Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Leverage is a powerful trading tool that allows traders to borrow money from their brokers to open large position sizes with a small amount of capital. It's crucial to understand the advantages and disadvantages of using leverage, and what levels of leverage suit which trading strategies.

Now, we all know that Forex Trading is not easy, and in order to trade effectively, you need to be able to read the market movements, have a trading strategy, and utilize trading tools to improve your chances of becoming profitable. One of these tools is leverage.

Through the correct use of leverage, you can increase your chances of making a profit without as much capital input. However, it's important to note that leveraging also increases the risk of losing your money. In this video, I'm going to cover what leverage is, how to use it effectively, and which trading strategies benefit from different types of leverage.

Leverage is provided by your broker. Essentially, the broker offers traders the ability to hold larger position sizes without needing extra capital. This means that even with a small trading account, traders can access much larger positions. Leverage amounts vary and are typically represented as ratios like 50:1, 100:1, 200:1, and even up to 500:1. The Forex Market traditionally offers some of the highest levels of leverage in the industry. Leverage has played a key role in expanding the Forex market, attracting more investors to make their capital go further.

However, when considering leverage, there's no one-size-fits-all approach. To understand real leverage, divide the total transaction amount by the balance in your trading account. For example, if you have $10,000 in your account and you open a position worth $100,000, you're trading with 10 times leverage:

Trading two standard lots ($200,000) instead of one standard lot ($100,000) equates to trading at 20 times leverage:

There are some popular leveraged trading strategies. One is scalping, which often uses very high levels of leverage. Scalpers aim to make quick trades, using leverage of up to 1000:1 or even 3000:1. They focus on low-spread trades, setting small pip targets to compensate for the higher exposure:

Scalpers are meticulous with risk management, using tight take profits and stop losses to prevent large capital losses.

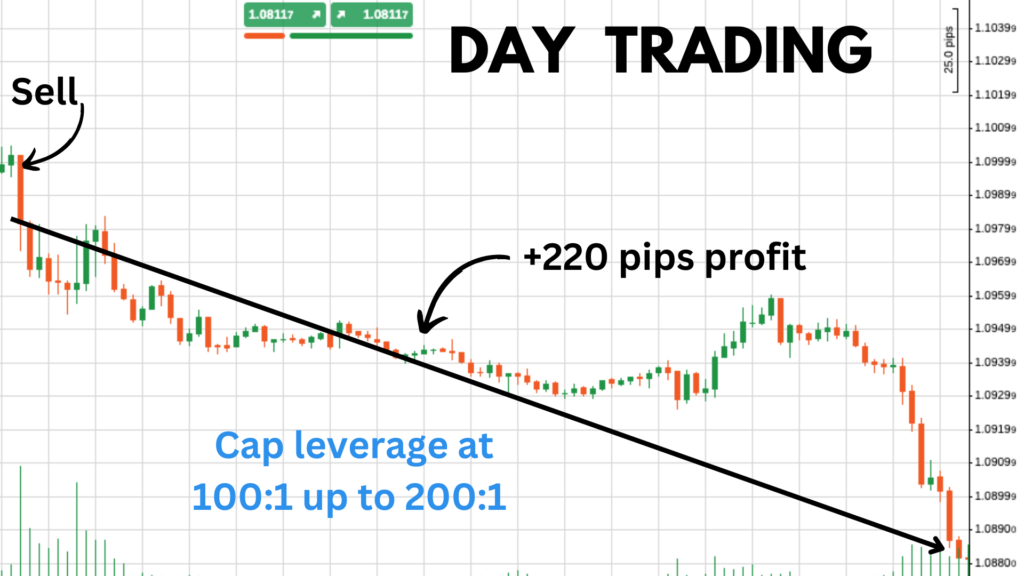

Day trading is another strategy that requires traders to open and close positions within the same trading day. Leverage is often used to maximize potential profits. Day traders tend to use slightly lower leverage levels compared to scalpers, typically around 100:1 or up to 200:1:

The choice of leverage depends on trading experience and risk appetite. New traders might stick to 5:1 or 10:1, while more experienced ones might use 50:1 or even 100:1. However, regardless of experience, cautious risk management is crucial.

Using leverage has its advantages. It allows traders to open larger positions with less starting capital. However, there are also disadvantages. While leverage can increase profits, it can also magnify losses. The greater the leverage, the higher the risk. Leverage is a double-edged sword, where a significant market shift can lead to rapid account depletion.

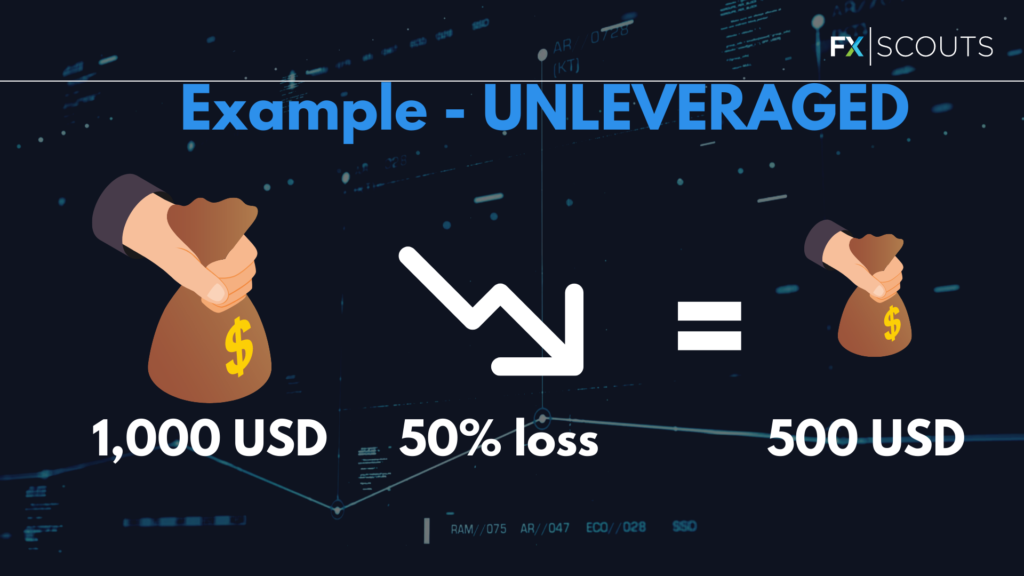

For example, if a trader invested $1000 and the USD's price dropped by 50%, without leverage, they'd lose $500.

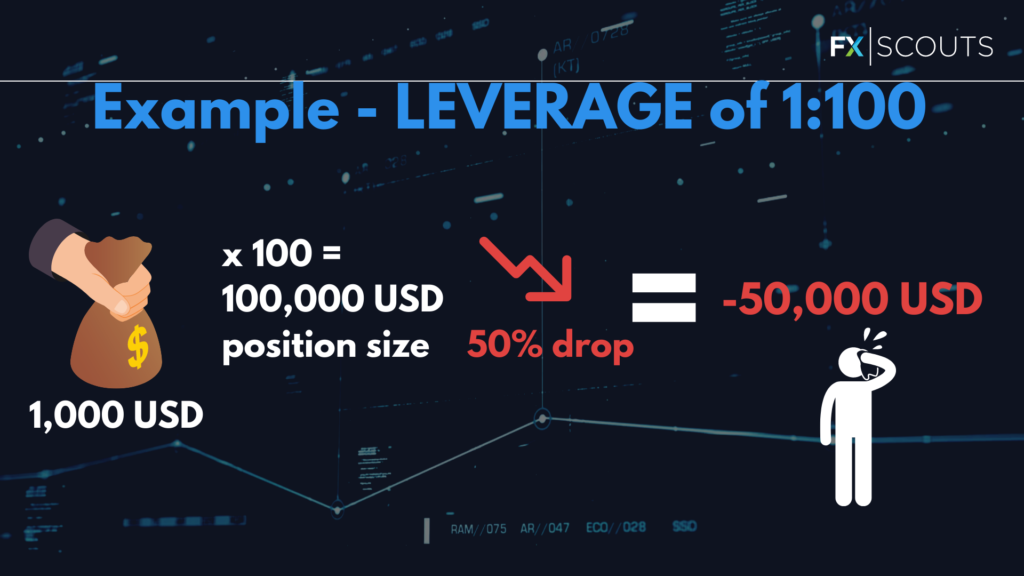

With 100:1 leverage, they'd lose their entire investment:

This illustrates the importance of responsible leverage use and risk management.

In conclusion, leveraging can be risky, but it's favoured by many traders due to its potential for increased profitability. Always practice on a demo account to understand how leverage affects your trades and whether it aligns with your strategy. Remember to manage risk with take-profits and stop-losses.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.