How Brokers Are Scored

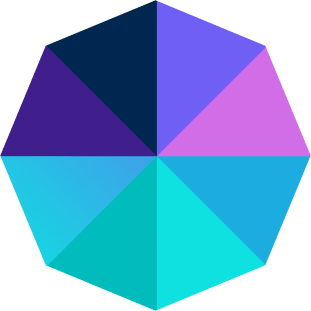

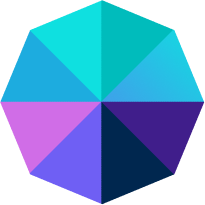

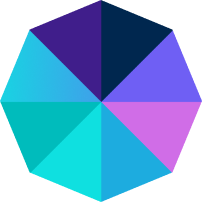

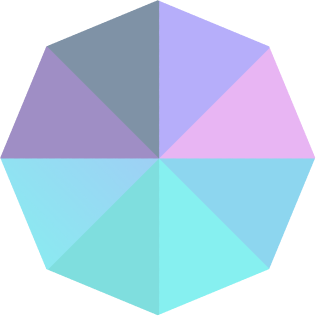

FxScouts’ Broker Score and Trust Rating constantly evolve to reflect the forex market’s dynamics. We ensure transparency by incorporating regulator data and user insights. Our in-depth reviews consider over 200 metrics across seven key categories. The radar chart to the left shows how important each category is when calculating a broker’s final score.

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

To ensure fairness and transparency, we independently verify broker claims and integrate real-user feedback, regulator data, and live trading tests. The radar chart to the left illustrates the weight of each category in our final scoring system.

Why Our Reviews Set the Standard

Every broker we recommend meets strict trust and safety criteria and is tested for reliability, transparency, and overall trading experience.