How CFD Trading Works

CFDs (Contracts for Difference) let you trade price movements without owning the underlying asset. When you open a position, you agree with your broker to exchange the difference between the opening and closing price. If the market moves in your favour, you profit; if it moves against you, the difference becomes your loss.

You can trade long (buy) when expecting prices to rise or short (sell) when expecting them to fall. Because CFDs use leverage, you only deposit a fraction of the trade’s total value as margin while your broker provides the rest. This boosts potential returns but also magnifies losses, making disciplined risk management essential.

Benefits of Trading CFDs

CFDs give traders flexible access to global markets, allowing them to react quickly to price movements while trading a wide range of assets through one platform.

Lower Barriers to Entry

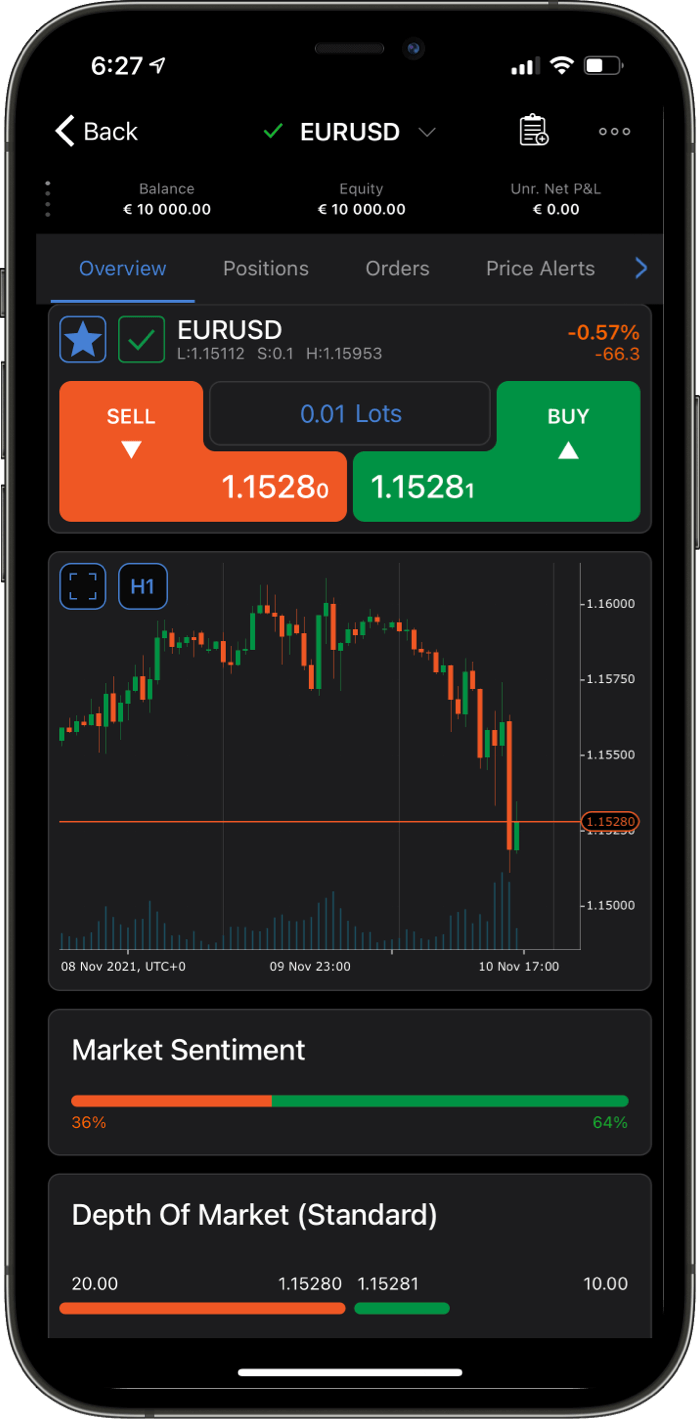

Small minimum deposits and low margin requirements make CFD trading accessible even with limited starting capital.

Leverage

Leverage allows you to control larger positions with a small deposit. For example, 20:1 leverage turns 500 USD into 10,000 USD of market exposure. It increases potential profits but also speeds up losses.

Trade Both Rising and Falling Markets

CFDs let you go long or short with a single click, without owning or borrowing the underlying asset.

Broad Market Coverage

One account gives access to Forex, indices, commodities, stocks, ETFs, bonds, and—in some regions—cryptocurrencies.

Flexible Holding Periods

CFDs have no expiry date. You can hold trades for seconds or for months if you meet margin requirements and accept any overnight financing costs.

Hedging Uses

Many traders hedge existing portfolios using CFDs, such as shorting an index to offset potential equity-market downside.

Risks of CFD Trading

CFDs are complex and high-risk instruments. Because they use leverage and react quickly to market movements, it’s essential to understand the risks before trading.

High Market Volatility

CFD prices can move sharply during economic news, geopolitical events, or shifts in sentiment. These rapid swings can cause significant losses — especially on leveraged positions.

Leverage Risk

Leverage amplifies both gains and losses. Even small adverse price movements can deplete your margin, trigger stop-outs, or wipe out an entire account without proper risk controls.

Wider Spreads in Volatile Conditions

During fast or thin markets, brokers may widen spreads, increasing your trading costs and affecting execution quality.

Need for Active Monitoring

CFD markets move around the clock, and unmanaged positions can be hit by overnight volatility or sudden gaps.

Liquidity Risk

Some instruments or time periods offer limited liquidity, which can result in slippage, partial fills, or difficulty closing trades at expected prices.

No Ownership Benefits

CFD traders don’t receive dividends, coupons, or voting rights. Returns come solely from price movement.

Because of these risks, traders should use strict risk management and never trade money they cannot afford to lose.

What You Can Trade with CFDs

CFD brokers provide access to a wide range of global markets from a single platform. Because CFDs mirror the price of the underlying asset, you can trade thousands of instruments without owning them outright.

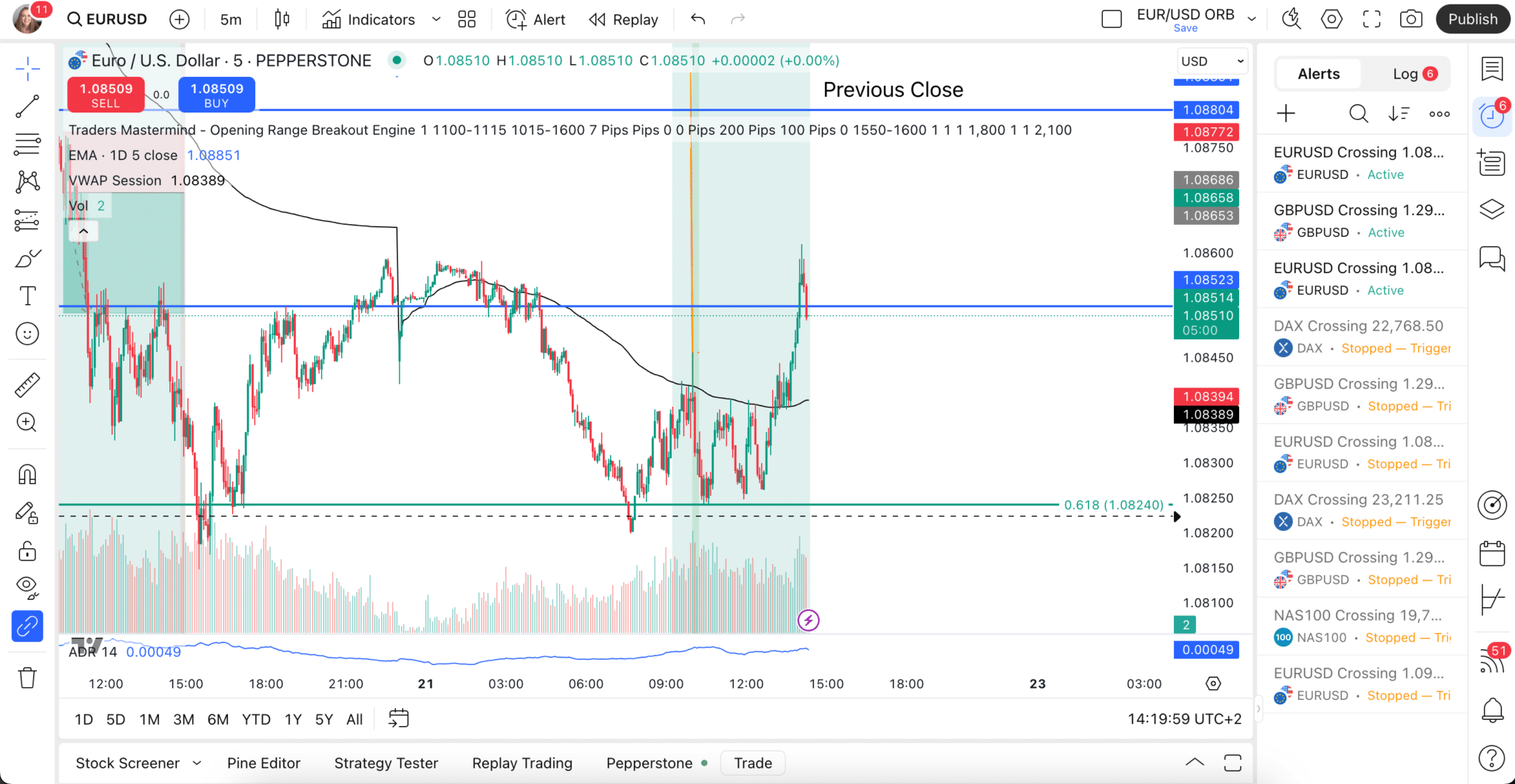

Forex (Currencies)

Trade major, minor, and exotic pairs such as EUR/USD or GBP/USD. Forex is the world’s most liquid market and operates 24/5, making it ideal for active traders.

Shares (Stocks)

Speculate on price movements of global companies without buying the shares themselves. Share CFDs support both long and short positions and require far less capital than direct stock ownership.

Indices

Index CFDs track baskets of stocks like the S&P 500, FTSE 100, DAX 40, or NASDAQ 100. They offer broad market exposure, tight spreads, and high liquidity in a single trade.

Commodities

Trade popular commodities such as gold, silver, oil, natural gas, and agricultural products. Prices are heavily influenced by supply and demand, macroeconomic conditions, and geopolitical events.

Cryptocurrencies

Some brokers offer crypto CFDs on assets like Bitcoin or Ethereum. These markets are highly volatile, so leverage is typically lower — and availability depends on your jurisdiction.

Bonds and Interest Rates

CFDs make it possible to trade bond price movements or interest-rate expectations without holding the underlying instruments.

ETFs and Other Markets

Many brokers also provide CFDs on ETFs, sector baskets, or volatility indices, allowing for wider diversification from a single account.

The Role of a CFD Broker

A CFD broker provides the necessary infrastructure that enables CFD trading. Because CFDs don’t trade on a central exchange, your broker controls pricing, execution quality, leverage, and the overall safety of your trading environment. This makes choosing a reliable, well-regulated broker critical.

A good CFD broker is responsible for:

- Platform & execution: Providing the trading platform, real-time pricing, stable execution, and order routing.

- Market access: Offering a wide range of instruments across forex, indices, commodities, shares, and more.

- Leverage & margin: Setting leverage limits, margin requirements, and enforcing margin-closeout rules.

- Trading costs: Determining spreads, commissions, and overnight financing fees, and disclosing them transparently.

- Risk protections: Segregated client funds, negative balance protection, and regulatory compliance.

- Tools & resources: Education, market analysis, and customer support to help traders improve their skills.

In short, your broker shapes your trading conditions, your trading costs, and your level of protection — which is why broker choice is one of the most important decisions a CFD trader makes.