Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

A good risk-to-reward ratio helps ensure that you are consistently profitable in the long term. Key factors to understand are how to calculate your risk-reward ratio, how risk and reward can inform your trades, and how to determine the right risk-reward ratio for long-term profitability.

Note that this guide is for intermediate or more serious beginner traders who have a grasp of the basics of trading and understand how to manage their risk through stop-losses and take profits.

What is Risk and Reward?

Understanding the Risk-Reward Ratio

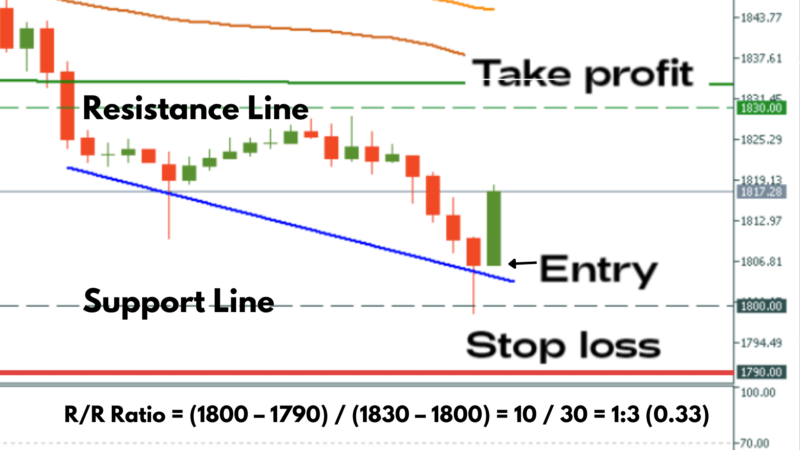

The risk-reward ratio represents the potential loss (risk) of a position compared to the potential gain (reward). A good ratio often sees the reward exceeding the risk.

Real-World Scenarios

Effect of Risk-Reward on Profitability

Even with a win rate of only 50%, a favourable risk-reward ratio can yield positive outcomes.

For instance: For ten trades, alternating between losses of $1,000 and gains of $3,000, the total loss would be $5,000 and the total gain $15,000, leaving a net profit of $10,000.

Factors Influencing Risk-Reward Ratios

More experienced traders might opt for a 1:1 or 1:2 ratio, while novices might prefer ratios like 1:3 or 1:4.

1:1 Risk-Reward Ratio

This is favoured by daring or advanced traders. They risk the same amount of capital as they stand to gain. This strategy can result in doubling capital or losing it entirely. Emotions can influence decisions, affecting position sizing and timing.

Calculating Risk-Reward Ratio

To determine the ratio:

Formula:

It's crucial to set realistic stop losses and take profits, considering factors like support and resistance levels.

Example Calculations

Note: Consider broker costs, spreads, and commissions in calculations.

Summary

Risk-reward ratios need adjustments based on the following:

Disclaimer: This transcript summary was created with AI assistance.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.