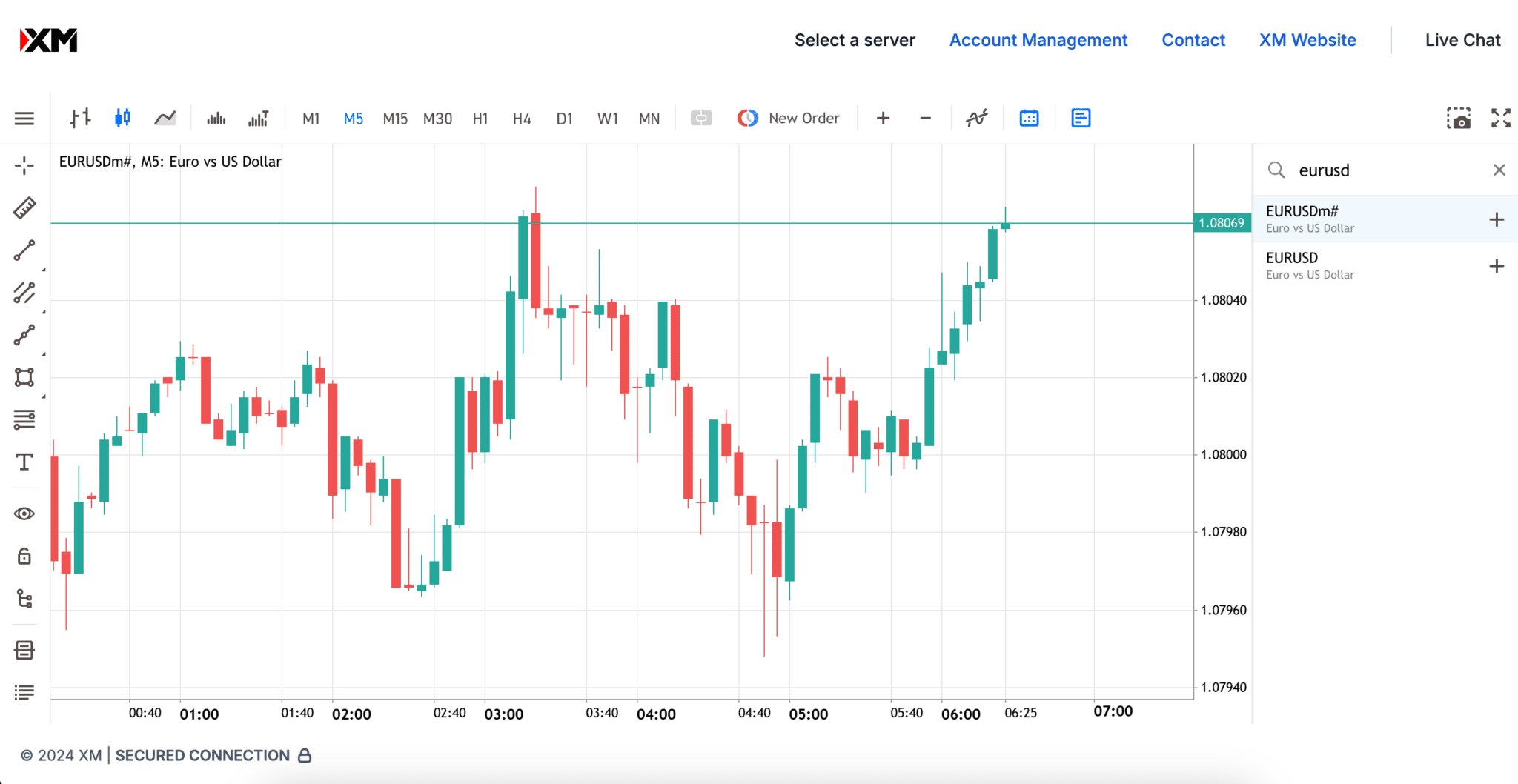

What is MT5?

MT5 (MetaTrader 5) is a trading platform that allows traders to access the Forex market via a broker. Released in 2010, it is more powerful than MT4 and provides access to stocks and futures. It also has extra trading tools and charts and has more advanced back-testing. MT5 (MetaTrader 5) is a trading platform that allows traders to access the Forex market via a broker. Released in 2010, it is more powerful than MetaTrader 4 (MT4) and provides access to stocks and futures. It also has extra trading tools and charts and has more advanced back-testing.

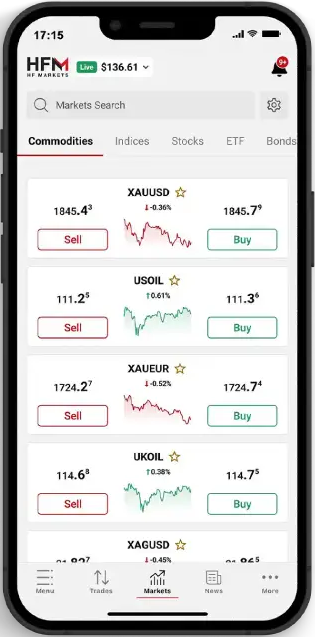

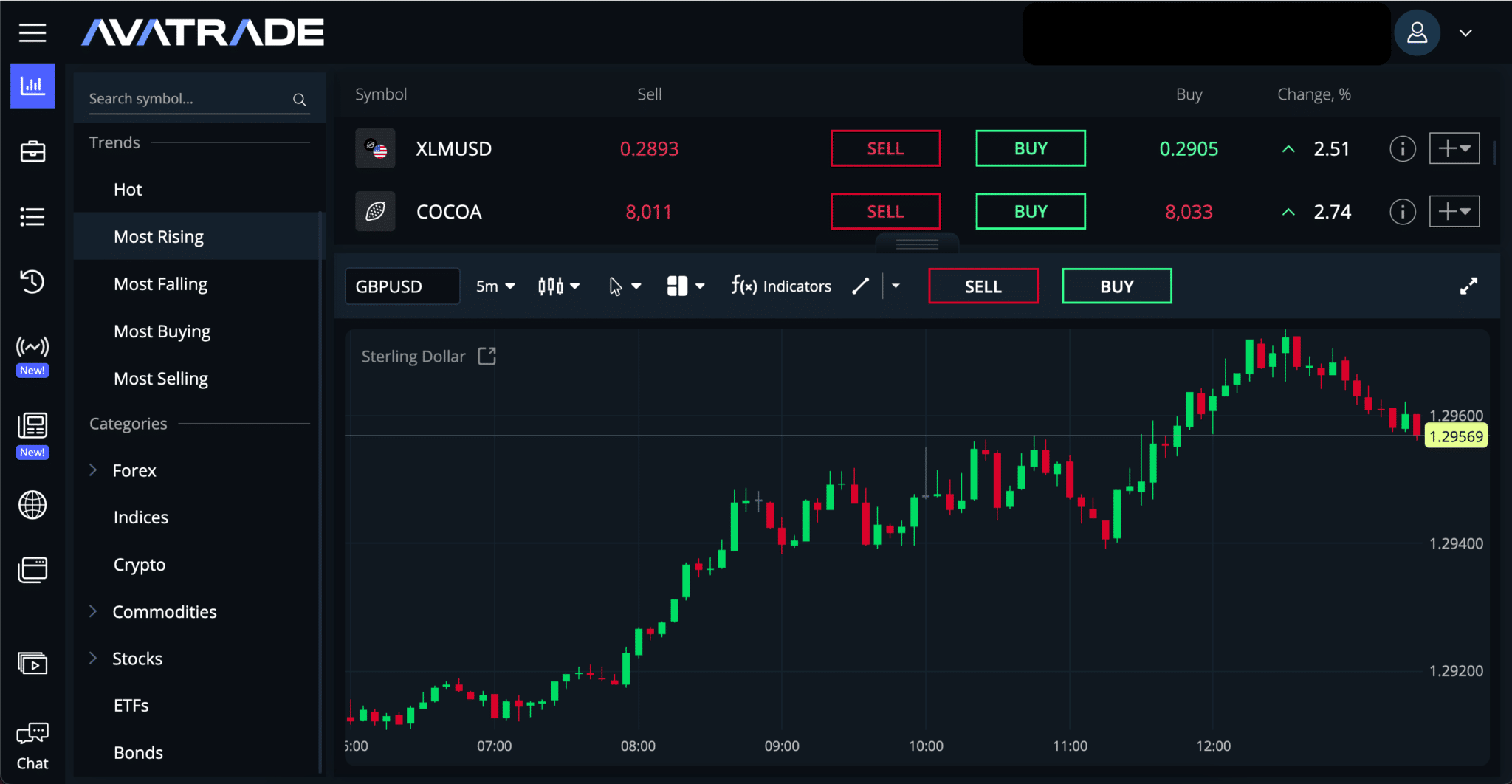

Much like MT4, MT5 allows traders to access the Forex market via a broker, but it also provides additional access to CFDs, stocks and futures. This also means that it is a more valuable asset for brokers as it allows them to reach a broader base of clientele – this has resulted in a noticeable uptick in the number of brokers supporting MT5, sometimes replacing their support for MT4 altogether.

MT5 comes with a new script-writing language, MQL5, which is much more efficient than MQL4, but harder to learn for beginners.

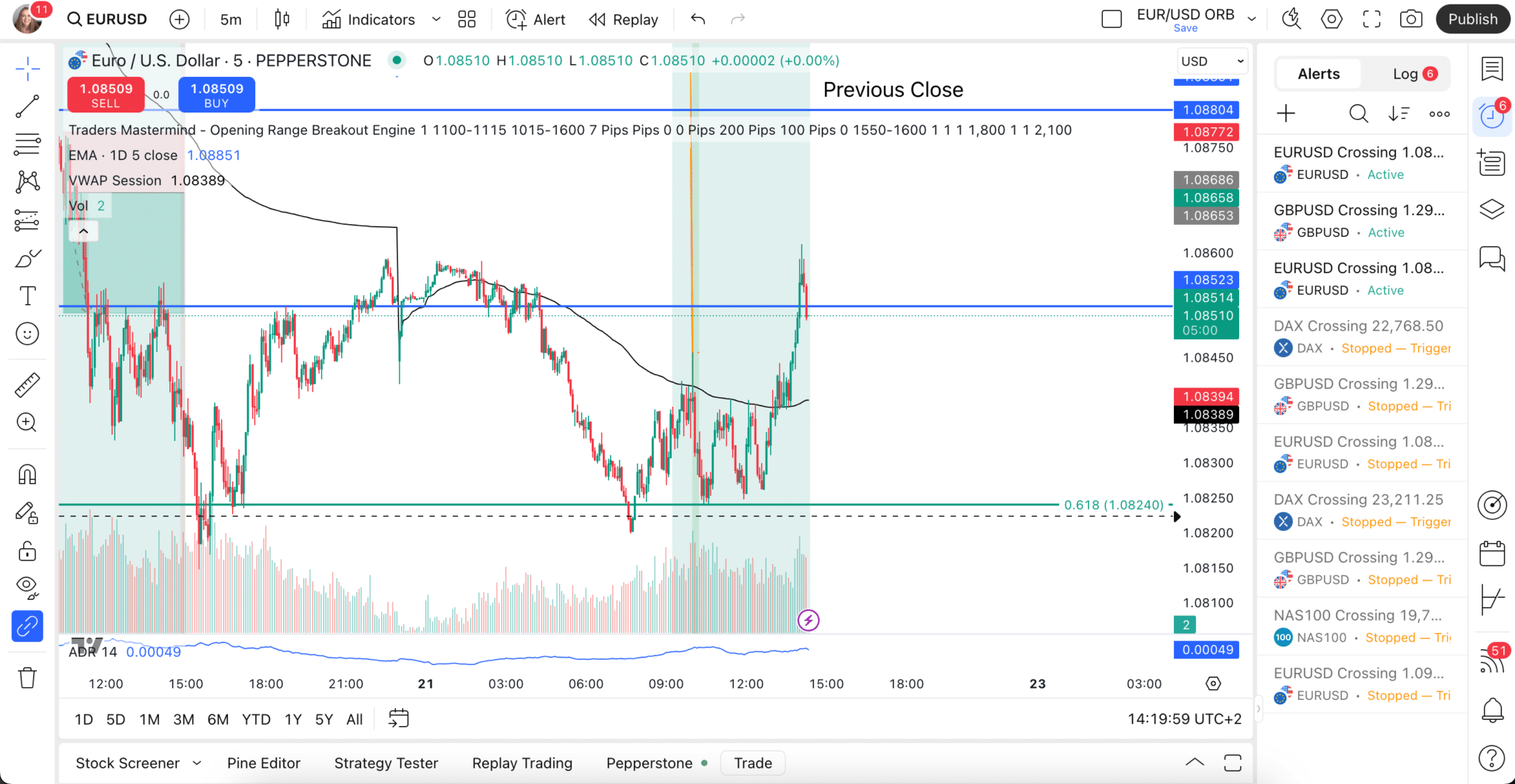

Though the interface is similar to MT4, MT5 has more advanced charting tools, including 12 more timeframes and more built-in technical indicators.

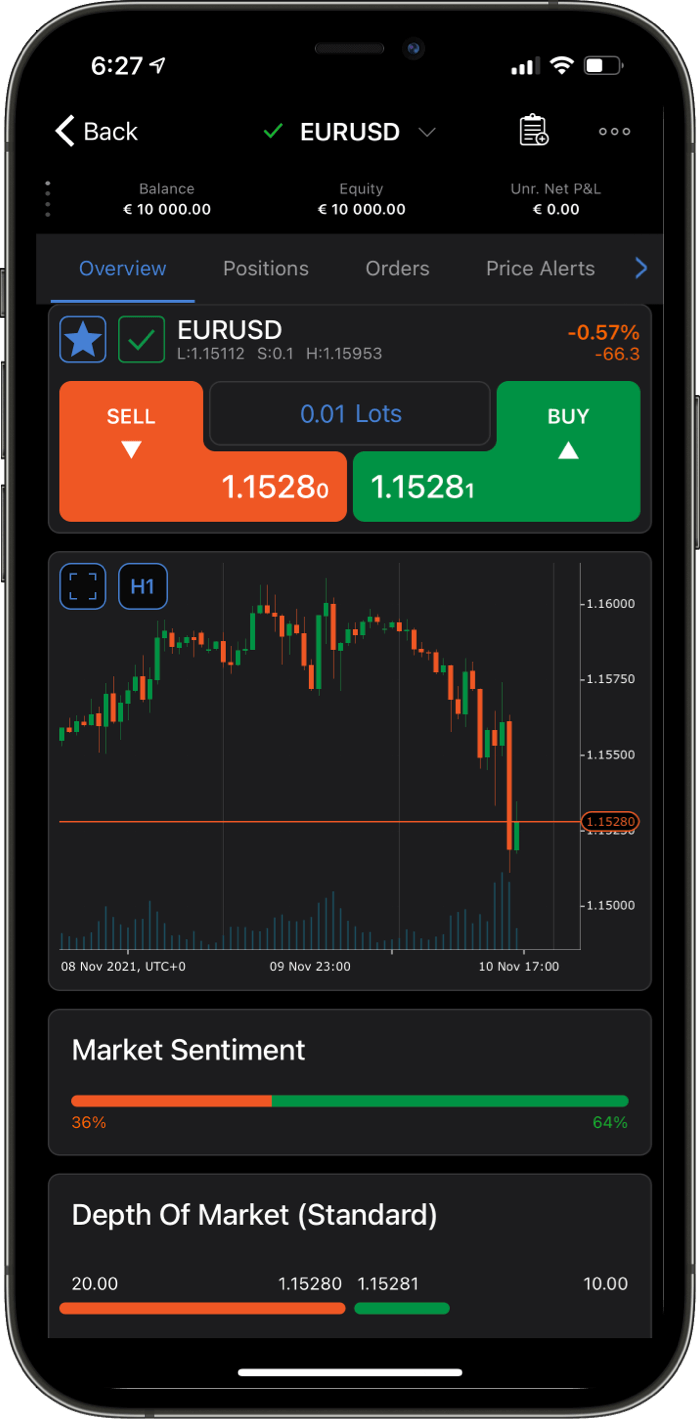

MT5 also allows for an unlimited amount of charts to be used, shows Depth of Market and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system.

How we chose the best MT5 brokers

Regulation: Regulation is always the first thing we look at when reviewing a broker. Regulation is needed to ensure your trading funds are safe and that the broker’s trading desk is not manipulating your trades. Although multiple regulators can regulate a broker, you should always know which regulator oversees your account. Only one regulator will be responsible for your trading account.

Assets available: One of MT5’s main attractions is the large number of tradable assets. We researched each broker to see who has the most tradable assets and in what classes. Having a wide range of assets means a wide range of trading opportunities. If you plan on mainly trading FX, always check the number of FX pairs your broker has available.

Trading costs: Trading costs, which include spread and commission fees, will vary with each broker. The lower the total trading cost, the more profit a client can make from each trade, so we always recommend brokers with lower trading costs.. Be aware that different trading accounts at the same broker can have different trading costs.

Fee structure: Most well-regulated brokers charge a few additional fees, and there are some common ones that we always look for. These fees are usually inactivity fees, withdrawal fees, or charges connected with special account types like Islamic accounts.

Customer service: The quality of customer service varies widely in the trading industry. It’s important that customer support is available via phone 24/5, but we also ensure that the customer support staff are prompt, competent, and knowledgeable.

Should I use MT5?

The answer to this question depends on what you want from your platform and your previous trading experience.

If you are a beginner trader and want to trade a range of assets, as well as Forex, but want a standalone client, MT5 is a good choice. If you only want to trade Forex on a simpler platform, you can start with MT4, but be aware that you are using a system that will eventually be replaced.

If you already have some experience with MT4 and are thinking of switching, it really depends on your reasons why. The only significant reason for switching to MT5 is if you want to trade other markets. The significant reason for not switching is that programmes written for MT4 will not run in MT5, so you will lose all your EAs, indicators and automated scripts in the transition.

The big question is how much longer the big brokers will support MT4. It is no longer as popular as it used to be, and recent upgrades to the MQL5 language have made it almost as easy as MQL4 for traders to create automated trading scripts.

That said, more brokers are offering MT5 all the time, and some have chosen to only support MT5 from now on. If you are new to trading, there is something to be said for getting used to MT5 before it starts overtaking its older sibling, which has already started happening.

MT5 Pros and Cons

Pros:

- Unlike MT4, MT5 allows users to trade centralised markets – such as indices, stocks and commodities.

- MT5 is more feature-complete and comes with an Economic Calendar, Depth of Market indicator, embedded chat function, unlimited chart windows, 80 built-in indicators, and 12 more timeframes than MT4.

- MT5’s new scripting language (MQL5) is a more efficient language and features a powerful built-in script tester.

Cons:

- MT5 scripts are not backwards compatible with MT4 – so anyone making the transition will lose all their EAs, etc.

- MT5 is a more complex platform than MT4.

MT5 has grown in popularity recently in response to higher demand for multi-asset trading and is now supported by many better brokers.