Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Day trading in Forex can be an exciting and rewarding approach for traders of all levels. This guide covers the basics of Forex day trading, offering tips on strategy, risk management, and how to get started in the fast-paced world of currency markets. Whether you're new to trading or looking to refine your skills, this resource will help you navigate the essentials of day trading in Forex. Let's start by clarifying what day trading is and how it differs from scalping.

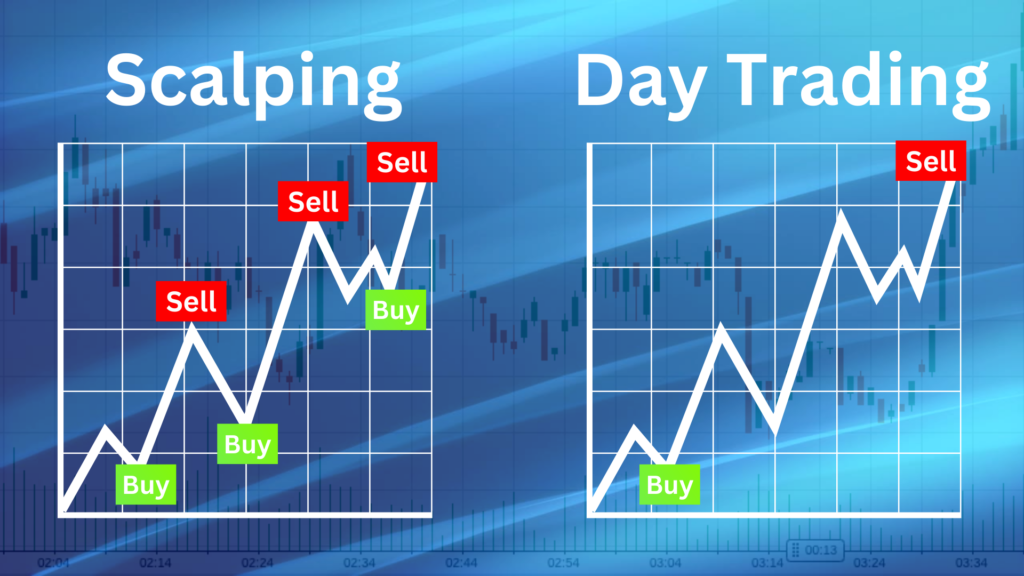

Day trading and scalping both occur within a single trading day, but they have distinct differences. Day traders open and close fewer setups than scalpers, often just one or a few trades per day. On the other hand, scalpers engage in frequent trading throughout the day.

Day traders aim to identify the best opportunities of the day and hold positions for several hours, usually not beyond the trading day. They aim to capture a significant portion of the expected daily price movement in a single trade. Scalpers, conversely, make quick, short-term trades, entering and exiting the market multiple times.

Understanding Day Trading

Day trading involves taking a position at the start of the trading day, acting on that bias, and closing the position by the day's end. Day traders avoid holding trades overnight, a practice common among positional traders.

Day Trading Rules

Now, let's outline five essential rules for successful day trading.

Rule 1: Avoid Holding Trades Overnight

Day traders should never hold their trades overnight. Positions are opened and closed within the same trading day, eliminating concerns about overnight swap fees and long-term trends.

Rule 2: Allocate Time for Planning and Monitoring

To succeed in day trading, allocate sufficient time for planning, identifying trade setups, and actively monitoring positions. This aspect can be challenging for individuals with full-time jobs but is very important when it comes to day trading.

Rule 3: Master Technical Analysis

Day traders heavily rely on technical analysis, utilising various indicators such as the MACD, RSI, and candlestick patterns, combined with price action to pinpoint optimal entry and exit points.

Rule 4: Exercise Patience

Patience is a virtue in day trading. Traders must wait for prices to reach specific chart levels with the highest profit potential. This may require enduring temporary drawdowns.

Rule 5: Stick to Your Trading Plan

Discipline is crucial for day traders. It's essential to adhere to your trading plan and resist the urge to exit trades prematurely. Deviating from the plan can lead to impulsive decisions and losses. Don’t let your emotions get in the way of what you have planned for your trades.

Choosing the Right Broker for Day Trading

When selecting a broker, always consider the following factors:

1: Find a Reliable and Well-Regulated Broker

Opt for a reputable broker with robust regulation and financial stability. This ensures uninterrupted trading.

2: Low Trading Fees

Select a broker with low trading fees, as day traders frequently open and close positions. Reduced costs can significantly impact overall profitability.

3: Access to Market Analysis

Select a broker with a strong market analysis team that provides valuable insights and timely news updates to inform your trading decisions. Market analysis is a skill, but it’s easier to manage and learn if you have the right indicators.

4: Access to Trading Tools

Look for brokers offering comprehensive trading tools, including platforms like Autochartist, Trading Central, or TradingView, which can enhance your technical analysis capabilities.

5: Availability of CFDs

Ensure the broker offers a diverse range of CFDs (Contracts for Difference) that align with your trading preferences and strategies.

Conclusion

If you have any questions or seek further guidance, please don't hesitate to reach out. Stay tuned, and feel free to share your comments or questions.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.