Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

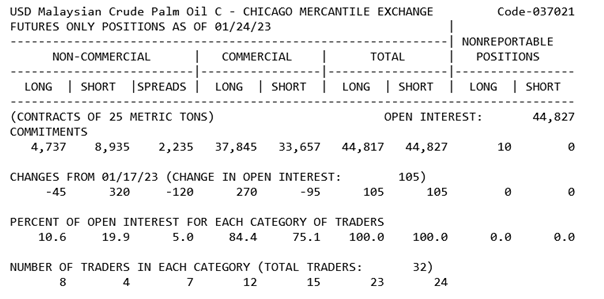

The COT (Commitments of Traders) report provides insights into who is buying and selling different contracts and in what volumes. The report is issued every Friday by the CFTC and split into several sections.

The sections are futures only, or futures and options combined, but the formatting of the report makes it hard to gain immediate value from. Your trading platform will better introduce the data into your charts.

The COT Report shows the positioning of three different types of traders in each of the futures markets, taken at the close of business on Tuesday of every week:

While the COT Report shows data with a three-day delay, the fact that the positioning information of the two most significant participants in each market is reported at all is pretty impressive. This data can provide traders with some detailed insights into the potential future direction of price movement.

Traders use the COT Report to gauge where the market currently is, and how to make profitable trading decisions going forward. Professional traders look at the COT report as either a contrarian or a consensus indicator.

The report tells us which group of traders is controlling the market. Are the commercial traders either buyers or sellers? Are the large speculators either the buyers or sellers? Once the market establishes who is in control, and compares that with the historical data, traders then wait for the next major market movement.

Retail traders lose most of their trades, and thus professional traders use the positioning of these small and large speculators as a contrarian indicator.

To do this, they look for an extreme position in the speculator group. Identifying and acting on these extreme positions works because we know that if something is going to go wrong, and the market moves against those positions, retail traders and even Hedge Funds, are quick to cover their position.

Figure 2: Japanese Yen Futures

In Figure 2 we have the Japanese Yen (JPY) futures contract, and the COT Report is highlighted at the bottom of the chart. Buying JPY future contracts is a typical long-term strategy for the large speculators that involves trading against the small speculators because they are usually wrong at most market turning points. In this particular example, we have watched the large speculators trimming down their long positions since the beginning of May, bringing the bullish bets to their lowest level since the beginning of the year.

The COT Report is not a timing tool, but it is a great supplementary tool to be appended to your trading strategy. Trading the COT report is not a long-term strategy as you can only trade the daily and weekly S/R levels.

The COT Report can also be used as a consensus indicator, to see what the commercial traders are doing. It is a fabulous trading strategy for spotting likely turning points in the market.

If we’re in a bullish trend and the commercial traders are selling at an extreme rate, then we know that we’re close to a significant reversal. The same is true if we’re in a bearish trend and the commercial traders are buying at extreme pace - then we’re close to a significant low in the market.

Figure 3: Gold – COT Report

The example in Figure 3, shows the commercial trader positioning in the market, and retail traders can use this to gauge market sentiment. As previously mentioned, the COT Report is not a timing tool, but as highlighted on the chart, the commercial's short trades had been at a record for almost three consecutive months before any real selling was observed. In this case, the trigger for our short trade could have been the breakdown of the $1300 major support.

When trading COT Report data, it is crucial to discern whether the commercials traders are net buyers or sellers and if the large speculators are net buyers or sellers. Trading COT report data is all about learning how long or short the major traders are in comparison to historical data, and thus the most profitable trades are made when these positions hit historic levels.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.