Trading Tools

GO Markets also offers a wide range of trading tools, including Metatrader Genesis, Autochartist, Myfxbook, a_Quant, a VPS hosting service, and Trading Central.

Autochartist

Autochartist is one of the most widely used MT4 charting tools among the GO client base. Autochartist removes the complex and time-consuming process of analysing charts for patterns by scanning and monitoring the markets on your behalf. It sends audio and visual alerts when emerging and completed patterns are identified. Traders gain access to this chart pattern recognition software when opening and funding a live trading account with 500 USD or more.

Trading Central

Trading Central is a collection of programs that offer actionable investment support with 24-hour multi-asset coverage, technical and fundamental analysis, and back-tested trading strategies. Actionable market news can be delivered to you through WebTV or email, and trading strategies can be built from within the platform. Trading Central is available for free for all GO Markets’ clients.

VPS

VPS services ensure that trades are never disrupted by technological or connectivity issues, such as load-shedding or internet service failure, which is a benefit to algorithmic traders who need to be connected to a server 24/7 to maximise uptime. With a GO Markets VPS, you can optimise the MT4 & MT5 trading platforms’ features and capabilities. A service fee of 30 USD will be charged for the service, but the fee will be waived should the client trade a minimum of 5 lots per calendar month.

MetaTrader Genesis

MT4 & 5 Genesis is a comprehensive suite of MetaTrader trading tools to enhance the power of the standard MetaTrader platform. Benefits of using the MetaTrader Genesis tool include:

- Access to a professional suite of MetaTrader add-ons.

- Use of the sophisticated order management system.

- Access to trading alerts.

Myfxbook

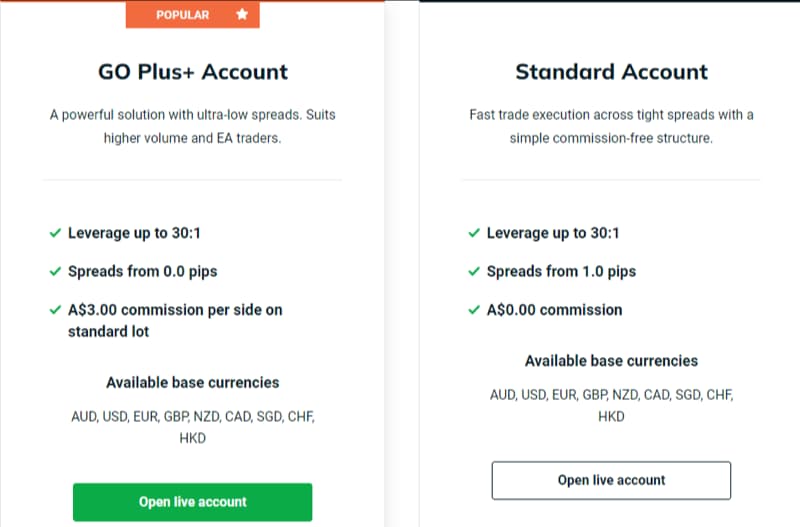

Myfxbook is a cross-broker copy trading tool for traders of all experience levels and is used by 90,000 traders worldwide. It is similar to using EAs, but instead of following an algorithmic pattern, traders can mirror the trades of other Forex traders. By connecting a GO Markets Standard Trading Account to Myfxbook, traders can take advantage of this system. Myfxbook also provides its users with a broad range of statistics and analytics.

a-Quant

a-Quant aggregates millions of data points and uses machine learning algorithms for regime detection, sentiment analysis, clustering, co-integration, and Hidden Markov Models development. a_Quant essentially produces high probability trading signals of certain risk/reward characteristics on various trading instruments.

Daily Strategies is a signal service created for FX Traders. It produces large numbers of signals for high-frequency trading of major FX currency pairs. a-Quant generates 9-12 signals per day on average, for the 10 most popular FX currency pairs. These can be delivered straight to your inbox.