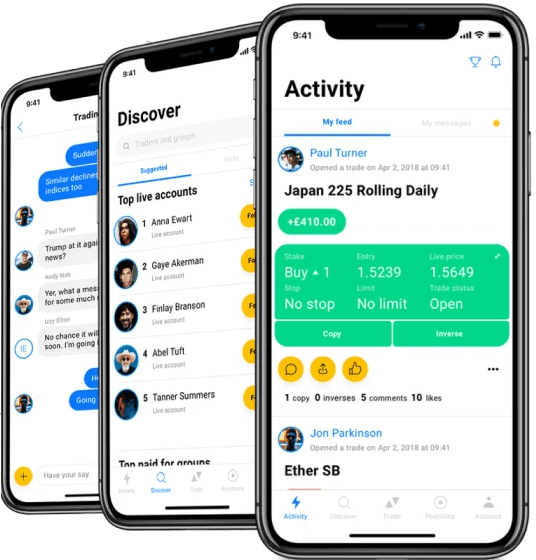

Offshore Brokers and High Leverage

International brokers commonly offer leverage of 1:500 or higher to Filipino clients. Popular choices include Exness, FBS, and Pepperstone, which combine strong global regulation with flexible leverage policies and cost-effective deposit options. However, Filipino clients are usually onboarded through offshore entities, where protections are not as strict as in the EU or UK.

Bottom line: Filipino traders should be cautious when using offshore brokers offering high leverage. While access is easy, protections are weaker, making conservative leverage levels safer for long-term success.