Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Forex trading can be done almost 24 hours a day, 5 days a week. We say “almost” because you cannot place trades for a few minutes every day at rollover time (1700 New York time).

The duration of rollover depends on the broker you use, but it's usually between 2-5 minutes. Close to rollover time, the spreads on different currency pairs can be much wider than usual. This makes trading close to rollover time impractical and risky, especially if you use a tight stop loss.

There are 4 main Forex trading sessions, the Sydney session, the Tokyo session, the London session, and the New York session. The Forex market opens every Sunday at 17:00 New York time (EST in winter and EDT in summer) and closes every Friday at the same time. We use New York time as our benchmark because the market open/close is always at 17:00 in New York, right through the year. 17:00 New York time is the end of the U.S. session; during certain times of the year, it is also the start of the Sydney session.

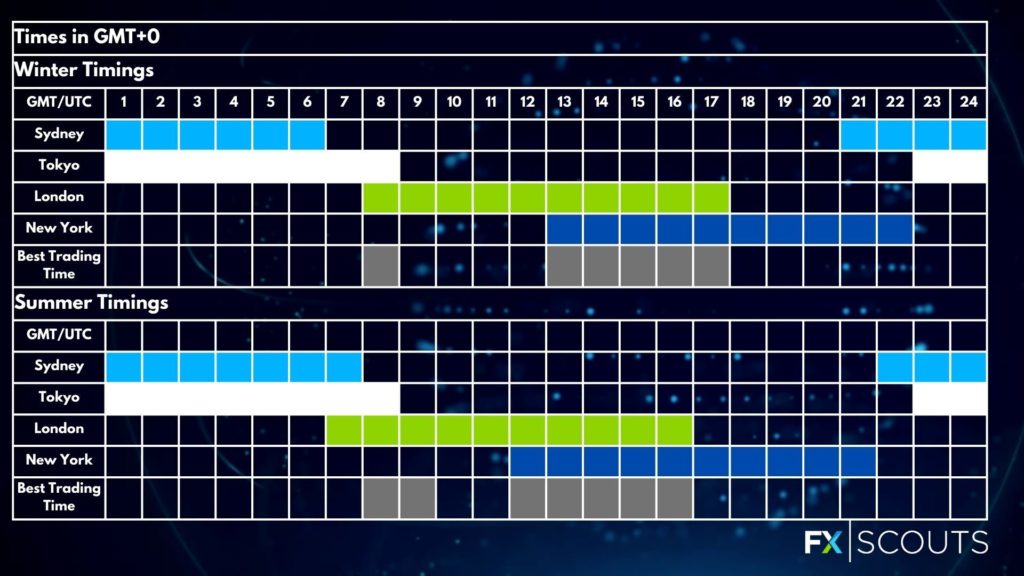

The table above is calculated from GMT, which is London time in the winter and London time -1 in the summer. It is important to know this because many traders start trading when the London session opens or when the London and US sessions overlap.

There is often big market participation and good volatility when the London session opens. Likewise, the US session open brings immense trading volume to the market. During these hours, intraday traders have the best chance of getting enough market movement to hit their profit targets. False moves (e.g. fakeouts) are also less common than during the first few hours of the Tokyo and Sydney sessions. Liquidity is also high, meaning that large positions can be absorbed by the market more easily, with a smaller chance of experiencing slippage or significant market impact.

Although the Forex market is open from Sunday at 17:00 EST/EDT to Friday at 17:00 EST/EDT, it also closes every day for a few minutes from Monday to Thursday at 17:00 EST/EDT for rollover. Soon after rollover, the Sydney trading session starts, and the cycle is repeated. Of course, rollover also takes place when the market closes on Friday.

*To keep it simple, we have only considered U.S. time transitions.

Although the Forex market can be traded 24/5, the best market liquidity, volatility, and trading conditions are generally experienced during the crossover between the London and early US sessions. During these sessions, some of the most important central banks, speculators, businesses, financial institutions, commodity markets, and stock markets are active, all of which can have a huge impact on the currency markets.

When the Forex market is most active, spreads are usually low and large orders can be executed effectively. Market movements are also generally more reliable and forceful than during less active market times.

To learn more about the best times to trade Forex, check out our episode on the subject:

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.