Desktop Trading Platforms and Trading Tools

AvaTrade offers a wider range of trading platforms than other brokers, including MT4, MT5, and its own in-house platforms – AvaTrade Webtrader and AvaOptions.

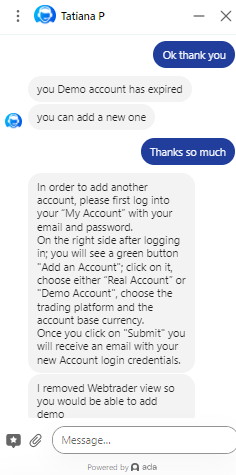

For the purposes of this review, we tested AvaTrade’s web trader platform. When you log in to your account you are immediately redirected to the platform.

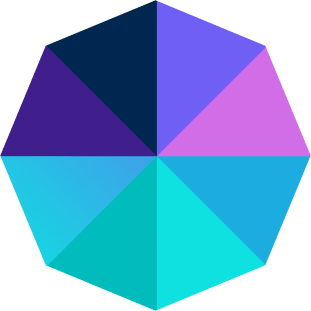

AvaTrade WebTrader

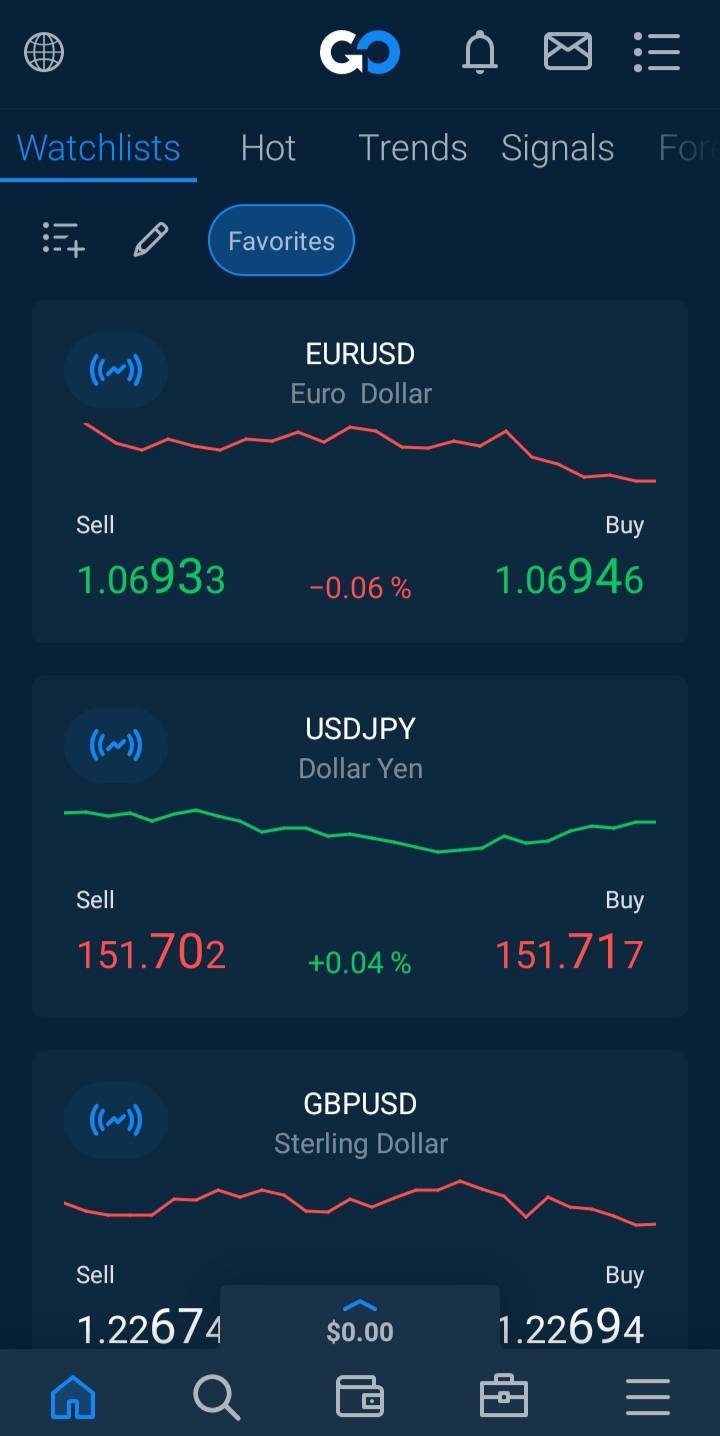

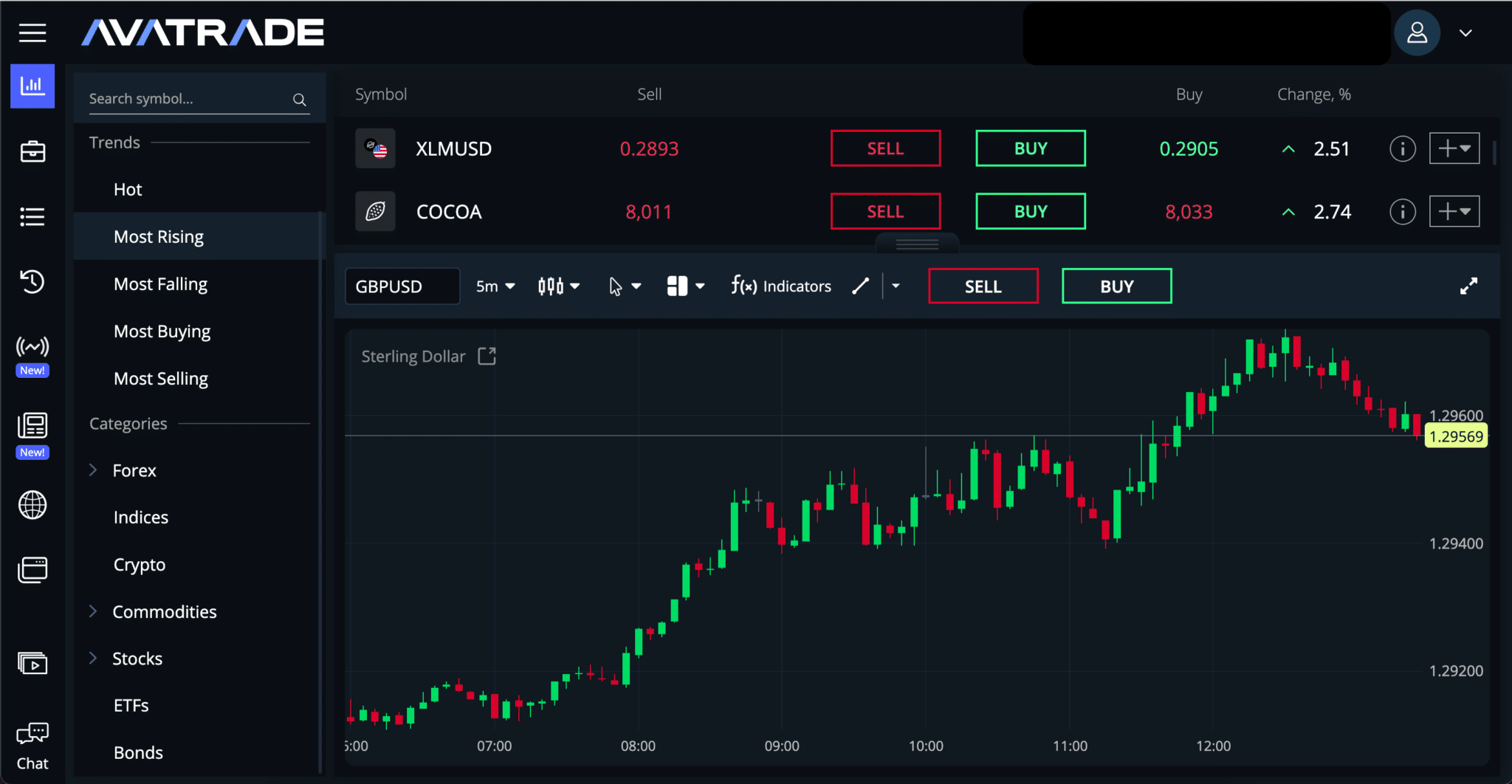

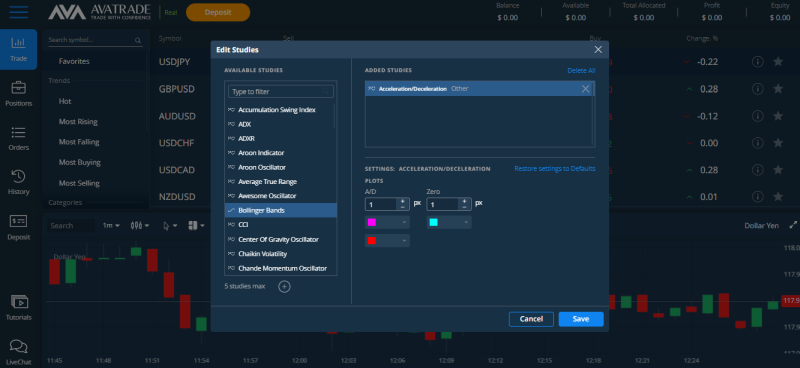

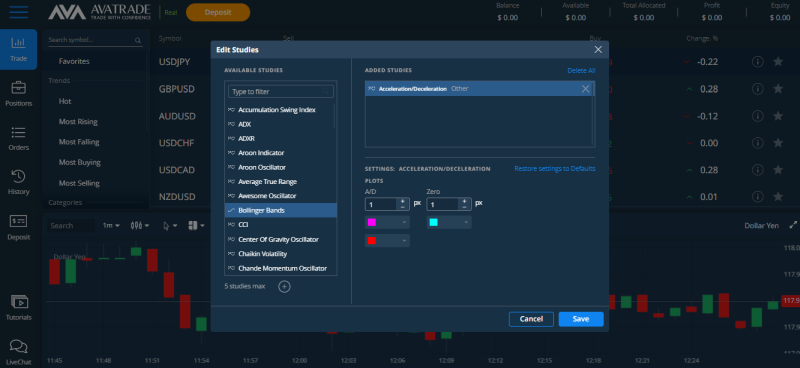

The webtrader platform requires no downloads or installation and is available for all devices. We found that the web trader has a clean user interface and intuitive design, and is easy to navigate and search for various instruments, making it a great option for beginner traders. There are three chart types, including Line, Bar, and Candlestick charts and you can also access a wide selection of indicators in multiple timeframes. See below:

One drawback is that the platform is not customisable, and traders can’t change the size and position of the tabs. The platform also does not allow traders to set price alerts and notifications. More advanced traders may prefer MT4 or MT5, both available at AvaTrade, which allows traders to customise their indicators, has many more chart types, and algorithmic (or automated) trading.

We were pleased to note that Trading Central, one of the most popular third-party trading tools on the market, is fully integrated into the platform and provides technical insight and instant pattern recognition.

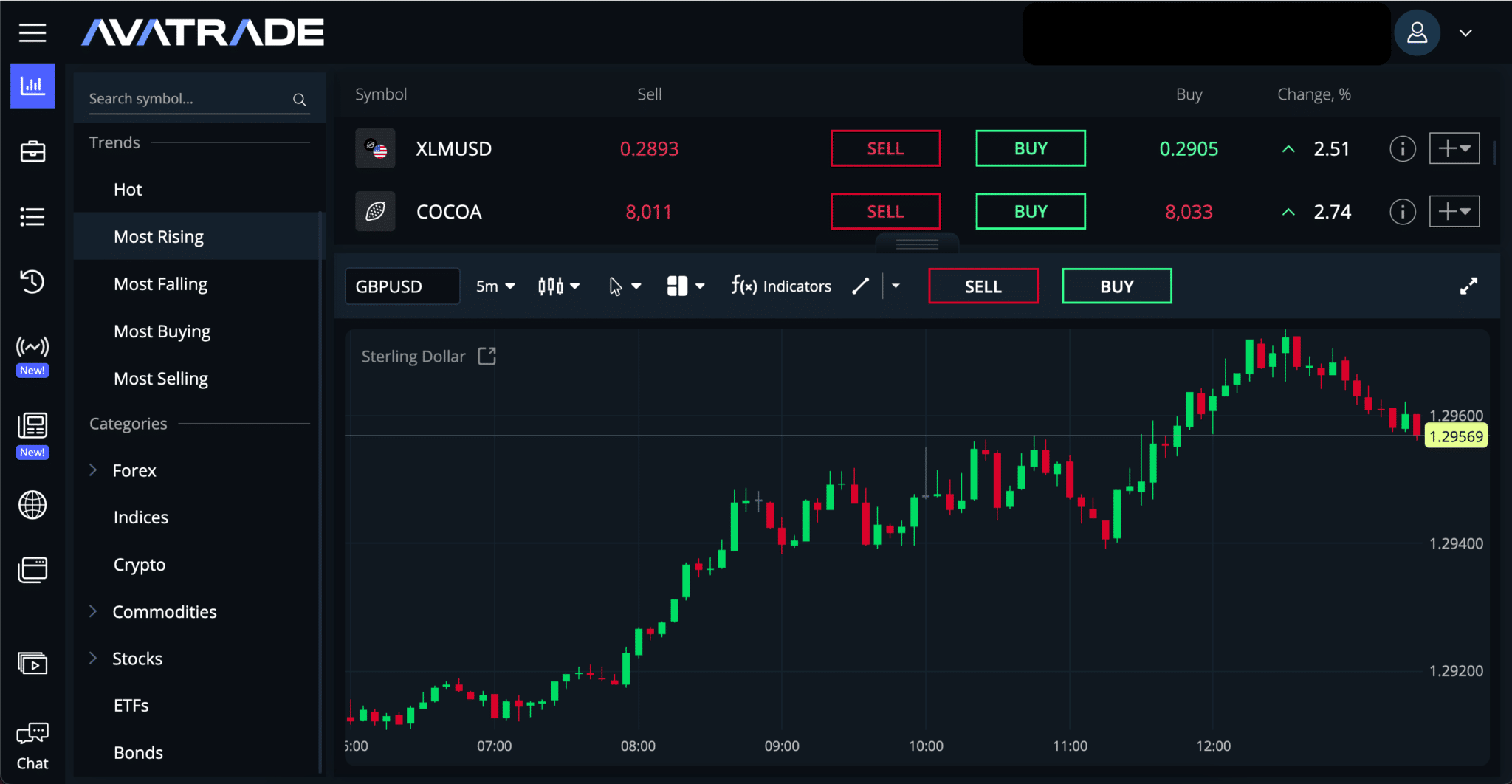

Metatrader 4 (MT4)

We found that like most brokers, the AvaTrade MT4 platform is the standard version with 24 graphical objects and 30 built-in indicators. Unlike AvaTrade’s proprietary web trader, algorithmic trading is available, and MT4 is fully customisable.

As you can see below, only the basic orders are available, Market, Limit, Stop, and Trailing Stop:

Metatrader 5 (MT5)

MT5, the newer version of MT4, is also available at AvaTrade. The difference between the two platforms is that MT4 is a Forex-only platform, while MT5 allows trading on all the assets available at AvaTrade. We recommend using MT5 if you are looking for a more powerful and faster trading platform when it comes to back-testing functionality for automated trading algorithms. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators, and analytical tools.

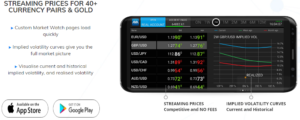

AvaOptions

AvaTrade allows trading on vanilla options. Options trading provides traders with opportunities to benefit from more than just the 2-dimensional nature of Forex trading. Vanilla options are available on more than 40 currency pairs, gold, and silver. Trading options can be a complex undertaking, but the AvaOptions platform simplifies the process.

Trading Tools and Social Trading

AvaTrade offers a limted selection of trading tools, but does have two social trading platforms.

Trading Central

Trading Central is a third-party company that provides AvaTrade’s clients with market insight and trade analysis. The market insight provided by Trading Central helps inform traders’ strategies and trading plans and is created by expert analysts. The tool helps merge these experts’ views with automated algorithms and offers pattern recognition to trigger trading ideas. Trading Central also delivers a daily strategy newsletter, combining both technical and fundamental research, directly to your inbox. Trading Central also provides an updated news feed for each asset, which also comes with a sentiment score for that asset. An additional feature of Trading Central is the Trend Analysis, which predicts whether assets will rise and fall and by what percentage.

Capitalise.ai

Capitalise.ai provides AI-powered financial services for investors and traders. The platform uses machine learning algorithms to analyze financial data and provide insights for investment decision-making. Some of the services offered by Capitalise.ai include automated trading, portfolio management, and risk analysis.

AvaProtect

This unique trading tool allows clients to purchase protection against losing trades for a specified time, and if a trade is closed during that period, any losses will be fully refunded. While the AvaProtect feature is active, traders will still be able to benefit from any gains on a position. The cost of AvaProtect changes according to the market and size of the trade. AvaProtect is also available on the AvaTrade Mobile App. Note that this feature is not available on limit orders, only on market orders.

Overall, while AvaTrade’s in-house team does not provide as much market analysis as is available at other large international brokers, it provides a good set of third-party tools to help its clients make trading decisions.

Duplitrade

Duplitrade is a popular copy trading platform that can link to the MT4 trading platform. DupliTrade allows traders to automatically duplicate the actions of expert traders (with proven histories) directly into their AvaTrade trading account. However, traders will have to deposit a minimum amount of 2,000 USD to access Duplitrade, way above the required minimum deposit. We thought this offering was expensive compared to other similar brokers.

AvaSocial

AvaTrade clients can also download the broker’s social and copy trading platform – AvaSocial. Available on iOS and Android devices, the mobile app allows clients to replicate the trades of successful investors. You can opt to manually trade on market signals or follow a fully automated service. In addition, users can interact with other traders via community channels and ask questions on specific strategies, find out more about crypto markets, or seek out a trading mentor, making it an excellent tool for beginner traders.