Desktop Trading Platforms and Trading Tools

While MT4 and MT5 are both excellent trading platforms, many other CFD brokers also offer their own web-based platforms, which tend to be easier to use for beginner traders. On the other hand, the benefit of HFM offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker.

For the purposes of this review, we tested both of HFM’s web trader platforms.

Metatrader 4 (MT4)

HFM offers the standard version of MT4, which has 24 graphical objects and 30 built-in indicators. However, it also offers Premium Trader tools, available to clients who deposit more than 100 USD, which plug directly into the MT4 platform, enhancing its functionality (click here for more on Premium trader tools).

MT4’s platform’s interface is dated but fully customisable. There are three chart types, including Line, Bar, and Candlestick charts and you can access a wide selection of indicators in multiple timeframes.

HFM also offers support for MT4 MultiTerminal, providing a convenient method of managing multiple accounts simultaneously from a single interface.

Metatrader 5 (MT5)

MT5, the newer version of its predecessor, MT4, is also available at HFM. We recommend using MT5 if you are looking for a more powerful and faster trading platform when it comes to back-testing functionality for automated trading algorithms. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators (38 as opposed to 30 on MT4), and analytical tools. It is also much easier to search for an instrument to add to the market watch list than on MT4.

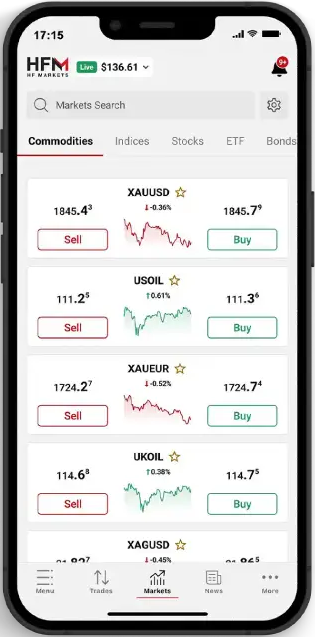

Both MT4 and MT5 are available as downloads, browser-based, and on iOS and Android devices. Mobile access is 24/7, and mobile apps employ the latest SSL encryption technology for security.

Overall, HFM provides a good selection of third-party platforms but lacks its own in-house trading platforms, which are usually more user-friendly.

Trading Tools

HFM offers an excellent range of trading tools, including Autochartist, a free VPS service, and a set of Premium Trading Tools. While all these tools are provided free, we were disappointed that traders are required to make a substantial deposit before access is provided.

Autochartist

For all HFM clients with a minimum deposit of 100 USD, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and MT5 and scans all available CFD markets for trading opportunities. It is one of the best technical analysis tools on the market, and we were pleased to see that HFM subscribes to its services.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

VPS

HFM clients with a minimum deposit of 5000 USD can also subscribe to a free VPS hosting service provided by external third-party providers. VPS services ensure trades are never disrupted by technological or connectivity issues, such as load-shedding or internet service failure. The VPS service is only available to traders using the MT4 platform. See below for more details:

Premium Trader Tools

Available to all HFM clients with a minimum deposit of 100 USD, Premium Trader Tools give traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trade analysis. It also includes an array of sophisticated alarms, messaging systems, and live sentiment and correlation tracking. A few of the tools in the package include:

- Trade Terminal: A feature-rich professional trade execution and analysis tool, providing several trading features and order controls that are not included in MT4 or MT5.

- Mini Terminal: The mini-terminal facilitates trade management by making commonly-used trading features more accessible than in the native version of the software.

- Connect: A customisable news feed aggregator and interactive economic calendar

- Correlation Matrix and Correlation Trader: These tools work together to show correlations between pairs of trading symbols. It functions with any symbols available in the trading platform, allowing a calculation of the correlation between multiple asset classes against Forex. The Correlation Trader will then allow for a detailed inspection of the correlation between any two instruments.

Other trading tools available at HFM include a range of trading calculators, which can be used to calculate pip value, swap fees, risk percentages, and support and resistance levels.