Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Fading a move is the unorthodox strategy of trading against the prevailing trend of the market, and can be very profitable with the right market conditions.

Using this strategy, a trader will sell expecting the momentum to fade away while in an uptrend, and a trader will buy with the expectation that the move will fade away and reverse while the market is in a downtrend.

There are two main components of a Fade a Move Strategy.

Fading strong market trends is a losing game and a receipt for disaster. Fading a trend successfully is not easy because trends can continue to stay in motion for long periods.

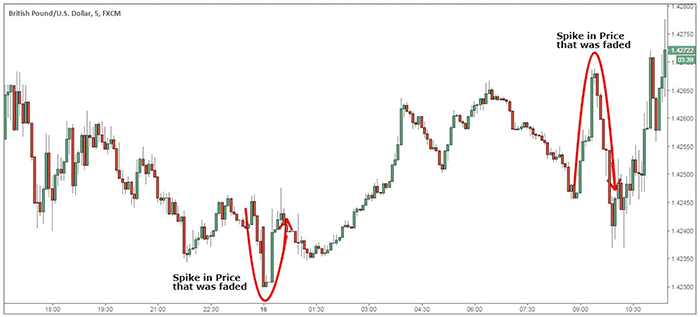

What we want to fade out are sudden or explosive moves or spikes in price that are unsustainable and lack the momentum to continue.

Most of these spikes in price happen on an intraday basis, so using a day trading strategy to fade spikes in price is best. Fading requires having a contrarian approach, and many of the most prominent hedge fund managers promote themselves as being contrarian traders.

The primary assumption behind fading strategies is either that the trend is overbought/oversold or the move lacks the momentum to continue.

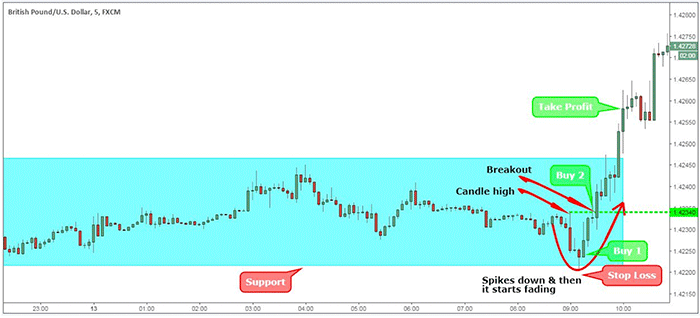

Consolidating or ranging market conditions are the ideal trading environment to fade spikes in price. First, a trader needs to find a ranging market. Luckily, the market spends most of the time in ranging conditions, which means that this trading strategy can be used frequently.

GBP/USD trading range right before the London session opening bell

The above chart highlights the GBP/USD trading range right before the London session opening bell. For this strategy to work, a trader does not need to guess in which direction the market will spike, and instead only watch the market move naturally and react afterwards.

The second condition to be satisfied to fade a move successfully is that the spike in price needs to happen from significant technical level (support/resistance; swing high/low; psychological numbers).

In our case, the GBP/USD spikes down to the support level and quickly start fading away. You can either buy right away when the support level is hit or you can use a more conservative entry strategy as follows:

When fading a move, keep your risk contained to prevent potential losses. Don’t forget to use a protective stop loss to minimise the possible loss in case the trade goes wrong.

Fade trading means waiting for the initial spike in price and only trade what happens after it. The first spike is usually a knee-jerk reaction that is designed to fool many traders into jumping into the market in the wrong direction.

Even though fade trading might seem to be risky because you’re trading against the trend, it can be extremely profitable if appropriately used. This is because the market spends most of the time consolidating which is where most of the spikes in price happen.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.